Global Cleaning Equipment and Supplies Market - Key Trends & Drivers Summarized

Why Is Demand for Cleaning Equipment and Supplies Intensifying Across Sectors?

Heightened awareness of hygiene, infection control, and workplace safety has elevated cleaning standards across residential, commercial, and industrial environments. The COVID-19 pandemic acted as a structural catalyst, transforming cleaning from a routine maintenance function into a core operational and compliance priority. This shift continues to shape procurement policies in offices, healthcare facilities, public transportation, hospitality venues, and educational institutions, where cleaning frequency, accountability, and visibility have become non-negotiable expectations.Beyond public health, growing emphasis on sustainability, indoor air quality, and labor optimization is driving adoption of more efficient, ergonomic, and environmentally responsible cleaning tools. Facility managers are increasingly integrating cleaning operations into broader ESG frameworks, with demand rising for chemical-free solutions, water-saving equipment, and low-noise or battery-powered cleaning machines that align with green building certifications and occupational health standards.

How Are Equipment Innovations Enhancing Productivity and Cleaning Outcomes?

Technological advancement is redefining the cleaning equipment landscape with the rise of automation, robotics, and data-driven maintenance workflows. Autonomous floor scrubbers, robotic vacuums, and UV-disinfection robots are gaining traction in large facilities, enabling 24/7 operation, improved cleaning consistency, and reduced dependence on manual labor. Smart dispensers, IoT-enabled equipment, and centralized tracking systems are also improving inventory control, service scheduling, and usage analytics.In parallel, traditional equipment - such as mops, carts, sweepers, and vacuums - is undergoing performance upgrades through modular designs, lightweight materials, and noise/vibration reduction features. Battery-powered and cordless models are improving mobility and runtime, especially in multi-shift operations. As labor shortages persist across janitorial services and facilities management, cleaning equipment that minimizes fatigue, training time, and repetitive strain is gaining preference across all verticals.

Which End-Use Industries Are Prioritizing Strategic Procurement of Cleaning Supplies and Equipment?

Healthcare facilities are among the most regulated and hygiene-sensitive environments, driving consistent demand for medical-grade cleaning supplies, anti-microbial wipes, disinfectants, and touchless dispensers. Hospitals and diagnostic labs are investing in sterilization equipment, ATP testing kits, and color-coded cleaning systems to prevent cross-contamination and meet infection control mandates. Similarly, food processing and pharmaceutical manufacturing require rigorous sanitation protocols, making them high-consumption sectors for specialty supplies and compliance-grade tools.Hospitality, commercial real estate, retail chains, and public transportation networks are also prioritizing visible cleanliness as part of customer experience and brand reputation management. Demand is rising for compact and mobile equipment suited to high-traffic areas, including escalator cleaners, mini-autoscrubbers, and air purification units. Educational institutions, airports, and entertainment venues are enhancing cleaning schedules and integrating advanced tools as part of their health and safety commitments to returning occupants and visitors.

How Are Supply Chain Resilience and Sustainability Shaping Vendor and Buyer Strategies?

Supply disruptions during the pandemic exposed vulnerabilities in the sourcing of cleaning chemicals, PPE, and disposable hygiene products - prompting buyers to diversify supplier bases and increase onshore or regional inventories. Manufacturers are responding with agile production, private-label offerings, and localized distribution networks to meet fluctuating demand cycles and contract-based volume guarantees. E-commerce and digital procurement platforms are streamlining sourcing, price comparisons, and compliance documentation for institutional buyers.Sustainability is also becoming a decisive factor, with end-users seeking biodegradable supplies, refillable containers, concentrated cleaning formulas, and equipment built for lifecycle durability. Green certifications, ecolabels, and transparent safety data sheets are now essential differentiators, particularly for government contracts and large enterprises pursuing environmental targets. In parallel, training programs and user education are gaining importance to ensure proper usage, waste reduction, and long-term product value realization.

What Are the Factors Driving Growth in the Cleaning Equipment and Supplies Market?

Growth in the global cleaning equipment and supplies market is underpinned by a confluence of macro and micro-level drivers: heightened hygiene awareness, labor automation, regulatory compliance, and ESG-aligned procurement policies. Rapid urbanization, increasing infrastructure investments, and a return to on-site operations across public and private sectors are further expanding the addressable demand base for both consumables and durable equipment. The convergence of health security with environmental responsibility is transforming cleaning into a strategically managed function across facilities worldwide.The defining question is: Can manufacturers, suppliers, and service providers innovate fast enough to deliver high-performance, cost-efficient, and sustainable cleaning solutions - while adapting to shifting regulatory expectations, labor constraints, and customer-specific standards across highly diversified end-use environments?

Report Scope

The report analyzes the Cleaning Equipment and Supplies market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Equipment, Cleaning Tools, Cleaning Chemicals & Disposable Supplies); Distribution Channel (Direct, Indirect); Application (Residential, Commercial, Industrial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cleaning Equipment segment, which is expected to reach US$80.1 Billion by 2030 with a CAGR of a 3.8%. The Cleaning Tools segment is also set to grow at 6.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $30.5 Billion in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $28.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cleaning Equipment and Supplies Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cleaning Equipment and Supplies Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cleaning Equipment and Supplies Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABO Energy GmbH & Co. KGaA, AES Corporation, Bloom Energy Corporation, Brookfield Renewable Partners, Canadian Solar Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Cleaning Equipment and Supplies market report include:

- 3M Company

- ABCO Cleaning Products

- Alfred Kärcher SE & Co. KG

- Bissell Inc.

- Bunzl plc

- Chemin Hygiene Sdn Bhd

- Clorox Company

- COMAC S.p.A.

- Core Products Co., Inc.

- Diversey Holdings, Ltd.

- Ecolab Inc.

- Eureka S.p.A.

- Hako GmbH

- Henkel AG & Co. KGaA

- Kimberly-Clark Corporation

- Nilfisk A/S

- Procter & Gamble Co.

- Roots Multiclean Ltd.

- Rubbermaid Commercial Products

- Tennant Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- ABCO Cleaning Products

- Alfred Kärcher SE & Co. KG

- Bissell Inc.

- Bunzl plc

- Chemin Hygiene Sdn Bhd

- Clorox Company

- COMAC S.p.A.

- Core Products Co., Inc.

- Diversey Holdings, Ltd.

- Ecolab Inc.

- Eureka S.p.A.

- Hako GmbH

- Henkel AG & Co. KGaA

- Kimberly-Clark Corporation

- Nilfisk A/S

- Procter & Gamble Co.

- Roots Multiclean Ltd.

- Rubbermaid Commercial Products

- Tennant Company

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 362 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

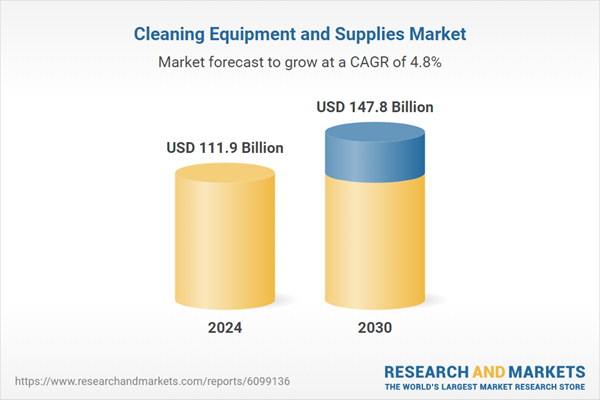

| Estimated Market Value ( USD | $ 111.9 Billion |

| Forecasted Market Value ( USD | $ 147.8 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |