Global Industrial Filters Market - Key Trends & Drivers Summarized

Why Are Industrial Filters Essential Across Manufacturing and Environmental Applications?

Industrial filters play a critical role in maintaining operational efficiency, product purity, environmental compliance, and workplace safety across a wide spectrum of industries. These filtration systems are used to remove particulates, contaminants, or chemical impurities from air, water, oil, gas, and other fluids within manufacturing and processing environments. Industries such as chemicals, pharmaceuticals, food and beverages, oil & gas, power generation, automotive, and mining all depend heavily on filtration systems to safeguard equipment, prevent contamination, and meet stringent regulatory standards.One of the core drivers of industrial filter usage is the growing emphasis on sustainability and pollution control. Governmental mandates related to emissions, wastewater discharge, and hazardous waste management are prompting industries to adopt advanced filtration solutions. Additionally, the drive for zero-defect manufacturing in high-precision sectors, including electronics and medical devices, has made filtration a mission-critical component of production workflows. Filters are also vital in HVAC systems, cleanrooms, hydraulic systems, and compressed air applications - underscoring their ubiquitous role in modern industrial infrastructure.

What Technological Innovations Are Enhancing Filter Performance and Lifespan?

Technological advancements in filter media, design engineering, and digital integration are driving significant improvements in filter efficiency, durability, and operational intelligence. One major innovation lies in the development of nanofiber and membrane-based filter media, which provide finer filtration at higher flow rates while minimizing pressure drop. These materials are being increasingly used in high-performance applications such as cleanroom environments, microelectronics manufacturing, and advanced water treatment facilities.Another key trend is the integration of smart filtration systems equipped with IoT sensors and predictive maintenance algorithms. These intelligent filters monitor differential pressure, flow rates, and contaminant load in real time, enabling early detection of clogging, reduced downtime, and more efficient filter replacement cycles. Self-cleaning and backwashable filters are also gaining traction, particularly in water and chemical processing industries where filter fouling and replacement frequency can significantly impact operational costs. Moreover, modular and compact filtration units are being designed for retrofit compatibility and easy scalability, allowing facilities to upgrade or expand filtration capacity without overhauling entire systems.

Where Is Market Demand Concentrated and What Are the Emerging Growth Sectors?

The most established markets for industrial filters are North America and Europe, where mature regulatory environments, high levels of industrialization, and early adoption of environmental technologies have driven strong filtration infrastructure. In the United States, Clean Air Act and EPA standards fuel demand for air filters in manufacturing, power plants, and refineries. In Germany, France, and Scandinavia, advanced wastewater treatment regulations are boosting uptake of membrane filtration and bio-filtration systems. However, the Asia-Pacific region is now emerging as the fastest-growing market due to rapid industrial expansion, urbanization, and rising environmental awareness.China and India are leading this regional growth, with significant investments in power generation, water purification, cement, steel, and pharmaceuticals. Southeast Asian nations are also upgrading air and water quality standards, which is encouraging widespread adoption of air intake filters, baghouse filters, and membrane technologies in manufacturing and infrastructure projects. Meanwhile, new growth sectors include battery manufacturing (especially for EVs), semiconductor production, 3D printing, and renewable energy installations such as biogas plants and solar panel facilities, where filtration plays a key role in process integrity and equipment protection.

The Growth in the Industrial Filters Market Is Driven by Several Factors…

It is driven by increasing regulatory pressure on industries to reduce emissions, manage waste, and comply with stringent air and water quality standards. The global push toward environmental sustainability, coupled with decarbonization efforts in manufacturing and energy sectors, is accelerating the adoption of advanced filtration systems. Rapid industrialization in emerging economies and the growth of sectors like pharmaceuticals, chemicals, food processing, and electronics are expanding the customer base for both liquid and air filtration technologies.Additionally, technological advancements in filter media - such as nanofiber coatings, ceramic membranes, and PTFE composites - are enhancing the longevity and performance of filters, making them more cost-effective over time. The integration of digital monitoring and predictive maintenance features is transforming filters into smart industrial assets, improving lifecycle management and reducing unplanned downtime. Market expansion is also supported by rising investments in water reuse, circular manufacturing systems, and indoor air quality solutions, especially in the wake of heightened health and hygiene standards post-pandemic. Overall, the convergence of regulatory enforcement, operational efficiency demands, and sustainable industrial design is fueling a strong and sustained trajectory for the global industrial filters market.

Report Scope

The report analyzes the Industrial Filters market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Liquid Filter Media, Air Filter Media); End-User (Food & Beverages, Chemical, Power Generation, Metals & Mining, Pharmaceutical, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Liquid Filter Media segment, which is expected to reach US$3.9 Billion by 2030 with a CAGR of a 6.7%. The Air Filter Media segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1 Billion in 2024, and China, forecasted to grow at an impressive 9.3% CAGR to reach $1.1 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Industrial Filters Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Industrial Filters Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Industrial Filters Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adimec Advanced Image Systems BV, Allied Vision Technologies GmbH, Axis Communications AB, Basler AG, Baumer Holding AG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Industrial Filters market report include:

- 3M Company

- Ahlstrom-Munksjö Oyj

- Alfa Laval AB

- BWF Envirotec

- Camfil AB

- Clear Edge Filtration Group

- Cummins Filtration

- Danaher Corporation

- Donaldson Company, Inc.

- Eaton Corporation plc

- Filtration Group Corporation

- Freudenberg Filtration Technologies

- Hollingsworth & Vose Company

- Lydall Inc.

- MANN+HUMMEL Group

- Nederman Holding AB

- Pall Corporation

- Parker Hannifin Corporation

- Sefar AG

- Valmet Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Ahlstrom-Munksjö Oyj

- Alfa Laval AB

- BWF Envirotec

- Camfil AB

- Clear Edge Filtration Group

- Cummins Filtration

- Danaher Corporation

- Donaldson Company, Inc.

- Eaton Corporation plc

- Filtration Group Corporation

- Freudenberg Filtration Technologies

- Hollingsworth & Vose Company

- Lydall Inc.

- MANN+HUMMEL Group

- Nederman Holding AB

- Pall Corporation

- Parker Hannifin Corporation

- Sefar AG

- Valmet Corporation

Table Information

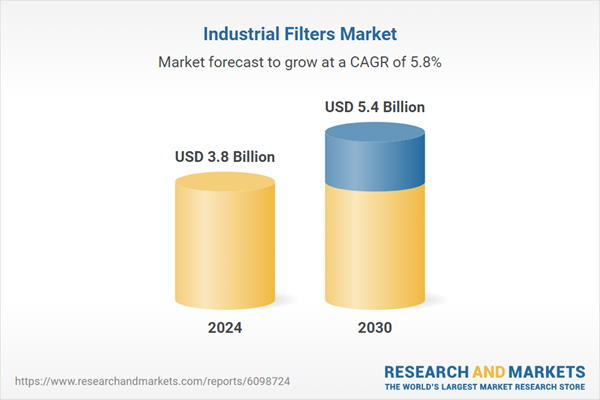

| Report Attribute | Details |

|---|---|

| No. of Pages | 286 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.8 Billion |

| Forecasted Market Value ( USD | $ 5.4 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |