Global Autonomous Driving SoC Market - Key Trends & Drivers Summarized

Why Are Autonomous Driving SoCs Becoming the Central Intelligence Layer in Next-Generation Mobility Platforms?

Autonomous Driving System-on-Chip (SoC) platforms are rapidly emerging as the computational core of self-driving vehicles, enabling real-time decision-making, high-speed data processing, and multi-sensor fusion essential for autonomy. Unlike traditional vehicle ECUs, which manage isolated control functions, these highly integrated chips consolidate CPUs, GPUs, neural processing units (NPUs), image signal processors (ISPs), and hardware accelerators onto a single silicon substrate. This architectural consolidation allows autonomous systems to process massive data streams from cameras, LiDAR, radar, ultrasonic sensors, and HD maps in real time - powering critical applications such as object detection, path planning, and vehicle control.As OEMs and Tier 1 suppliers race toward SAE Level 3+ autonomy, SoCs are becoming pivotal to reducing system complexity, increasing computational efficiency, and meeting automotive-grade safety and latency requirements. These chips enable scalable autonomy - supporting a wide range of functions from advanced driver-assistance systems (ADAS) to full self-driving capabilities. Their ability to host AI-based perception stacks, manage domain controllers, and interface with vehicle operating systems positions them as indispensable enablers in the shift to software-defined, sensor-rich, and continuously upgradable mobility ecosystems.

How Are AI Acceleration, Sensor Fusion, and Edge Computing Enhancing the Capabilities of Autonomous Driving SoCs?

The performance of autonomous driving SoCs is being significantly enhanced through specialized AI engines, advanced sensor fusion frameworks, and edge-based inferencing. Embedded neural processors and deep learning accelerators are now capable of executing billions of operations per second (TOPS), allowing real-time object classification, semantic segmentation, and behavioral prediction with high precision. These capabilities are essential for safe autonomous navigation under dynamic urban and highway conditions.Integrated sensor fusion engines allow SoCs to combine data from multiple sensing modalities - camera, LiDAR, radar, ultrasonic, and inertial measurement units (IMUs) - to construct a coherent, real-time 360° understanding of the vehicle's surroundings. By processing this information locally at the edge, autonomous SoCs reduce latency, eliminate dependence on cloud connectivity for critical decisions, and support fail-operational safety architectures. Advanced SoCs also include redundancy and hardware safety mechanisms (ASIL-D compliance), allowing fault-tolerant operations in line with ISO 26262 standards. Coupled with high-speed memory interfaces, PCIe connectivity, and thermal optimization, these architectures deliver the computational density needed to support both AI model execution and safety-critical control.

Where Is Demand for Autonomous Driving SoCs Expanding and Which Vehicle Segments Are Driving Integration?

Demand for autonomous driving SoCs is expanding most rapidly in North America, Europe, China, Japan, and South Korea - regions leading in AV R&D, smart infrastructure deployment, and regulatory support for Level 2+ autonomy. Premium passenger vehicles are at the forefront of SoC integration, with manufacturers deploying domain controllers powered by high-performance SoCs to support highway autopilot, traffic jam assist, and lane centering systems. As autonomy trickles down the product ladder, mid-segment vehicles are beginning to adopt SoC-based Level 2 ADAS suites to meet consumer demand and regulatory safety targets.Electric vehicles (EVs) are particularly aligned with autonomous SoC integration, as their centralized electrical architecture and zonal domain controllers provide ideal conditions for SoC-based control units. Commercial vehicle segments - including robotaxis, autonomous delivery vehicles, and freight fleets - are also significant adopters, where edge-based SoCs are essential for efficient fleet navigation, obstacle avoidance, and remote monitoring. Industrial AV applications in agriculture, mining, and warehousing are further expanding use cases, requiring robust SoCs capable of operating in mission-critical, harsh environments.

What Is Fueling the Global Growth of the Autonomous Driving SoC Market?

The growth of the autonomous driving SoC market is driven by the convergence of vehicle digitalization, AI innovation, and the global pursuit of safer, more efficient transportation systems. OEMs are embracing centralized compute platforms to simplify wiring, reduce latency, and accelerate the deployment of software-driven vehicle features. SoCs enable this architectural transformation by offering scalable compute power that supports incremental upgrades from assisted driving to full autonomy - minimizing revalidation costs and maximizing software reuse.Intensifying competition among chipmakers - such as NVIDIA, Qualcomm, Intel (Mobileye), Renesas, and emerging players - is pushing the boundaries of SoC design, with roadmaps promising up to 1000+ TOPS performance, full-stack software support, and ASIL-D safety compliance. As regulatory bodies mandate ADAS features for new vehicles, and public-private partnerships expand AV testing zones, the commercialization of autonomy is accelerating. Cloud-to-edge AI orchestration, OTA update capabilities, and continuous training loops are further solidifying SoCs as the strategic control layer in autonomous mobility. As the complexity of autonomy scales, one critical question defines the sector's trajectory: Can autonomous driving SoCs deliver the real-time intelligence, safety, and upgradability needed to power the transition from pilot projects to mass-market, self-driving mobility?

Report Scope

The report analyzes the Autonomous Driving SoC market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Autonomy Level (Level 2, Level 3, Level 4, Level 5); Application (Adaptive Cruise Control, Lane Keeping Assistance System, Traffic Jam Assist, Automated Parking System, Other Applications); End-Use (Passenger Cars, Commercial Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Level 2 Autonomy segment, which is expected to reach US$26.6 Billion by 2030 with a CAGR of a 7.9%. The Level 3 Autonomy segment is also set to grow at 11.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $11.5 Billion in 2024, and China, forecasted to grow at an impressive 9.2% CAGR to reach $12 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Autonomous Driving SoC Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Autonomous Driving SoC Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Autonomous Driving SoC Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BorgWarner Inc., Calsonic Kansei Corporation, Continental AG, Dana Incorporated, Denso Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Autonomous Driving SoC market report include:

- Ambarella Inc.

- Arm Ltd.

- Black Sesame Technologies

- Bosch

- DeepGrid Semiconductor

- Horizon Robotics

- Huawei Technologies Co., Ltd.

- Infineon Technologies AG

- Intel Corporation

- MediaTek Inc.

- Mobileye

- NVIDIA Corporation

- NXP Semiconductors N.V.

- Qualcomm Technologies Inc.

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- STMicroelectronics N.V.

- Tenstorrent Inc.

- Texas Instruments Inc.

- Xilinx Inc. (now part of AMD)

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ambarella Inc.

- Arm Ltd.

- Black Sesame Technologies

- Bosch

- DeepGrid Semiconductor

- Horizon Robotics

- Huawei Technologies Co., Ltd.

- Infineon Technologies AG

- Intel Corporation

- MediaTek Inc.

- Mobileye

- NVIDIA Corporation

- NXP Semiconductors N.V.

- Qualcomm Technologies Inc.

- Renesas Electronics Corporation

- Samsung Electronics Co., Ltd.

- STMicroelectronics N.V.

- Tenstorrent Inc.

- Texas Instruments Inc.

- Xilinx Inc. (now part of AMD)

Table Information

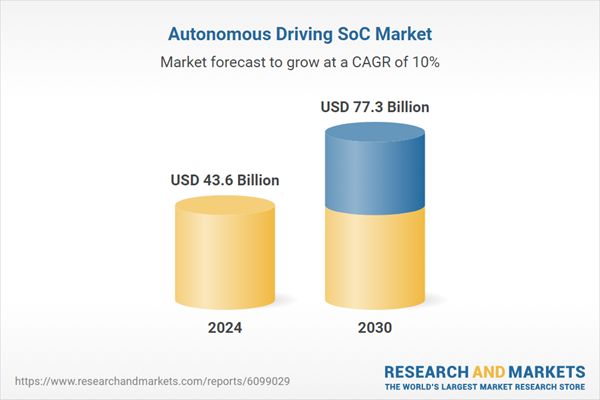

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 43.6 Billion |

| Forecasted Market Value ( USD | $ 77.3 Billion |

| Compound Annual Growth Rate | 10.0% |

| Regions Covered | Global |