Global Cell Sorters Market - Key Trends & Drivers Summarized

Why Are Cell Sorters Gaining Strategic Importance in High-Precision Cell Analysis and Therapeutic Development?

Cell sorters are becoming indispensable in biomedical research and clinical diagnostics as demand rises for high-purity, functionally intact cell populations across applications in immunology, oncology, stem cell research, and regenerative medicine. These instruments enable real-time separation of heterogeneous cell mixtures based on size, granularity, fluorescence markers, and surface antigens - offering unparalleled precision in isolating target cell subpopulations for downstream applications such as single-cell genomics, cell therapy, and drug screening.As workflows increasingly demand greater specificity and viability in sorted cells, especially in areas such as CAR-T cell development and circulating tumor cell (CTC) isolation, cell sorting technologies are evolving into essential tools for translational research and advanced therapeutics. Their ability to integrate sorting with phenotypic and functional characterization is positioning them as critical enablers of next-generation biomedical innovation.

How Are Technological Advancements Enhancing Throughput, Sensitivity, and Application Versatility in Cell Sorters?

Modern cell sorters are leveraging advancements in optics, microfluidics, and automation to deliver greater accuracy, speed, and ease of use. High-speed fluorescence-activated cell sorting (FACS) systems are now equipped with multicolor laser configurations, advanced droplet control systems, and real-time image-based detection to handle increasingly complex cell phenotyping requirements. These improvements are enabling the isolation of ultra-rare cell types and minimal residual disease (MRD) detection with enhanced sensitivity and reproducibility.Innovations such as microfluidic chip-based sorters, closed-system sterile sorting for clinical-grade applications, and sorter-integrated single-cell dispensers are expanding use cases in clinical research and cell manufacturing. AI-enabled gating algorithms and user-friendly software interfaces are also improving data interpretation, throughput, and reproducibility, reducing the reliance on highly specialized operators and accelerating workflow standardization in core labs and hospital-based research centers.

Where Is Demand for Cell Sorters Accelerating and Which Segments Are Leading Adoption?

North America and Europe lead global demand, driven by strong investments in life sciences R&D, established academic and clinical research infrastructure, and active pipelines in cell and gene therapy. The U.S., Germany, and the U.K. represent key markets, supported by the presence of major research institutes, biopharma hubs, and public funding programs. Asia-Pacific is emerging as a growth engine - particularly in China, Japan, South Korea, and India - where expanding research capacity and growing participation in cell-based therapy development are driving adoption.Key end-users include academic research institutions, biopharmaceutical companies, contract research organizations (CROs), and clinical laboratories focused on translational medicine, immunophenotyping, and hematologic malignancy analysis. Cell therapy developers and GMP-compliant manufacturing centers are increasingly investing in sterile, high-throughput sorters to meet regulatory and scalability requirements in personalized medicine workflows.

What Is Fueling the Global Growth of the Cell Sorters Market?

The global cell sorters market is expanding on the strength of rising demand for single-cell analysis, rapid advances in cellular therapies, and the increasing complexity of immunological and oncology research. The ability to isolate rare, functional, or engineered cells with high purity is central to innovation in diagnostics, therapeutics, and basic research. As personalized medicine, precision oncology, and stem cell applications scale globally, cell sorting systems are becoming vital for upstream quality control and cell population characterization.Strategic collaborations between instrument manufacturers, biotech companies, and academic consortia are fostering product innovation and workflow integration. Additionally, rising demand for closed-system, GMP-compliant sorters is supporting the clinical translation of cell sorting technologies. As precision, sterility, and scalability become defining needs, a key question shapes the market's future: Can cell sorter technologies continue to evolve toward higher resolution, automation, and regulatory readiness - while supporting the expanding role of cellular insights in research, diagnostics, and therapeutics?

Report Scope

The report analyzes the Cell Sorters market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Instruments, Consumables & Reagents); Application (Research Application, Clinical Applications); End-User (Hospitals & Clinical Testing Laboratories, Pharma & Biotech Companies, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Instruments segment, which is expected to reach US$630.5 Million by 2030 with a CAGR of a 8.9%. The Consumables & Reagents segment is also set to grow at 5.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $155.9 Million in 2024, and China, forecasted to grow at an impressive 12.2% CAGR to reach $191.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cell Sorters Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cell Sorters Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cell Sorters Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACS Dobfar S.p.A., Aurobindo Pharma Ltd., Baxter International Inc., Cipla Ltd., CSPC Pharmaceutical Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Cell Sorters market report include:

- Affymetrix Inc. (Thermo Fisher Scientific)

- Beckman Coulter Inc. (Danaher Corporation)

- Becton, Dickinson and Company

- Bio-Rad Laboratories Inc.

- Bulldog Bio Inc.

- Cell Microsystems Inc.

- Cytonome/ST LLC

- Danaher Corporation

- Miltenyi Biotec GmbH

- Molecular Devices LLC

- Namocell Inc.

- NanoCellect Biomedical Inc.

- On-Chip Biotechnologies Co. Ltd.

- Sartorius AG

- Sony Biotechnology Inc.

- Standard BioTools Inc.

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- uFluidix

- Union Biometrica Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Affymetrix Inc. (Thermo Fisher Scientific)

- Beckman Coulter Inc. (Danaher Corporation)

- Becton, Dickinson and Company

- Bio-Rad Laboratories Inc.

- Bulldog Bio Inc.

- Cell Microsystems Inc.

- Cytonome/ST LLC

- Danaher Corporation

- Miltenyi Biotec GmbH

- Molecular Devices LLC

- Namocell Inc.

- NanoCellect Biomedical Inc.

- On-Chip Biotechnologies Co. Ltd.

- Sartorius AG

- Sony Biotechnology Inc.

- Standard BioTools Inc.

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- uFluidix

- Union Biometrica Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 361 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

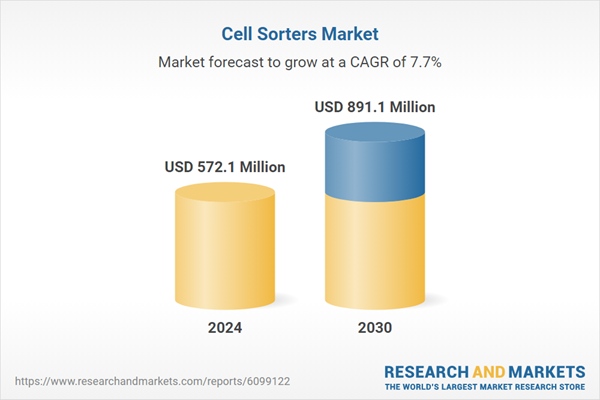

| Estimated Market Value ( USD | $ 572.1 Million |

| Forecasted Market Value ( USD | $ 891.1 Million |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |