Global 'Sleep Tourism' Market - Key Trends & Drivers Summarized

Why Is Sleep Tourism Emerging As The Ultimate Wellness Travel Experience?

Sleep tourism is rapidly gaining traction as a specialized form of wellness travel, catering to a growing population of fatigued, stress-ridden, and digitally drained individuals seeking to improve sleep quality while on vacation. Unlike traditional leisure travel, sleep tourism is centered around rest, recovery, and sleep enhancement through scientifically designed programs and tranquil environments. High-end hotels, wellness resorts, and boutique retreats are curating sleep-focused experiences that include circadian-friendly lighting, soundproof rooms, personalized sleep coaching, melatonin-regulating diets, and access to sleep diagnostics. The concept is particularly appealing in a world where sleep deprivation is a public health crisis, with the WHO and CDC labeling it a modern epidemic. Modern travelers are prioritizing holistic well-being over sightseeing marathons, and sleep-focused travel offers an antidote to burnout, jet lag, and digital overload. Elite destinations - from Switzerland to Bali and the Maldives - are branding sleep as luxury, offering packages that combine neuroscience, spa therapies, aromatherapy, and biohacking tools to help guests achieve deep, restorative sleep. The fusion of wellness and hospitality, amplified by social media and influencers who champion “slow travel” and mental health, is turning sleep tourism into a premium travel movement that prioritizes rest over rush.How Are Technology And Science Elevating Sleep-Centric Travel Experiences?

Technology and medical science are transforming sleep tourism into a data-driven, personalized, and clinically informed wellness journey. Advanced sleep labs are being embedded within luxury accommodations, offering overnight polysomnography, wearable monitoring devices, and EEG-based sleep mapping to analyze sleep patterns in real time. Hotels are investing in smart mattresses with pressure sensors, climate control, and sleep-stage tracking capabilities. Circadian lighting systems that mimic natural light cycles are now standard in sleep suites, helping guests recalibrate their biological rhythms. Some properties offer in-room access to guided sleep meditations, binaural beats, and white noise generators, curated by neuroscientists and sleep specialists. Digital detox programs - removing blue light-emitting devices and promoting screen-free zones - are further enhancing melatonin production and reducing pre-sleep anxiety. Additionally, dietary personalization plays a key role, with menus tailored to support sleep through ingredients like tryptophan, magnesium, and valerian root. Cutting-edge properties are even introducing sleep-focused IV therapies, oxygen treatments, and infrared saunas as part of integrative bio-wellness programs. This scientific and technological integration not only elevates guest experiences but also legitimizes sleep tourism as a measurable health intervention, blending hospitality with functional health optimization.Where Is Sleep Tourism Creating Economic And Cultural Shifts Across The Travel Industry?

Sleep tourism is reshaping the travel and hospitality industry by creating new business models, revenue streams, and service ecosystems focused on sleep as a wellness commodity. In the luxury segment, brands such as Six Senses, Four Seasons, and Rosewood are rolling out specialized sleep retreats and add-on programs that attract high-spending wellness travelers. Medical tourism hubs in Switzerland, Germany, and Thailand are combining sleep diagnostics with rehabilitative therapies, attracting affluent travelers looking for medically supervised rest. Urban boutique hotels and wellness resorts are also targeting corporate travelers, digital nomads, and burnout-prone executives through “sleepcation” packages that replace business suites with restorative pods and mindfulness spaces. Sleep-focused travel is generating demand for new job roles - such as sleep concierges, circadian consultants, and behavioral therapists - adding a therapeutic layer to hospitality services. Meanwhile, local communities benefit from increased engagement in wellness-focused supply chains, including organic agriculture, aromatherapy producers, and holistic health practitioners. Culturally, the rise of sleep tourism challenges the productivity-obsessed norms of modern travel by promoting “rest as luxury” and encouraging people to view sleep not as a passive necessity but as an active, enriching experience worth investing in.The Growth In The Sleep Tourism Market Is Driven By Several Factors That Reflect Changing Wellness Priorities, Travel Behaviors, And Hospitality Innovation

One major driver is the global wellness trend that increasingly prioritizes mental health, stress recovery, and sleep hygiene - pushing travelers to seek experiences that enhance rest rather than deplete energy. Rising sleep disorders, exacerbated by work-from-home fatigue, digital burnout, and anxiety, have created a strong demand for professional, supportive environments designed for sleep restoration. Demographic shifts - such as aging populations, health-focused millennials, and wellness-conscious Gen Z - are fueling interest in sleep-improving getaways. On the supply side, hotels and resorts are rebranding around wellness tourism, retrofitting facilities with sleep-friendly infrastructure and forming partnerships with sleep clinics, integrative health experts, and wellness brands. Increased media coverage of sleep's role in immunity, longevity, and cognitive performance is also pushing affluent consumers to “travel to sleep better” rather than simply “sleep to travel.” The growth of travel influencers and niche wellness tourism platforms is expanding visibility and aspirational appeal. Additionally, post-pandemic health awareness and cautious travel attitudes are driving demand for slower, more purposeful journeys where rest and recovery are central. Together, these factors - anchored in consumer health trends, innovation in hospitality, and redefined travel priorities - are accelerating the expansion of the global sleep tourism market.Report Scope

The report analyzes the Sleep Tourism market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Accommodation Type (Luxury Hotels, Boutique Hotels, Resorts, Homestays / Villas, Other Accommodation Types); Activity / Experience (Wellness, Meditation, Holistic, Sleep Therapies, Other Activity / Experiences); Purpose of Visit (Medical / Therapeutic, Leisure, Educational, Other Purpose of Visits).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Luxury Hotels segment, which is expected to reach US$57.7 Billion by 2030 with a CAGR of a 9%. The Boutique Hotels segment is also set to grow at 5.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $19.9 Billion in 2024, and China, forecasted to grow at an impressive 7.5% CAGR to reach $18.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sleep Tourism Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sleep Tourism Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sleep Tourism Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Advanced Brain Monitoring, Inc., Braebon Medical Corporation, Cleveland Medical Devices Inc., Contec Medical Systems Co., Ltd., Cryosa and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Sleep Tourism market report include:

- &Beyond

- Ananda in the Himalayas

- Atmantan Wellness Centre

- Black Tomato

- Canyon Ranch

- Carnoustie Ayurveda & Wellness Resort

- Castle Hot Springs

- Cliveden House

- Conrad Hotels & Resorts

- Four Seasons Hotels and Resorts

- Hästens Sleep Spa

- Hilton Worldwide

- Hoshino Resorts

- Hotel Figueroa

- Kairali Ayurvedic Healing Village

- Lifehouse Spa & Hotel

- Niraamaya Retreats

- Nirvana Naturopathy & Retreat

- Rosewood Hotels & Resorts

- Six Senses Hotels Resorts Spas

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- &Beyond

- Ananda in the Himalayas

- Atmantan Wellness Centre

- Black Tomato

- Canyon Ranch

- Carnoustie Ayurveda & Wellness Resort

- Castle Hot Springs

- Cliveden House

- Conrad Hotels & Resorts

- Four Seasons Hotels and Resorts

- Hästens Sleep Spa

- Hilton Worldwide

- Hoshino Resorts

- Hotel Figueroa

- Kairali Ayurvedic Healing Village

- Lifehouse Spa & Hotel

- Niraamaya Retreats

- Nirvana Naturopathy & Retreat

- Rosewood Hotels & Resorts

- Six Senses Hotels Resorts Spas

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 240 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

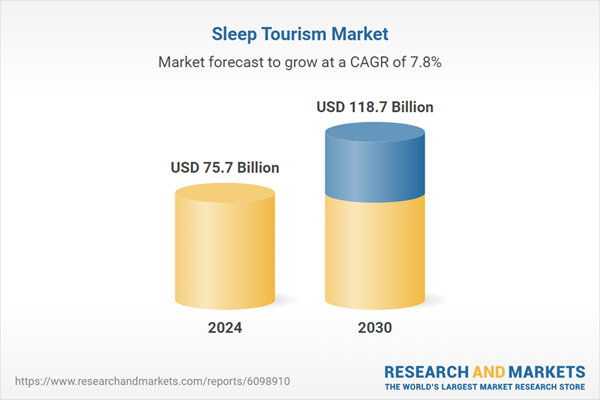

| Estimated Market Value ( USD | $ 75.7 Billion |

| Forecasted Market Value ( USD | $ 118.7 Billion |

| Compound Annual Growth Rate | 7.8% |

| Regions Covered | Global |