Global Manufactured Sand And Granite Market - Key Trends & Drivers Summarized

Why Are Manufactured Sand and Crushed Granite Emerging as Preferred Alternatives in Construction?

Manufactured sand (M-sand) and crushed granite are increasingly being adopted as sustainable, high-performance alternatives to natural river sand and traditional aggregates in the construction and infrastructure sectors. With depleting natural sand reserves, environmental restrictions on river sand mining, and the need for consistent quality in concrete production, construction firms are turning to manufactured sand produced by crushing hard granite rock using vertical shaft impact (VSI) crushers. The resulting sand has controlled particle size distribution, cubical shape, and lower silt content - ideal for concrete, mortar, and plaster applications.Crushed granite, on the other hand, is gaining prominence as a durable and high-load-bearing construction aggregate used in road base layers, railway ballast, concrete structures, and precast blocks. Known for its strength, weather resistance, and interlocking properties, granite aggregates improve the compressive strength and skid resistance of final structures. Together, manufactured sand and granite are forming a composite solution to address the dual challenges of aggregate scarcity and the need for improved concrete performance in mega infrastructure, affordable housing, and industrial construction projects globally.

How Are Production Technologies and Quality Control Enhancing Market Viability?

Technological advancements in crushing, screening, and washing systems have played a crucial role in scaling up manufactured sand and granite aggregate production while ensuring consistent quality. High-speed VSI crushers, triple-deck vibratory screens, and wet classification systems are being used to fine-tune the particle shape and eliminate deleterious materials such as clay and fines. Air classifiers and hydrocyclones further refine sand gradation and enhance workability properties when used in concrete mix designs.Quality control protocols have become highly standardized, particularly for M-sand, which must meet IS 383 (India), ASTM C33 (U.S.), or EN 12620 (Europe) standards for fine aggregates. Producers are investing in on-site labs to test particle size distribution, shape index, water absorption, and silt content. In many regions, ready-mix concrete (RMC) plants are entering into long-term contracts with certified M-sand suppliers to ensure continuity of supply and concrete mix compatibility. The availability of automated material handling systems, ERP-integrated production lines, and GPS-enabled fleet logistics is further enhancing the scalability and commercial viability of these alternatives.

Which Construction Segments and Geographic Markets Are Driving Demand for M-Sand and Granite?

The demand for manufactured sand and granite aggregates is being driven by the global infrastructure push, especially in high-growth economies such as India, China, Indonesia, Brazil, and Nigeria. Government-backed projects in roads, bridges, metros, and smart cities require large volumes of high-strength concrete - fuelling adoption of M-sand and granite due to their engineering properties and sustainable sourcing credentials. The residential and commercial real estate sectors are also significant consumers, with builders seeking alternatives to river sand to comply with green building codes and reduce material variability.In regions where river sand mining is either banned or highly restricted - such as parts of South India, Western Europe, and the Middle East - M-sand has become the default construction material. Coastal infrastructure and heavy engineering projects favor granite due to its high compressive strength and saltwater resistance. Furthermore, the increasing adoption of precast and modular construction methods in North America and Europe is creating additional demand for granular materials with tight quality tolerances - strengthening the case for manufactured aggregates over natural variants.

What Is Driving Long-Term Growth in the Manufactured Sand and Granite Market?

The growth in the manufactured sand and granite market is driven by interlinked trends in sustainable construction, material standardization, and regulatory transformation. One of the foremost drivers is the environmental degradation caused by riverbed mining, which has led to strict enforcement of sustainable aggregate sourcing practices by urban planning authorities. As compliance costs and penalties rise, construction companies are proactively shifting to industrially produced sand and granite aggregates to align with sustainability mandates and lifecycle assessment goals.The surge in infrastructure spending under national programs such as India's PM Gati Shakti, China's Belt and Road Initiative, and the U.S. Infrastructure Investment and Jobs Act is creating long-term aggregate demand with a preference for high-performance, traceable materials. Simultaneously, the concrete industry's push for consistent batching, high early strength, and reduced water demand is favoring the use of engineered aggregates like M-sand and graded granite. Digital concrete mix design software and performance modeling tools are also enabling more precise use of these materials in optimized formulations.

Private investments in automated quarries, mineral beneficiation units, and mobile crushing plants are expanding the availability of M-sand and granite even in semi-urban and remote regions. Strategic partnerships between cement manufacturers, EPC firms, and aggregate producers are leading to integrated supply chains that offer superior cost-efficiency and logistical flexibility. As construction practices evolve and material sustainability becomes a differentiator, manufactured sand and granite are poised to become foundational inputs in the global transition to resilient, future-ready infrastructure.

Report Scope

The report analyzes the Manufactured Sand and Granite market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Manufactured Sand, Granite); End-User (Residential, Commercial, Industrial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

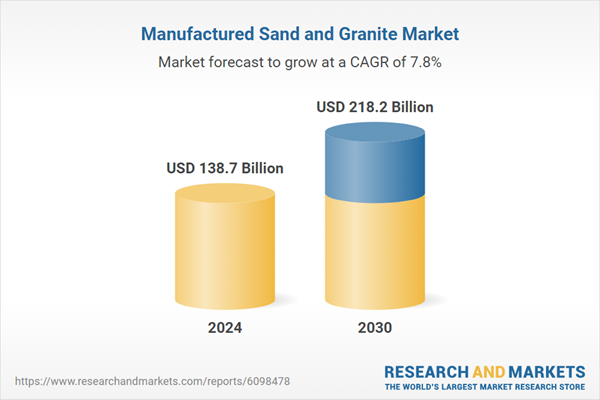

- Market Growth: Understand the significant growth trajectory of the Manufactured Sand segment, which is expected to reach US$145.4 Billion by 2030 with a CAGR of a 9.4%. The Granite segment is also set to grow at 5.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $37.8 Billion in 2024, and China, forecasted to grow at an impressive 12.5% CAGR to reach $47.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Manufactured Sand and Granite Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Manufactured Sand and Granite Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Manufactured Sand and Granite Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BAE Systems plc, Boeing Defense, Space & Security, Denel Dynamics, Elbit Systems Ltd., General Dynamics Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Manufactured Sand and Granite market report include:

- Ablegroup Berhad

- Adelaide Brighton Ltd

- Antolini Luigi & C. S.p.A.

- Arizona Tile

- Cambria

- CDE Global

- CEMEX S.A.B. de C.V.

- Cosentino S.A.

- CRH plc

- Dakota Granite Company

- Gem Granites

- Granite Construction Inc.

- HeidelbergCement AG

- Holcim Ltd

- Lasselsberger Group

- Levantina y Asociados de Minerales

- M S International, Inc.

- Pokarna Limited

- R.E.D. Graniti S.p.A.

- Vulcan Materials Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ablegroup Berhad

- Adelaide Brighton Ltd

- Antolini Luigi & C. S.p.A.

- Arizona Tile

- Cambria

- CDE Global

- CEMEX S.A.B. de C.V.

- Cosentino S.A.

- CRH plc

- Dakota Granite Company

- Gem Granites

- Granite Construction Inc.

- HeidelbergCement AG

- Holcim Ltd

- Lasselsberger Group

- Levantina y Asociados de Minerales

- M S International, Inc.

- Pokarna Limited

- R.E.D. Graniti S.p.A.

- Vulcan Materials Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 281 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 138.7 Billion |

| Forecasted Market Value ( USD | $ 218.2 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |