Global 'SIM Card' Market - Key Trends & Drivers Summarized

Why Does The SIM Card Still Matter In An Era Of Hyperconnectivity?

Despite the rise of embedded and virtualized alternatives, the SIM card (Subscriber Identity Module) remains a foundational component of global mobile communication infrastructure. It securely stores the International Mobile Subscriber Identity (IMSI) and authenticates users on cellular networks, enabling voice, SMS, and data services. From traditional 2G/3G networks to modern 4G LTE and 5G ecosystems, SIM cards are essential for network access and billing, identity management, and service personalization. With over 8 billion mobile connections worldwide, SIM technology plays a central role in mobile penetration, especially in developing regions where feature phones and low-cost smartphones dominate. The evolution of SIM form factors - from full-size to mini, micro, nano, and now embedded SIM (eSIM) and integrated SIM (iSIM) - demonstrates its adaptability to changing device designs and market needs. SIM cards are not just about connectivity - they are also the linchpins of mobile security and user authentication, increasingly being used in banking, M2M (Machine-to-Machine) communications, and government ID programs. In many emerging markets, SIM registration is tied to national identity schemes, enhancing its role in digital governance. As mobile services continue to expand across sectors, the SIM remains a crucial enabler of the mobile-first economy.How Are Technological Shifts Reshaping The SIM Card Ecosystem?

The SIM card ecosystem is undergoing a major transformation driven by the advent of eSIM, iSIM, and remote SIM provisioning (RSP). eSIMs eliminate the need for physical cards, enabling network profiles to be downloaded directly onto a chip embedded in the device. This shift is streamlining device manufacturing and enabling seamless operator switching - particularly useful for IoT, wearables, and global travel. Integrated SIM (iSIM), which embeds SIM functionality into the device's system-on-chip (SoC), offers even greater miniaturization, reduced power consumption, and enhanced security - ideal for compact devices and industrial IoT. Meanwhile, RSP platforms are making it easier for consumers and enterprises to manage multiple network profiles remotely, allowing for dynamic connectivity without physical intervention. In parallel, SIM-based authentication is being extended beyond telecom to enable two-factor authentication for fintech apps, e-health platforms, and enterprise mobility. Security enhancements such as over-the-air (OTA) updates, end-to-end encryption, and tamper-resistant designs are keeping SIMs relevant in the cybersecurity space. Mobile network operators (MNOs) and SIM vendors are also focusing on programmable SIMs and multi-IMSI technologies to support global connectivity in smart vehicles, logistics, and drone communications. These innovations are reshaping the SIM from a static identity token into a dynamic, software-driven connectivity engine.Where Are SIM Cards Powering Digital Inclusion, Connectivity, And IoT Expansion?

SIM cards continue to be critical in advancing digital inclusion, particularly in developing regions across Africa, Southeast Asia, and Latin America where prepaid SIMs offer affordable, accessible mobile services. Governments and telecom operators use SIM-based outreach for healthcare messaging, mobile money, digital education, and emergency alerts. In urbanized nations, SIMs serve more sophisticated roles in enabling smart mobility, connected homes, and enterprise connectivity. The automotive sector is increasingly reliant on M2M SIMs for telematics, navigation, and vehicle-to-infrastructure (V2I) communication. In logistics and supply chain, SIM-enabled trackers monitor real-time location, temperature, and security of goods, ensuring visibility across global networks. Utility companies employ SIM cards in smart meters for real-time energy consumption monitoring and remote management. Even agriculture benefits through connected sensors powered by SIM-based IoT modules that collect soil, crop, and weather data. In consumer electronics, SIMs support always-on connectivity in tablets, laptops, e-readers, and wearables. The public sector uses SIMs in law enforcement, transport management, and border security systems. Across these sectors, SIMs function as low-cost, secure, and standardized gateways to digital services, enabling seamless mobility, automation, and service delivery at scale.The Growth In The SIM Card Market Is Driven By Several Factors That Reflect Device Proliferation, Connectivity Demands, And Emerging Digital Economies

A primary growth driver is the continuing global expansion of mobile device usage - smartphones, tablets, wearables, and IoT endpoints - all requiring secure and reliable network access. The rapid adoption of 5G networks is further accelerating demand for advanced SIM solutions capable of supporting low-latency, high-throughput applications. The rise of eSIM and iSIM technologies is not cannibalizing the market but rather expanding it - enabling new business models in automotive, consumer electronics, and enterprise IoT where remote profile management and global roaming are essential. Meanwhile, government policies mandating SIM registration and digital KYC (Know Your Customer) are increasing the demand for secure, programmable SIMs with identity management features. Growth in mobile payments and digital banking across emerging markets is strengthening SIM's role as a secure transaction enabler. The increasing focus on smart cities, smart agriculture, and Industry 4.0 is fueling demand for M2M and IoT SIM cards capable of operating in rugged, mission-critical environments. Telecom operators are also launching multi-profile SIM offerings to address cross-border and dual-network usage. With billions of IoT connections expected by 2030, SIM technology - particularly its software-defined and embedded variants - will remain vital to global digital transformation. These drivers - spanning connectivity expansion, regulatory alignment, and embedded intelligence - are collectively ensuring the robust growth and evolution of the global SIM card market.Report Scope

The report analyzes the SIM Card market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Embedded-SIM, Software SIM, Full Size SIM, Mini-SIM, Micro-SIM, Nano-SIM); Vertical (Automotive, Consumer Electronics, Manufacturing, Telecommunication, Transportation & Logistics, Other Verticals).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Embedded-SIM segment, which is expected to reach US$2 Billion by 2030 with a CAGR of a 5.9%. The Software SIM segment is also set to grow at 5.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 8.9% CAGR to reach $1.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global SIM Card Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global SIM Card Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global SIM Card Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Bosch, Coherent Corp., Diodes Incorporated, Fuji Electric Co., Ltd., GeneSiC Semiconductor Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this SIM Card market report include:

- 1NCE

- Airalo

- Businesim Ltd

- Chengdu MIND IOT Technology Co.

- Deutsche Telekom AG

- DZ Cards

- Flickswitch (Pty) Ltd

- Giesecke+Devrient GmbH

- Guangzhou JY Electronic Tech

- HKCARD Electronics Co., Ltd.

- IDEMIA

- iQsim

- Nature Solution Tech Co., Ltd

- Reday Electronics Technology Ltd

- Roamless

- Shenzhen MUP Industrial Co., Ltd

- Shenzhen ZCGH Technology Co., Ltd

- STMicroelectronics

- Tele-Pak Card Printing Inc.

- Thales Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 1NCE

- Airalo

- Businesim Ltd

- Chengdu MIND IOT Technology Co.

- Deutsche Telekom AG

- DZ Cards

- Flickswitch (Pty) Ltd

- Giesecke+Devrient GmbH

- Guangzhou JY Electronic Tech

- HKCARD Electronics Co., Ltd.

- IDEMIA

- iQsim

- Nature Solution Tech Co., Ltd

- Reday Electronics Technology Ltd

- Roamless

- Shenzhen MUP Industrial Co., Ltd

- Shenzhen ZCGH Technology Co., Ltd

- STMicroelectronics

- Tele-Pak Card Printing Inc.

- Thales Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 296 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

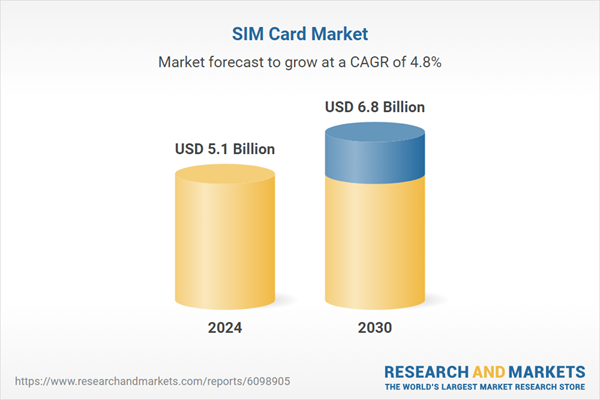

| Estimated Market Value ( USD | $ 5.1 Billion |

| Forecasted Market Value ( USD | $ 6.8 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |