Global Autonomous Forklifts Market - Key Trends & Drivers Summarized

Why Are Autonomous Forklifts Emerging as Strategic Assets in Warehouse Automation and Industrial Logistics?

Autonomous forklifts are becoming pivotal in modern supply chains and manufacturing environments, addressing labor shortages, operational inefficiencies, and safety concerns in material handling operations. Unlike traditional forklifts that rely on human drivers, autonomous forklifts use a combination of sensors, AI, and real-time navigation systems to execute complex material transport tasks without manual intervention. These systems improve throughput, reduce human error, and operate continuously - delivering consistent productivity gains in warehousing, e-commerce, automotive manufacturing, pharmaceuticals, and third-party logistics (3PL) sectors.The shift toward just-in-time delivery models, lean inventory systems, and 24/7 fulfillment centers is driving the adoption of autonomous material handling solutions that offer scalability, traceability, and lower total cost of ownership (TCO). OEMs and system integrators are embedding intelligence into forklifts - enabling them to detect pallet positions, avoid obstacles, adapt routes dynamically, and interact with conveyor systems and warehouse management software (WMS). As businesses race to digitize logistics infrastructure and future-proof supply chains, autonomous forklifts are emerging as strategic enablers of end-to-end intralogistics automation.

How Are AI, SLAM Navigation, and Fleet Management Software Enhancing Forklift Autonomy and Performance?

Autonomous forklifts are powered by advanced navigation and perception technologies that enable safe, efficient movement in dynamic environments. Simultaneous localization and mapping (SLAM) algorithms - augmented by LiDAR, vision systems, inertial measurement units (IMUs), and 3D cameras - allow forklifts to create and continuously update maps of their surroundings without relying on physical infrastructure such as QR codes or magnetic tracks. This infrastructure-free navigation increases deployment flexibility, reduces setup time, and enables easy route reconfiguration.AI and machine learning further enhance autonomy by enabling forklifts to recognize objects, interpret contextual cues, and make decisions based on real-time environmental data. These systems support obstacle detection, load verification, and optimal path planning even in mixed-traffic scenarios with humans and manual vehicles. Integration with cloud-based fleet management platforms allows operators to monitor forklift performance, assign tasks, optimize routing, and conduct predictive maintenance from centralized dashboards. Battery management systems and IoT sensors ensure uptime and operational continuity, while APIs enable seamless interfacing with ERP, WMS, and MES platforms - turning autonomous forklifts into integral nodes in smart factory ecosystems.

Where Is Demand for Autonomous Forklifts Accelerating and Which Industries Are Leading Adoption?

Demand for autonomous forklifts is rising sharply across industrialized regions, with early and aggressive adoption in North America, Europe, Japan, China, and South Korea. High labor costs, tightening workplace safety regulations, and the growth of e-commerce fulfillment centers are pushing companies to automate material handling processes. Warehousing and logistics operations are the largest adopters, particularly among 3PLs, retailers, and consumer goods manufacturers looking to boost efficiency in high-throughput environments.Automotive and electronics manufacturing are key verticals where autonomous forklifts are being deployed to manage just-in-sequence part delivery, line feeding, and inter-line transfers with minimal human oversight. Pharmaceuticals and food & beverage sectors are adopting these systems to meet traceability and hygiene requirements in temperature-controlled environments. The trend is also gaining traction in mid-sized enterprises and SMEs, facilitated by the availability of modular and retrofit-friendly autonomous forklift platforms that lower upfront costs and reduce integration barriers.

What Is Fueling the Global Growth of the Autonomous Forklifts Market?

The global growth of the autonomous forklifts market is fueled by structural shifts in supply chain strategies, accelerated digitalization of warehousing operations, and heightened pressure to improve labor efficiency and safety. The COVID-19 pandemic and ongoing labor shortages have underscored the vulnerabilities of labor-intensive material handling, prompting enterprises to invest in automation as a resilience-building measure. At the same time, rapid advances in robotics, edge AI, sensor affordability, and cloud connectivity are making autonomous forklifts more reliable, scalable, and cost-accessible.Government incentives, smart manufacturing policies, and Industry 4.0 initiatives are further driving adoption, particularly in countries focused on reshoring and automation-led competitiveness. Strategic partnerships between robotics firms, forklift OEMs, and systems integrators are accelerating product innovation and deployment speed, while venture capital investment is catalyzing the development of AI-native autonomous forklift startups. As logistics and manufacturing sectors increasingly converge on intelligent, connected, and agile operations, a defining question arises: Can autonomous forklifts scale across industrial tiers to become the standard for safe, responsive, and intelligent material movement in the next generation of automated supply chains?

Report Scope

The report analyzes the Autonomous Forklifts market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Tonnage (Below 5 Tons, 5 - 10 Tons, Above 10 Tons); Navigation Technology (Laser, Vision, Optical Tape, Magnetic, Inductive Guidance); Application (Indoor, Outdoor); End-Use (Retail & Wholesale, Logistics, Automotive, Food, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Below 5 Tons Forklifts segment, which is expected to reach US$6.5 Billion by 2030 with a CAGR of a 14.2%. The 5 - 10 Tons Forklifts segment is also set to grow at 9.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.4 Billion in 2024, and China, forecasted to grow at an impressive 11.7% CAGR to reach $1.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Autonomous Forklifts Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Autonomous Forklifts Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Autonomous Forklifts Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ambarella Inc., Arm Ltd., Black Sesame Technologies, Bosch, DeepGrid Semiconductor and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 37 companies featured in this Autonomous Forklifts market report include:

- Agilox Services GmbH

- ArcBest Corporation

- BALYO

- CYNGN

- Fox Robotics

- Gideon Brothers

- GreyOrange

- Hangcha Group Co., Ltd.

- Hyster-Yale Materials Handling

- Jungheinrich AG

- KION Group AG

- Mitsubishi Logisnext Co., Ltd.

- OTTO Motors

- Rocla AGV Solutions

- SMARLOGY

- Swisslog Holding AG

- Third Wave Automation

- Toyota Industries Corporation

- Vecna Robotics

- VisionNav Robotics

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Agilox Services GmbH

- ArcBest Corporation

- BALYO

- CYNGN

- Fox Robotics

- Gideon Brothers

- GreyOrange

- Hangcha Group Co., Ltd.

- Hyster-Yale Materials Handling

- Jungheinrich AG

- KION Group AG

- Mitsubishi Logisnext Co., Ltd.

- OTTO Motors

- Rocla AGV Solutions

- SMARLOGY

- Swisslog Holding AG

- Third Wave Automation

- Toyota Industries Corporation

- Vecna Robotics

- VisionNav Robotics

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 207 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

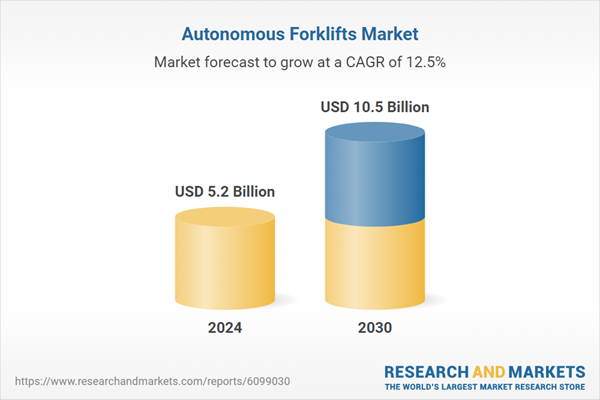

| Estimated Market Value ( USD | $ 5.2 Billion |

| Forecasted Market Value ( USD | $ 10.5 Billion |

| Compound Annual Growth Rate | 12.5% |

| Regions Covered | Global |