Global Automotive Digital Keys Market - Key Trends & Drivers Summarized

Why Are Automotive Digital Keys Emerging as a Cornerstone of Connected Vehicle Access and Mobility Personalization?

Automotive digital keys are transforming traditional vehicle access by enabling secure, smartphone-based entry and ignition systems that align with the growing shift toward connected, contactless, and personalized mobility. Replacing or augmenting physical key fobs, these digital solutions allow authorized users to lock, unlock, and start vehicles using mobile apps, wearable devices, or biometric authentication methods. As vehicles become more software-defined and embedded with IoT connectivity, digital keys are evolving from convenience features into strategic enablers of shared mobility, fleet management, and customer-centric ownership experiences.Digital keys support multi-user access rights, allowing vehicle owners to grant temporary or conditional access to others - an essential capability in car-sharing, ride-hailing, valet, and corporate fleet applications. This enhances both operational efficiency and user flexibility, particularly in the post-pandemic era where contactless interaction is valued. For OEMs, digital keys provide an opportunity to deepen customer engagement via mobile apps, integrate with vehicle diagnostics, and support subscription-based features. As the automotive ecosystem converges with digital identity frameworks, digital keys are quickly becoming an essential layer in the broader connected mobility infrastructure.

How Are Standards, Security Protocols, and Integration Platforms Advancing Digital Key Capabilities?

The evolution of automotive digital keys is being driven by robust security protocols, global standardization efforts, and the integration of mobile operating systems with vehicle control units. The Car Connectivity Consortium (CCC) has been instrumental in developing a standardized Digital Key specification - now in its 3.0 iteration - which uses ultra-wideband (UWB), Bluetooth Low Energy (BLE), and near-field communication (NFC) technologies to ensure secure, passive, and proximity-based access. These standards enable interoperability across OEMs, mobile devices, and Tier 1 suppliers, fostering scalability and user adoption across brands and platforms.End-to-end encryption, tokenization, and embedded secure elements within smartphones ensure that digital key data is tamper-proof, non-clonable, and revocable in real-time. Integration with mobile wallets (e.g., Apple Wallet, Samsung Pass) allows users to store digital keys alongside credit cards and boarding passes, simplifying user experience. Advanced solutions are incorporating biometric authentication, remote key sharing, geofencing, and time-restricted access - all managed through cloud-based platforms that synchronize with vehicle telematics systems. These developments are enabling a seamless, secure, and software-upgradable user experience, while reducing reliance on mechanical or proximity-based physical keys.

Where Is Demand for Automotive Digital Keys Accelerating and Which Vehicle Segments Are Leading Deployment?

Global demand for automotive digital keys is growing rapidly across both premium and mass-market vehicle segments, with the strongest traction in North America, Europe, China, and South Korea. OEMs in these regions - such as BMW, Hyundai, Tesla, and Mercedes-Benz - are leading deployment, offering digital key functionality as part of their connected vehicle suites. The luxury vehicle segment was the first to adopt digital keys, driven by a focus on premium user experience and technology leadership. However, mainstream automakers are quickly following suit, integrating digital key features in mid-segment EVs, crossovers, and SUVs to appeal to digitally native consumers.Electric vehicles (EVs) are particularly aligned with digital key adoption, as their centralized electronic architecture and app-based user interfaces support seamless feature integration. Shared mobility platforms, car rental agencies, and corporate fleet operators are also increasingly adopting digital keys to streamline vehicle handovers, reduce physical key logistics, and enhance asset utilization. Additionally, automotive start-ups and subscription-based mobility providers are embedding digital key platforms to enable user authentication, access tracking, and remote customer onboarding. The rise of vehicle-as-a-service (VaaS) models further cements digital keys as a foundational enabler of new ownership and access paradigms.

What Is Fueling the Global Growth of the Automotive Digital Keys Market?

The growth of the automotive digital keys market is underpinned by converging trends in connected mobility, cybersecurity innovation, and consumer demand for seamless digital experiences. As vehicles become more connected and autonomous, the need for secure, flexible, and scalable access control is escalating - driving widespread interest in digital key technologies across OEMs, suppliers, and mobility providers. The shift toward app-based vehicle ecosystems, integration with smart home devices, and real-time data analytics is positioning digital keys as gateways to broader vehicle interaction and service personalization.OEM strategies to future-proof their platforms through over-the-air (OTA) updates and modular software integration are also accelerating digital key rollouts, especially in software-defined vehicles that prioritize continuous enhancement. Regulations around digital identity, secure communication, and data privacy are fostering greater focus on cybersecurity compliance, prompting manufacturers to invest in hardened, standards-compliant digital key systems. As the automotive landscape shifts toward electrification, shared usage, and personalized digital ecosystems, a key question defines the future: Can automotive digital keys scale across platforms, users, and use cases to become the universal, secure access layer of next-generation mobility?

Report Scope

The report analyzes the Automotive Digital Keys market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Component (Switches Component, Sensors Component, Electronic Control Units Component, Other Components); Connectivity (Remote Cloud Key Access Connectivity, Biometric Connectivity, Near Field Communication Connectivity, Bluetooth Connectivity, Wi-Fi Connectivity); Technology (Passive Keyless Entry System Technology, Remote Keyless Entry System Technology); Application (Vehicle Engine Start / Stop Application, Fleet Management Application, Vehicle Security Application, Charging Application, Payment Application, Shared Mobility Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Switches Component segment, which is expected to reach US$3.6 Billion by 2030 with a CAGR of a 21.8%. The Sensors Component segment is also set to grow at 15.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $812.7 Million in 2024, and China, forecasted to grow at an impressive 26.4% CAGR to reach $2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Automotive Digital Keys Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Automotive Digital Keys Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Automotive Digital Keys Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Atlas Copco AB, BAUER Maschinen GmbH, Boart Longyear Ltd., Caterpillar Inc., China National Petroleum Corporation (CNPC) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Automotive Digital Keys market report include:

- ALPHA Corporation

- BMW AG

- Car Keys Express

- Continental AG

- DENSO Corporation

- Everykey Inc.

- Ford Motor Company

- General Motors Company

- Geotab Inc.

- Heights Security Inc.

- HELLA GmbH & Co. KGaA

- Hyundai Mobis Co., Ltd.

- Hyundai Motor Company

- Marquardt Group

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- STMicroelectronics N.V.

- Tesla, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ALPHA Corporation

- BMW AG

- Car Keys Express

- Continental AG

- DENSO Corporation

- Everykey Inc.

- Ford Motor Company

- General Motors Company

- Geotab Inc.

- Heights Security Inc.

- HELLA GmbH & Co. KGaA

- Hyundai Mobis Co., Ltd.

- Hyundai Motor Company

- Marquardt Group

- Mitsubishi Electric Corporation

- NXP Semiconductors N.V.

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- STMicroelectronics N.V.

- Tesla, Inc.

Table Information

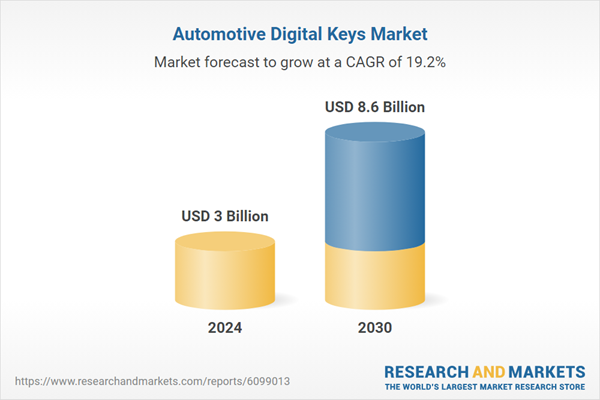

| Report Attribute | Details |

|---|---|

| No. of Pages | 340 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3 Billion |

| Forecasted Market Value ( USD | $ 8.6 Billion |

| Compound Annual Growth Rate | 19.2% |

| Regions Covered | Global |