Global Hydrodeoxygenation Catalysts Market - Key Trends & Drivers Summarized

Why Are Hydrodeoxygenation Catalysts Crucial to Renewable Fuel Production?

Hydrodeoxygenation (HDO) catalysts are essential for upgrading bio-oils and biomass-derived feedstocks into high-value fuels by removing oxygen-containing compounds via catalytic hydrogenation. These catalysts play a critical role in the production of renewable diesel, sustainable aviation fuel (SAF), and advanced biofuels that can be directly blended with or substituted for petroleum-based fuels. As global climate policies intensify and the demand for carbon-neutral fuels rises, HDO processes are becoming central to bio-refinery operations.HDO catalysts facilitate the transformation of triglycerides, lignin derivatives, and fatty acids into hydrocarbons by breaking C-O bonds and saturating them with hydrogen. This step is vital for improving the stability, energy density, and compatibility of bio-oils with existing fuel infrastructures. Their effectiveness determines the yield, selectivity, and operational cost-efficiency of renewable fuel production, making them a high-value input in decarbonized energy pathways.

How Are Catalyst Designs Evolving to Enhance Selectivity and Process Efficiency?

The performance of HDO catalysts hinges on their metal composition, pore structure, and thermal stability. Common active metals include nickel, molybdenum, cobalt, palladium, and platinum, often supported on alumina, zeolites, or silica. Bimetallic catalysts and nano-engineered formulations are gaining popularity due to enhanced deoxygenation activity, coke resistance, and lower sulfur tolerance requirements. Research is also focused on developing non-noble metal alternatives to reduce cost and improve scalability.Increased use of lignocellulosic biomass and waste-derived oils - both containing complex oxygenated compounds - has driven innovation in multifunctional catalysts that combine hydrogenation, cracking, and isomerization functions. Pilot-scale and commercial bio-refineries are testing catalysts that allow single-stage upgrading of feedstock, reducing energy intensity and hydrogen consumption. Tailored catalysts for continuous flow reactors and slurry-phase systems are being developed to optimize performance in industrial-scale operations.

Which End-Use Sectors and Regions Are Driving the HDO Catalyst Market?

The transportation fuel sector is the primary consumer of HDO catalysts, especially for renewable diesel and SAF production. Refineries and chemical companies are adapting existing hydroprocessing units or building standalone facilities to integrate HDO pathways into biofuel output. Governments are mandating increased biofuel blending ratios and lifecycle carbon reduction, which is creating steady demand for catalytic upgrading of renewable feedstocks.North America and Europe are the leading regions, supported by aggressive decarbonization targets and financial incentives for SAF and renewable diesel. The U.S., in particular, is investing in large-scale bio-refining capacity driven by the Renewable Fuel Standard (RFS) and LCFS (Low Carbon Fuel Standard) frameworks. Asia-Pacific, led by China, Japan, and South Korea, is also expanding its green diesel output, fueling R&D in local catalyst manufacturing.

The Growth in the Hydrodeoxygenation Catalysts Market Is Driven by Several Factors…

The growth in the hydrodeoxygenation catalysts market is driven by several factors, including rising demand for renewable fuels, increased investment in bio-refinery infrastructure, and ongoing innovations in catalyst composition and reusability. The transition to low-carbon transportation fuels - especially renewable diesel and SAF - is heavily reliant on HDO processes to achieve fuel-grade purity and performance metrics.From a technology perspective, developments in bifunctional catalysts, nanostructured active sites, and low-cost supports are expanding industrial application. Policy mandates for carbon intensity reduction, combined with growing end-use commitments from aviation and freight sectors, are reinforcing the market for high-performance deoxygenation catalysts. As global fuel markets transition to greener alternatives, HDO catalysts will play a pivotal role in unlocking the commercial viability of next-generation biofuels.

Report Scope

The report analyzes the Hydrodeoxygenation Catalysts market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Catalyst Type (Conventional Catalyst Type, Solid Acid Support Catalyst Type, Metal-based Catalyst Type, Bifunctional Metal-acid Catalyst Type, Other Catalyst Types); Application (Partial Deoxygenation Application, Complete Deoxygenation Application); End-Use (Chemical End-Use, Oil & Gas End-Use, Pharmaceutical End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Conventional Catalyst segment, which is expected to reach US$69.9 Million by 2030 with a CAGR of a 2.9%. The Solid Acid Support Catalyst segment is also set to grow at 4.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $36.2 Million in 2024, and China, forecasted to grow at an impressive 6.5% CAGR to reach $32.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hydrodeoxygenation Catalysts Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hydrodeoxygenation Catalysts Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hydrodeoxygenation Catalysts Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Andritz AG, Dongfang Electric Corporation, Dongturbo Electric Co., Ltd., DTEC (Dongturbo Electric Co., Ltd.), Fuchun Industry Development Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Hydrodeoxygenation Catalysts market report include:

- Albemarle Corporation

- Arkema Inc.

- Axens

- BASF SE

- Clariant International Ltd.

- Criterion Catalysts & Technologies LP

- Evonik Industries

- Haldor Topsoe A/S

- Honeywell UOP LLC

- Johnson Matthey

- Katalco

- Linde Engineering

- Noble Group

- Recycling Technologies

- Shell Catalysts & Technologies

- Sinopec Catalyst Co., Ltd.

- Sud-Chemie (now part of Clariant)

- Umicore

- W.R. Grace

- Yunnan Tin Company Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Albemarle Corporation

- Arkema Inc.

- Axens

- BASF SE

- Clariant International Ltd.

- Criterion Catalysts & Technologies LP

- Evonik Industries

- Haldor Topsoe A/S

- Honeywell UOP LLC

- Johnson Matthey

- Katalco

- Linde Engineering

- Noble Group

- Recycling Technologies

- Shell Catalysts & Technologies

- Sinopec Catalyst Co., Ltd.

- Sud-Chemie (now part of Clariant)

- Umicore

- W.R. Grace

- Yunnan Tin Company Limited

Table Information

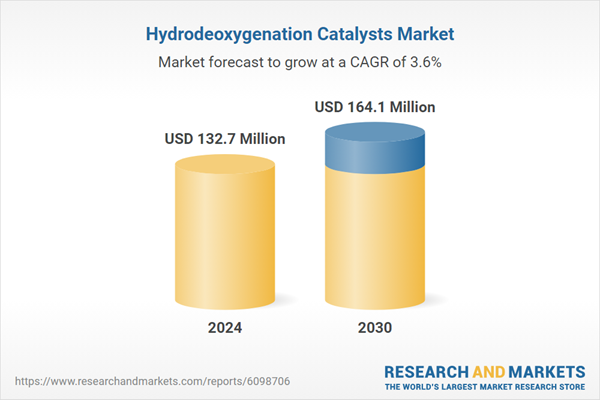

| Report Attribute | Details |

|---|---|

| No. of Pages | 373 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 132.7 Million |

| Forecasted Market Value ( USD | $ 164.1 Million |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Global |