Global Maritime Digitization Market - Key Trends & Drivers Summarized

Why Is the Maritime Industry Undergoing Accelerated Digital Transformation?

Maritime digitization is transforming the global shipping industry by introducing advanced technologies that enhance efficiency, safety, compliance, and sustainability across maritime operations. As one of the last major industries to undergo digital disruption, the shipping sector is rapidly catching up with innovations that digitize everything from vessel navigation and cargo handling to fleet coordination, port logistics, and supply chain integration. This transformation is being driven by rising stakeholder expectations, growing trade volumes, decarbonization mandates, and the need for real-time operational visibility.Digitalization is not only helping shipping companies optimize fuel usage and maintenance cycles but is also enabling end-to-end cargo traceability, smarter port calls, and autonomous decision-making capabilities. It is allowing shipping to transition from reactive, paper-intensive practices to predictive and data-driven workflows. Maritime digitization is also vital for achieving compliance with IMO regulations, improving cyber-resilience, and creating interoperable networks that connect ships, ports, and maritime authorities in real time. As vessels become increasingly data-rich platforms, the digital layer is emerging as the strategic interface that drives competitiveness and future-readiness in the maritime domain.

How Are Key Technologies Like IoT, AI, and Cloud Computing Reshaping Maritime Operations?

Several foundational technologies are reshaping maritime operations under the umbrella of digitization. IoT-enabled sensors installed on ships, cargo containers, and port equipment are providing real-time data on fuel consumption, engine status, cargo condition, and navigation parameters. These data streams are analyzed using AI and machine learning algorithms to optimize route planning, preventive maintenance, crew deployment, and cargo loading. Predictive insights help prevent equipment failure, reduce emissions, and improve asset utilization.Cloud computing platforms facilitate centralized data access, cross-fleet visibility, and seamless integration between shipboard and shoreside systems. Edge computing is gaining traction for latency-sensitive operations such as autonomous maneuvering, real-time weather routing, and onboard machine diagnostics. Blockchain is being piloted to enable secure documentation of shipping contracts, bills of lading, and compliance certifications, reducing fraud and administrative delays. Meanwhile, digital twins - virtual replicas of ships and ports - are allowing operators to simulate scenarios, forecast outcomes, and fine-tune operational decisions without incurring real-world risk.

Which Market Segments and Operational Domains Are Driving Digital Adoption?

Digitization is being rapidly adopted across commercial, naval, offshore, and port operations, each with specific needs and digital maturity levels. In commercial shipping, fleet operators are digitizing voyage management, bunkering operations, and crew rotation using integrated dashboards and maritime ERP platforms. Port authorities and terminal operators are investing in smart port solutions that automate gate operations, yard planning, berth scheduling, and customs clearance. These tools enhance port throughput, reduce congestion, and enable real-time visibility across the maritime supply chain.Naval and coast guard fleets are focusing on digital surveillance, combat readiness, and asset tracking via integrated command systems and AI-assisted threat analysis. Offshore energy operators use digital platforms to manage drilling platforms, subsea assets, and emergency response systems under hazardous and high-risk conditions. In maritime logistics and freight forwarding, real-time shipment visibility, electronic documentation, and predictive delivery timelines are becoming key differentiators in customer service and competitive positioning. As each of these domains matures, tailored digitization strategies are emerging based on asset type, mission profile, and regulatory environment.

What Is Fueling the Long-Term Growth of the Maritime Digitization Ecosystem?

The growth in the maritime digitization market is being fueled by structural industry shifts, policy mandates, and investor expectations for transparency, sustainability, and resilience. The IMO's digitalization strategy, coupled with cybersecurity guidelines and e-navigation frameworks, is creating regulatory tailwinds for digital technology deployment. Decarbonization mandates under the EEXI and CII frameworks are also pushing shipping companies to adopt digital tools that provide accurate emissions tracking, efficiency analytics, and regulatory reporting.Commercial factors such as port call optimization, vessel utilization maximization, and fuel cost control are driving return on investment in digital platforms. The emergence of digital classification societies, remote inspection services, and autonomous ship trials is broadening the scope of what digitization can achieve. Furthermore, the increasing convergence between maritime operations and global logistics ecosystems is positioning digitization as the bridge between sea and land-based supply chains.

Private equity, venture capital, and strategic corporate investors are pouring capital into maritime tech startups offering AI-driven routing, digital chartering platforms, cybersecurity solutions, and automated vessel compliance tools. As shipping continues to evolve into a data-centric industry, maritime digitization will remain a critical enabler of sustainable, agile, and future-proof maritime commerce.

Report Scope

The report analyzes the Maritime Digitization market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Technology (AI, IoT, Blockchain, Other Technologies); Application (Fleet Management, Vessel Management, Energy Management, Inventory Management, Predictive Maintenance); End-User (Ports & Terminals, Shipping Companies, Maritime Freight Forwarders).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the AI Technology segment, which is expected to reach US$158.8 Billion by 2030 with a CAGR of a 8.1%. The IoT Technology segment is also set to grow at 8.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $59 Billion in 2024, and China, forecasted to grow at an impressive 8.3% CAGR to reach $58.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Maritime Digitization Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Maritime Digitization Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Maritime Digitization Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Aquametro Oil & Marine AG, Banlaw Systems Ltd., Bergan Marine Systems, BMT Group Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Maritime Digitization market report include:

- ABB Ltd.

- Aquametro Oil & Marine AG

- Banlaw Systems Ltd.

- Bergan Marine Systems

- BMT Group Ltd.

- DNV AS

- Emerson Electric Co.

- Endress+Hauser Group

- Eniram (a Wärtsilä company)

- Equatorial Marine Fuel Management Services Pte Ltd

- Fueltrax

- Inatech (a Glencore company)

- Interschalt Maritime Systems GmbH

- Krill Systems Inc.

- Marorka Ltd.

- Marubeni Corporation

- Mustang Technologies

- Nautical Control Solutions LP

- Siemens AG

- World Fuel Services Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Aquametro Oil & Marine AG

- Banlaw Systems Ltd.

- Bergan Marine Systems

- BMT Group Ltd.

- DNV AS

- Emerson Electric Co.

- Endress+Hauser Group

- Eniram (a Wärtsilä company)

- Equatorial Marine Fuel Management Services Pte Ltd

- Fueltrax

- Inatech (a Glencore company)

- Interschalt Maritime Systems GmbH

- Krill Systems Inc.

- Marorka Ltd.

- Marubeni Corporation

- Mustang Technologies

- Nautical Control Solutions LP

- Siemens AG

- World Fuel Services Corporation

Table Information

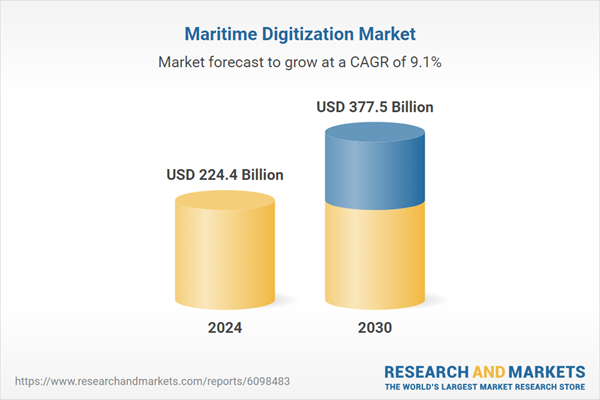

| Report Attribute | Details |

|---|---|

| No. of Pages | 170 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 224.4 Billion |

| Forecasted Market Value ( USD | $ 377.5 Billion |

| Compound Annual Growth Rate | 9.1% |

| Regions Covered | Global |