Global Clinical Immunoanalyzers Market - Key Trends & Drivers Summarized

Why Are Clinical Immunoanalyzers Essential in Modern Diagnostic and Disease Monitoring Workflows?

Clinical immunoanalyzers are integral to contemporary diagnostic laboratories, enabling high-throughput detection of analytes such as hormones, infectious disease markers, tumor antigens, cardiac biomarkers, and autoimmune antibodies. Leveraging immunoassay techniques such as ELISA, chemiluminescence, fluorescence, and radioimmunoassay, these systems provide high sensitivity, specificity, and scalability across a wide range of clinical settings - from core hospital labs to decentralized diagnostic units. Their ability to support rapid, multi-parametric analysis makes them indispensable in managing both acute and chronic conditions.The growing burden of lifestyle diseases, infectious outbreaks, and oncology-related disorders is driving increased demand for reliable and real-time biomarker assessment. Immunoanalyzers play a key role in early disease detection, prognosis evaluation, therapeutic monitoring, and patient stratification, all of which are critical to outcome-based care. As diagnostic strategies evolve toward precision medicine and preventive health models, clinical immunoassay platforms are expanding their relevance beyond diagnostic labs and into physician offices, outpatient clinics, and mobile health infrastructure.

How Are Technological Advancements Transforming the Performance and Utility of Immunoassay Platforms?

The clinical immunoanalyzer landscape is rapidly evolving with innovations in assay miniaturization, automation, multiplexing, and digital integration. Modern analyzers are incorporating microfluidics, magnetic separation, and enzyme-enhanced signal amplification to improve detection sensitivity and reduce turnaround time. Fully automated systems now offer continuous loading, barcode-based traceability, and random-access capabilities, streamlining laboratory workflows while minimizing human error and operator dependency.Integration with laboratory information systems (LIS), electronic medical records (EMR), and cloud-based analytics is enhancing data interoperability and remote access, enabling more agile and data-rich diagnostic ecosystems. Additionally, point-of-care (POC) compatible immunoanalyzers are being introduced to support rapid testing in emergency care, rural clinics, and home healthcare settings. These technology shifts are not only improving diagnostic confidence and patient throughput but are also reshaping business models for diagnostics companies aiming to serve both centralized and decentralized care networks.

Which Disease Areas and Testing Categories Are Driving Immunoanalyzer Utilization?

Cardiac care remains one of the leading areas of immunoanalyzer use, with tests such as troponin, BNP, and CRP widely employed in acute coronary syndrome diagnosis and risk stratification. Oncology applications are also expanding as demand rises for tumor markers including PSA, CA 125, and CEA, which assist in screening, staging, and treatment monitoring. Reproductive health testing - including hormone assays and fertility panels - is another major segment, particularly with growing emphasis on personalized care in women's health.Infectious disease diagnostics, including viral hepatitis, HIV, influenza, and more recently, SARS-CoV-2 serology, have reinforced the critical role of immunoanalyzers in public health response. Autoimmune and allergy testing, as well as therapeutic drug monitoring (TDM), are additional growth segments as chronic disease management becomes more biomarker-guided. The versatility and adaptability of immunoanalyzers are enabling their integration into disease-specific panels and syndromic testing approaches, enhancing clinical decision-making across specialties.

How Are Market Players Addressing Regulatory Demands, Cost Pressures, and Global Access Challenges?

Regulatory compliance is a key determinant in the development and commercialization of immunoanalyzer systems, particularly in regions governed by stringent oversight such as the U.S. FDA, European CE-IVDR, and China's NMPA. Manufacturers must continuously validate analytical performance, system robustness, and quality controls under real-world conditions to maintain market authorization and client trust. The trend toward decentralized diagnostics also introduces new compliance complexities, especially in ensuring test accuracy outside of traditional lab environments.Price sensitivity among healthcare providers, especially in public systems and resource-limited settings, is encouraging vendors to develop tiered product portfolios that balance functionality with affordability. Compact benchtop models, reagent rental agreements, and bundled service contracts are emerging as popular solutions in small and mid-sized laboratories. At the same time, strategic partnerships with diagnostic chains, procurement alliances, and health ministries are helping global companies expand access while supporting local capacity building in clinical laboratory infrastructure.

What Are the Factors Driving Growth in the Clinical Immunoanalyzers Market?

The global clinical immunoanalyzers market is being driven by rising diagnostic demand for early disease detection, treatment monitoring, and population-wide screening, fueled by increasing chronic disease prevalence, aging demographics, and post-pandemic health system strengthening. Technological enhancements in assay sensitivity, workflow automation, and digital integration are further expanding the clinical and operational appeal of immunoassay platforms. These systems are enabling higher throughput, broader test menus, and more streamlined data interoperability - all of which align with the clinical imperatives of accuracy, speed, and scalability.As decentralized care delivery gains momentum and healthcare policies shift toward value-based outcomes, immunoanalyzers will play an increasingly pivotal role in both centralized laboratories and near-patient environments. The ability of manufacturers to balance regulatory compliance, cost-effectiveness, and clinical innovation will largely determine how well these platforms meet evolving diagnostic needs across diverse global markets - raising the critical question of how effectively the sector can deliver next-generation immunoassay solutions that scale precision, access, and impact in a highly dynamic healthcare landscape.

Report Scope

The report analyzes the Clinical Immunoanalyzers market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (ELISA, CLIA, RIA, Other Types); Application (Clinical Chemistry, Endocrinology, Oncology, Infectious Disease Diagnostics, Cardiology, Other Applications); End-User (Hospitals & Clinics, Diagnostic Laboratories, Research Institutes, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the ELISA segment, which is expected to reach US$14.1 Billion by 2030 with a CAGR of a 5.2%. The CLIA segment is also set to grow at 2.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.9 Billion in 2024, and China, forecasted to grow at an impressive 7.7% CAGR to reach $5.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Clinical Immunoanalyzers Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Clinical Immunoanalyzers Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Clinical Immunoanalyzers Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, ADEX S.r.l., Anchor Packaging LLC, Berry Global Inc., CeDo Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Clinical Immunoanalyzers market report include:

- Abbott Laboratories

- Agilent Technologies

- Arlington Scientific, Inc.

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- bioMérieux S.A.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- DiaSorin S.p.A.

- Getein Biotech, Inc.

- Hologic, Inc.

- Luminex Corporation

- Meril Life Sciences Pvt. Ltd.

- Mindray Medical International Ltd.

- Ortho Clinical Diagnostics

- PerkinElmer, Inc.

- Quidel Corporation

- Randox Laboratories Ltd.

- Roche Diagnostics

- Siemens Healthineers AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abbott Laboratories

- Agilent Technologies

- Arlington Scientific, Inc.

- Beckman Coulter, Inc.

- Becton, Dickinson and Company

- bioMérieux S.A.

- Bio-Rad Laboratories, Inc.

- Danaher Corporation

- DiaSorin S.p.A.

- Getein Biotech, Inc.

- Hologic, Inc.

- Luminex Corporation

- Meril Life Sciences Pvt. Ltd.

- Mindray Medical International Ltd.

- Ortho Clinical Diagnostics

- PerkinElmer, Inc.

- Quidel Corporation

- Randox Laboratories Ltd.

- Roche Diagnostics

- Siemens Healthineers AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 389 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

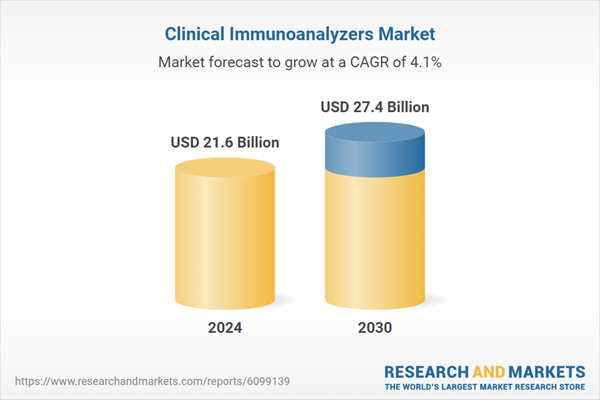

| Estimated Market Value ( USD | $ 21.6 Billion |

| Forecasted Market Value ( USD | $ 27.4 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |

![IVD Labware Market by Product [Plastic, Glass], Type, Application, End User - Global Forecast to 2030 - Product Image](http://www.researchandmarkets.com/product_images/12894/12894573_60px_jpg/ivd_labware_market.jpg)