Global Sophorolipids Market - Key Trends & Drivers Summarized

Why Are Sophorolipids Gaining Global Attention as Sustainable Biosurfactants?

Sophorolipids are glycolipid biosurfactants produced by non-pathogenic yeast species such as Starmerella bombicola, known for their biodegradability, low toxicity, and high surface activity. These microbial surfactants are gaining traction as sustainable alternatives to petrochemical-based surfactants across industries such as personal care, home cleaning, agriculture, and oilfield chemicals. Their ability to reduce surface and interfacial tension, emulsify oils, and function under a wide pH and temperature range makes them highly versatile for industrial use.Consumer preference for eco-friendly, non-toxic, and naturally derived ingredients is reshaping the landscape of the surfactant industry. Sophorolipids, with their renewable production pathway and benign environmental profile, align well with the principles of green chemistry and circular bioeconomy. As regulatory pressure grows against synthetic surfactants and microplastic-laden formulations, manufacturers are turning to sophorolipids to meet both performance expectations and compliance with sustainability mandates.

What Advances Are Driving Production Scalability and Commercialization?

Historically, large-scale sophorolipid production faced challenges related to fermentation yields, downstream purification, and cost competitiveness. However, recent advances in metabolic engineering, fed-batch fermentation, and substrate optimization have significantly improved production efficiency. Scientists have developed genetically enhanced yeast strains and low-cost feedstock strategies - including the use of waste oils and agricultural residues - to boost sophorolipid yields while reducing environmental impact.Techniques such as foam fractionation and membrane filtration are streamlining purification processes, lowering energy inputs and improving product quality. These process innovations are making sophorolipids more commercially viable for mass-market applications. Additionally, partnerships between biotech firms and consumer goods companies are fostering the scale-up of production infrastructure and integration of biosurfactants into mainstream product lines. The emergence of precision fermentation and synthetic biology platforms is expected to further lower production costs and expand the structural diversity of sophorolipids available for functional customization.

Which Applications and Geographies Are Leading Demand for Sophorolipids?

Personal care and cosmetic products are the most prominent application areas, where sophorolipids serve as mild surfactants, emulsifiers, and skin-conditioning agents in shampoos, facial cleansers, and moisturizers. Home care products such as dishwashing liquids and laundry detergents are also incorporating sophorolipids to achieve both foaming and cleaning efficiency with low environmental impact. In agriculture, sophorolipids are used in bio-pesticide formulations and as adjuvants to improve the efficacy of foliar sprays.Geographically, Europe is at the forefront of sophorolipid adoption due to strong consumer demand for natural and organic products, combined with regulatory support for biodegradable and low-impact chemicals. North America follows, driven by the rise of clean-label brands and sustainable product certifications. Asia-Pacific is emerging rapidly, especially in South Korea, Japan, and China, where innovation in green cosmetics and agricultural inputs is accelerating. Several biotech firms in India and Southeast Asia are also exploring sophorolipid production as part of broader bioeconomy development initiatives.

The Growth in the Sophorolipids Market Is Driven by Several Factors…

It is driven by the rising demand for biodegradable and bio-based surfactants in personal care, home cleaning, and agrochemical industries. Technological advancements in microbial fermentation, metabolic engineering, and low-cost substrate utilization are making large-scale production more efficient and economically feasible. Increasing regulatory restrictions on synthetic surfactants and environmentally hazardous chemicals are pushing manufacturers toward biosurfactant alternatives.Moreover, growing investment in industrial biotechnology, especially in Europe and Asia, is catalyzing R&D and infrastructure for sophorolipid manufacturing. Collaborations between biotech startups and FMCG giants are accelerating commercial adoption, while expanding applications in cosmetics, detergents, and crop protection products continue to open new revenue streams. As sustainability becomes a core criterion in product development and supply chain decisions, sophorolipids are well-positioned to become mainstream components of the global surfactants market.

Report Scope

The report analyzes the Sophorolipids market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Acidic Sophorolipids, Lactonic Sophorolipids); Application (Detergents, Personal Care & Cosmetics, Agrochemicals, Food Additives, Medicine Production, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Acidic Sophorolipids segment, which is expected to reach US$465.5 Million by 2030 with a CAGR of a 6.7%. The Lactonic Sophorolipids segment is also set to grow at 3.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $136 Million in 2024, and China, forecasted to grow at an impressive 9.1% CAGR to reach $141.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sophorolipids Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sophorolipids Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sophorolipids Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ampcera Inc., Cymbet Corporation, Excellatron Solid State, Factorial Energy, Hitachi Zosen Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Sophorolipids market report include:

- Actera Ingredients

- Allied Carbon Solutions Co., Ltd.

- Aqua Bio Technology ASA

- BASF SE

- Biobar Pty Ltd.

- Biotensidon GmbH

- Cognis (now part of BASF)

- Dow Inc.

- Ecover

- Envgreen Biotechnology

- Evonik Industries AG

- Givaudan SA

- Godrej Industries Ltd.

- Henkel AG & Co. KGaA

- Holiferm Ltd.

- Locus Ingredients

- MG Intobio Co., Ltd.

- Saraya Co., Ltd.

- Soliance (now part of Givaudan)

- Unilever

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Actera Ingredients

- Allied Carbon Solutions Co., Ltd.

- Aqua Bio Technology ASA

- BASF SE

- Biobar Pty Ltd.

- Biotensidon GmbH

- Cognis (now part of BASF)

- Dow Inc.

- Ecover

- Envgreen Biotechnology

- Evonik Industries AG

- Givaudan SA

- Godrej Industries Ltd.

- Henkel AG & Co. KGaA

- Holiferm Ltd.

- Locus Ingredients

- MG Intobio Co., Ltd.

- Saraya Co., Ltd.

- Soliance (now part of Givaudan)

- Unilever

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 287 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

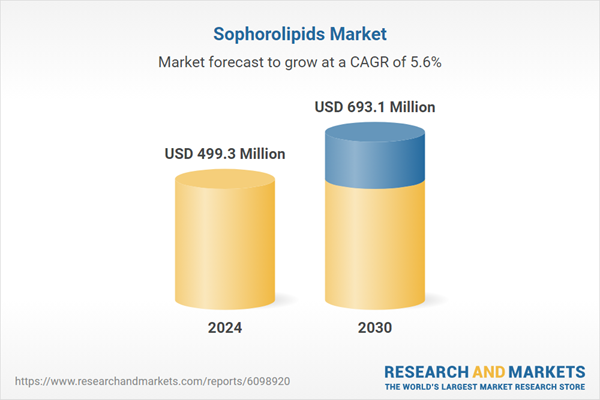

| Estimated Market Value ( USD | $ 499.3 Million |

| Forecasted Market Value ( USD | $ 693.1 Million |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |