Global Biobank Management Systems Market - Key Trends & Drivers Summarized

Why Are Biobank Management Systems Gaining Strategic Significance in Precision Medicine and Biomedical Research?

Biobank management systems are becoming indispensable in modern biomedical ecosystems as the volume, complexity, and strategic value of biological sample collections continue to grow. These digital platforms facilitate the standardized acquisition, cataloging, storage, tracking, and retrieval of biospecimens - ranging from blood and tissue to DNA, RNA, and cell lines - ensuring data integrity, regulatory compliance, and long-term usability. As precision medicine, genomics, and translational research demand increasingly diverse and high-quality biospecimens, robust biobank informatics infrastructures are essential for managing large-scale, multi-institutional repositories.Biobank systems are also integral to the success of longitudinal population studies, rare disease research, and clinical trials, where accurate linkage between samples and metadata (e.g., clinical histories, genetic profiles, and demographic attributes) is critical. They enable harmonized protocols and governance structures across institutions, thereby increasing sample accessibility, research reproducibility, and cross-border collaboration. In an era where biological data is as valuable as the specimens themselves, biobank management platforms serve as the digital backbone of advanced biomedical research networks.

How Are Software Innovations and Data Integration Enhancing Biobank Management Capabilities?

Technological innovation is transforming biobank management systems into highly configurable, interoperable platforms that support real-time inventory management, automated workflows, and high-throughput sample processing. Cloud-based architectures, modular software design, and customizable dashboards are enabling institutions to tailor systems to specific research needs while ensuring scalability. Integration with laboratory information management systems (LIMS), electronic health records (EHRs), and data analytics platforms is streamlining biospecimen-data connectivity and enabling dynamic cohort building.Advanced features such as barcode-based tracking, RFID-enabled sample logging, automated audit trails, and AI-assisted sample quality analytics are improving traceability, reducing errors, and enhancing regulatory compliance with standards such as GDPR, HIPAA, and ISO 20387. Additionally, role-based access controls, consent management modules, and blockchain-backed data integrity features are supporting governance, security, and trust in collaborative biobanking environments. These software capabilities are making biobank management systems central to the digital transformation of life sciences R&D and clinical sample operations.

Where Is Demand for Biobank Management Systems Rising and Which Institutions Are Leading Adoption?

Demand is accelerating globally, with North America and Europe leading due to robust biomedical research funding, national biobank initiatives, and strong regulatory oversight. Institutions such as research universities, cancer centers, public health agencies, and pharmaceutical companies are heavily investing in biobank infrastructure to support translational science and personalized therapy development. Asia-Pacific is witnessing growing adoption, particularly in Japan, South Korea, China, and Australia, where population-scale genomics programs and local biotech expansion are driving demand for advanced biobank IT systems.Academic medical centers, CROs, and biopharma firms are primary adopters, leveraging these systems to streamline biospecimen lifecycle management and support multi-site clinical studies. National biobank programs and disease-specific consortia are increasingly adopting centralized platforms to facilitate harmonized data capture and cross-institutional research. Additionally, private biorepositories and contract biobanking service providers are upgrading digital infrastructure to meet the growing demand for regulatory-compliant, client-integrated sample management solutions.

What Is Fueling the Global Growth of the Biobank Management Systems Market?

The global growth of the biobank management systems market is being driven by the convergence of data-centric research models, regulatory stringency, and the rising strategic value of high-quality biospecimens. As omics technologies advance and global collaborations intensify, the ability to manage samples with precision, transparency, and interoperability is becoming a core competency for research institutions and biopharma companies alike. The market is further fueled by increased investment in digital health infrastructure and the push toward FAIR (Findable, Accessible, Interoperable, and Reusable) data principles.Vendor innovation, cloud-native deployments, and subscription-based pricing models are enhancing system accessibility for both large and mid-sized organizations. Strategic partnerships between biobank software developers, academic consortia, and clinical research networks are expanding the ecosystem and improving standardization. As biobanking evolves from static storage to dynamic research enablement, a critical question arises: Can biobank management systems continue to evolve with the pace of biomedical innovation - delivering compliance, scalability, and data-driven insight to power the next generation of precision medicine and global health research?

Report Scope

The report analyzes the Biobank Management Systems market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Sample Type (Absorbable Human Tissue & Organ Samples, Plant & Animal Samples, Microbial Samples); Application (Regenerative Medicine, Life Sciences Research, Clinical Research, Environmental Research).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Absorbable Human Tissue & Organ Samples segment, which is expected to reach US$1.7 Billion by 2030 with a CAGR of a 5.1%. The Plant & Animal Samples segment is also set to grow at 8.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $601.2 Million in 2024, and China, forecasted to grow at an impressive 10% CAGR to reach $658.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Biobank Management Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Biobank Management Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Biobank Management Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AvantiGas, BioLPG LLC, Cavagna Group, Diamond Green Diesel, Eni S.p.A. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 47 companies featured in this Biobank Management Systems market report include:

- AMS Biotechnology (Europe) Ltd.

- AstridBio Ltd.

- Autoscribe Informatics

- Azenta Life Sciences

- BBMRI-ERIC

- Biomatrica, Inc.

- Biomax Informatics AG

- Cureline, Inc.

- Firalis SA

- Hamilton Company

- IQVIA

- Merck KGaA

- OpenSpecimen

- Promega Corporation

- QIAGEN N.V.

- Sophia Genetics SA

- STEMCELL Technologies Inc.

- Technidata

- Thermo Fisher Scientific Inc.

- Wuxi NEST Biotechnology Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AMS Biotechnology (Europe) Ltd.

- AstridBio Ltd.

- Autoscribe Informatics

- Azenta Life Sciences

- BBMRI-ERIC

- Biomatrica, Inc.

- Biomax Informatics AG

- Cureline, Inc.

- Firalis SA

- Hamilton Company

- IQVIA

- Merck KGaA

- OpenSpecimen

- Promega Corporation

- QIAGEN N.V.

- Sophia Genetics SA

- STEMCELL Technologies Inc.

- Technidata

- Thermo Fisher Scientific Inc.

- Wuxi NEST Biotechnology Co., Ltd.

Table Information

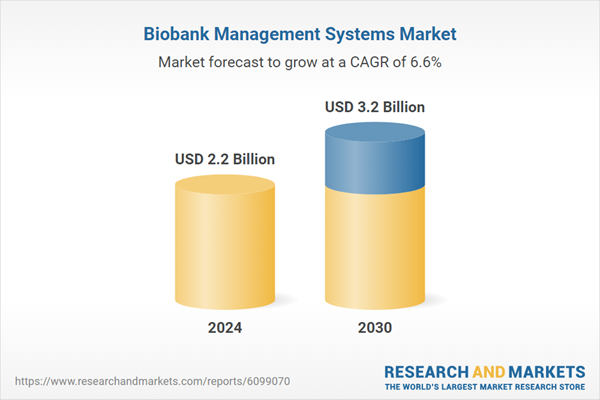

| Report Attribute | Details |

|---|---|

| No. of Pages | 287 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.2 Billion |

| Forecasted Market Value ( USD | $ 3.2 Billion |

| Compound Annual Growth Rate | 6.6% |

| Regions Covered | Global |