Global Aloe Vera Juice Market - Key Trends & Drivers Summarized

Why Is Aloe Vera Juice Experiencing Mainstream Acceptance as a Functional Health Beverage?

Aloe vera juice is transitioning from a niche wellness product to a mainstream functional beverage, driven by rising global consumer interest in natural health remedies, digestive health, and immune support. Extracted from the inner gel of the Aloe barbadensis plant, aloe vera juice is rich in bioactive compounds including vitamins, enzymes, amino acids, and polysaccharides that are believed to contribute to gut health, detoxification, hydration, and anti-inflammatory activity. These attributes align well with the global shift toward preventive health and wellness, as consumers increasingly seek plant-based and clean-label alternatives to synthetic supplements and sugary drinks. The growing prevalence of digestive disorders, acid reflux, and irritable bowel syndrome (IBS) is also boosting demand for aloe-based gastrointestinal support products, where aloe vera juice is marketed as a soothing, alkalizing, and fiber-rich beverage.In emerging markets such as India, China, and parts of Latin America, aloe vera juice is experiencing strong demand through Ayurvedic and traditional medicine channels, where it is promoted for its blood-purifying, immunity-boosting, and skin-enhancing properties. Meanwhile, in Western markets, it is gaining shelf space in natural food stores, fitness beverage aisles, and specialty retail chains as an on-the-go wellness drink or functional mixer. Both sweetened and unsweetened variants - often blended with fruit extracts such as mango, pomegranate, or cranberry - are being developed to improve palatability and broaden consumer appeal. With clean eating, detox diets, and gut microbiome health becoming central themes in the wellness narrative, aloe vera juice is finding a growing role as a multi-benefit, plant-derived beverage across demographics and geographies.

How Are Product Innovations and Processing Improvements Expanding Market Reach?

Advancements in cold-pressed extraction, decolorization, and enzymatic stabilization techniques are significantly improving the taste, shelf life, and safety of aloe vera juice, addressing earlier consumer concerns around bitterness, laxative effects, and microbial contamination. Manufacturers are now deploying low-temperature processing and UV treatment to preserve bioactives while eliminating spoilage risks. Decolorized, filtered, and low-aloin formulations are gaining regulatory approval and consumer trust, particularly in markets where aloin content restrictions are strictly enforced by food safety authorities such as the FDA and EFSA. These processing improvements are also enabling the development of ready-to-drink (RTD) formats, smoothies, and functional beverage blends with extended shelf life and better flavor profiles, making aloe vera juice more accessible and convenient.Product differentiation is increasingly centered on functional positioning and value-added claims. Brands are introducing aloe vera juice infused with complementary botanicals, vitamins, adaptogens, and probiotics to create targeted health solutions - such as digestive health, skin rejuvenation, hydration, and immunity. Organic, non-GMO, and sugar-free formulations are being launched to capture demand from clean-label and diabetic-friendly consumer segments. Packaging innovation is also enhancing product appeal, with recyclable PET bottles, portion-sized shots, and minimalist aesthetic branding aligning with premium wellness trends. E-commerce and direct-to-consumer channels are playing a growing role in product visibility, especially for niche brands and startups targeting digitally engaged wellness consumers. As processing technology continues to optimize safety and palatability, aloe vera juice is poised to scale from a traditional remedy to a modern, functional beverage category with broad market access.

Where Is Market Growth Accelerating and Which Consumer Segments Are Leading Demand?

Market growth for aloe vera juice is accelerating across health-conscious urban populations in Asia-Pacific, North America, and Europe, where wellness trends and self-care awareness are influencing daily consumption habits. In Asia-Pacific, demand is expanding rapidly in China, India, Japan, and South Korea, driven by the convergence of traditional herbal medicine, expanding middle-class incomes, and greater awareness of digestive and skin health. Indian FMCG brands are incorporating aloe juice into mass-market Ayurvedic health drinks, while Chinese nutraceutical brands are positioning it within their functional beverage portfolios as a cooling and detoxifying elixir. In Japan and South Korea, aloe juice is being introduced in beauty-focused functional beverages as part of holistic skin care routines.In North America and Europe, the fastest-growing consumer segments include millennials, wellness-focused women, and fitness enthusiasts seeking plant-based hydration and gut health support. Aloe juice is being consumed both as a daily wellness shot and as a meal-accompanying beverage in vegan and health-conscious households. Clean-label seekers, especially those avoiding artificial preservatives, added sugars, and allergens, are showing high receptivity to organic aloe beverages. In addition, consumers managing chronic conditions such as acid reflux or gastrointestinal inflammation are adopting aloe vera juice as a natural therapeutic supplement. Foodservice and hospitality channels are also beginning to include aloe juice in premium health bars, spas, and airport lounges. These evolving use cases are expanding aloe vera juice from the traditional herbal medicine shelf into lifestyle-driven consumption formats with growing crossover appeal.

What Is Driving the Continued Growth of the Aloe Vera Juice Market Globally?

The growth in the aloe vera juice market is driven by several factors, including heightened consumer awareness of plant-based health solutions, increased emphasis on digestive and immune wellness, and rapid product diversification by beverage and nutraceutical companies. A core growth driver is the alignment of aloe vera juice with prevailing consumer priorities such as clean-label nutrition, functional hydration, and minimally processed superfoods. Rising prevalence of lifestyle diseases and chronic gut disorders is encouraging consumers to adopt natural, anti-inflammatory beverages as part of their daily routines. Aloe's multifunctional appeal - as a digestive aid, hydration booster, skin enhancer, and detox agent - makes it an ideal fit for holistic wellness lifestyles.Commercial expansion is also being propelled by improved sourcing, global supply chain integration, and strategic alliances between aloe growers, processors, and CPG companies. Investments in organic aloe cultivation and traceable raw material networks are strengthening product consistency and regulatory compliance across international markets. Moreover, cross-category synergies - such as aloe-infused sports drinks, collagen beverages, herbal teas, and juice cleanses - are multiplying points of entry for new consumers. Social media, influencer-led marketing, and wellness content are amplifying consumer education and brand differentiation, especially among younger demographics. With consumer expectations evolving toward personalization, plant-powered nutrition, and traceable wellness products, the market continues to scale - raising the question: Can aloe vera juice sustain its rise as a core pillar of functional beverage innovation in the global health economy?

Report Scope

The report analyzes the Aloe Vera Juice market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Flavor Type (Flavored, Unflavored); Distribution Channel (Supermarkets / Hypermarkets, Departmental Stores, Online Retail, Medical Stores); Application (Food & Beverages, Cosmetics, Medicine, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Some of the 34 companies featured in this Aloe Vera Juice market report include -

- ALO Drink

- Aloe Laboratories Inc.

- Aloe Vera of America

- Aloecorp Inc.

- AloeCure

- Alterfood

- Ashland Global Holdings Inc.

- Atlantia UK Ltd.

- Baor Products S.L.

- BHASKARA BIOTECH

- Brihans Natural Products Ltd.

- Cultino Agrotech Pvt Ltd

- Family Health Market

- Forever Living Products

- Fruit of the Earth

- Grace Foods

- Green Earth Products Pvt. Ltd.

- Houssy Global

- Jiva Ayurveda

- Keumkang B&F Co., Ltd.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Flavored Juice segment, which is expected to reach US$12.7 Billion by 2030 with a CAGR of a 6.6%. The Unflavored Juice segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.9 Billion in 2024, and China, forecasted to grow at an impressive 8.9% CAGR to reach $4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Aloe Vera Juice Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Aloe Vera Juice Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Aloe Vera Juice Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accuride Corporation, Alcoa Wheels, American Eagle Wheels, BBS Kraftfahrzeugtechnik AG, BORBET GmbH and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 34 Featured):

- ALO Drink

- Aloe Laboratories Inc.

- Aloe Vera of America

- Aloecorp Inc.

- AloeCure

- Alterfood

- Ashland Global Holdings Inc.

- Atlantia UK Ltd.

- Baor Products S.L.

- BHASKARA BIOTECH

- Brihans Natural Products Ltd.

- Cultino Agrotech Pvt Ltd

- Family Health Market

- Forever Living Products

- Fruit of the Earth

- Grace Foods

- Green Earth Products Pvt. Ltd.

- Houssy Global

- Jiva Ayurveda

- Keumkang B&F Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ALO Drink

- Aloe Laboratories Inc.

- Aloe Vera of America

- Aloecorp Inc.

- AloeCure

- Alterfood

- Ashland Global Holdings Inc.

- Atlantia UK Ltd.

- Baor Products S.L.

- BHASKARA BIOTECH

- Brihans Natural Products Ltd.

- Cultino Agrotech Pvt Ltd

- Family Health Market

- Forever Living Products

- Fruit of the Earth

- Grace Foods

- Green Earth Products Pvt. Ltd.

- Houssy Global

- Jiva Ayurveda

- Keumkang B&F Co., Ltd.

Table Information

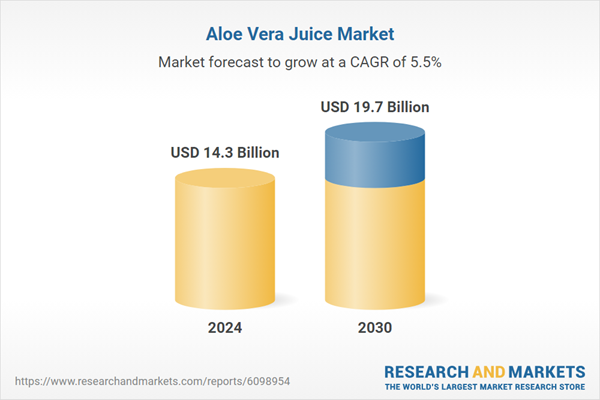

| Report Attribute | Details |

|---|---|

| No. of Pages | 370 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14.3 Billion |

| Forecasted Market Value ( USD | $ 19.7 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |