Global Cold Milling Machines Market - Key Trends & Drivers Summarized

Why Are Cold Milling Machines Critical to Modern Road Rehabilitation and Pavement Recycling?

Cold milling machines are indispensable in roadway maintenance and rehabilitation, providing a cost-effective method for removing aged asphalt and concrete surfaces with precision and minimal environmental disruption. These machines use rotating drums fitted with cutting tools to grind and remove surface layers, enabling accurate surface profiling, full-depth removal, and selective material extraction. Their role is central to optimizing pavement restoration timelines, minimizing traffic disruption, and supporting sustainable road construction practices.The technology supports efficient reuse of milled material, which can be recycled on-site or in asphalt mixing plants, significantly reducing the need for virgin materials and cutting greenhouse gas emissions. Cold milling is also used to improve drainage, correct surface irregularities, and prepare substrates for new overlays - making it a key step in extending pavement lifecycle and lowering long-term maintenance costs. As road networks age and maintenance budgets tighten, demand for efficient, accurate, and environmentally conscious milling solutions is rising globally.

How Are Machine Capabilities and Automation Technologies Enhancing Operational Precision?

Modern cold milling machines are incorporating advanced automation, grade control systems, and telematics to improve cutting precision, reduce operator workload, and optimize fuel efficiency. Automatic depth and slope control systems ensure uniform milling results while minimizing material over-removal and costly rework. GPS and 3D mapping integration allows operators to follow predefined milling profiles with sub-centimeter accuracy, which is particularly important in urban or high-traffic environments.Remote diagnostics, machine-to-machine communication, and real-time performance monitoring are enabling predictive maintenance and fleet optimization. Engine efficiency improvements and emissions-compliant powertrains are further reducing operational costs and environmental impact. Manufacturers are also focusing on ergonomic cabin design, intuitive interfaces, and modular cutter drum configurations to boost productivity across varying job site conditions. These enhancements are making cold milling machines more versatile and user-friendly for contractors navigating increasingly complex pavement rehabilitation projects.

Which End-Use Sectors and Geographic Markets Are Fueling Demand for Cold Milling Machines?

Government-funded road infrastructure upgrades remain the primary demand driver for cold milling machines, particularly in developed economies with mature, aging roadway networks requiring periodic resurfacing. Departments of transportation and municipal agencies routinely use milling machines for both highway and urban street maintenance, where speed, accuracy, and noise reduction are critical to maintaining traffic flow and minimizing public disruption. The machines are also widely deployed in airport runway resurfacing and bridge deck restoration projects where surface integrity is paramount.In emerging markets across Asia-Pacific, Latin America, and Africa, rising investments in transportation infrastructure are generating new demand for milling equipment as part of greenfield and brownfield development programs. As these regions scale urbanization and logistics networks, local governments and private contractors are increasingly adopting cold milling machines to support long-term pavement performance. Public-private partnerships, stimulus-backed construction, and international development funding are also expanding equipment demand in countries focused on sustainable, cost-effective road-building solutions.

How Are Environmental Regulations, Lifecycle Costs, and Equipment Versatility Shaping Market Strategy?

Stricter environmental regulations around noise, dust, and particulate emissions are pushing manufacturers to engineer quieter, cleaner, and more fuel-efficient milling machines. Tier 4 and Stage V engine compliance, advanced exhaust treatment systems, and integrated dust extraction capabilities are now standard in many models. These upgrades not only ensure regulatory compliance but also enhance equipment appeal in urban settings, environmentally sensitive zones, and green procurement initiatives.Contractors are also evaluating total cost of ownership (TCO) more rigorously, factoring in fuel consumption, maintenance intervals, wear part longevity, and machine flexibility. Machines capable of accommodating a variety of milling widths and drum configurations are gaining traction, as they allow operators to transition between full-lane, fine-milling, and slot-cutting tasks with minimal downtime. This versatility improves job-site economics and maximizes machine utilization across project types. Rental models and equipment financing are further influencing procurement decisions, particularly among small and mid-sized contractors seeking access to high-end technology without high upfront capital investment.

What Are the Factors Driving Growth in the Cold Milling Machines Market?

Growth in the cold milling machines market is being driven by the rising need for efficient, sustainable, and precision-based road maintenance solutions. As urban infrastructure strains under aging pavements and expanding traffic volumes, municipalities and contractors are turning to technologically advanced milling equipment to meet performance, safety, and environmental goals. The integration of automation, emission control, and multi-functionality is increasing the value proposition of these machines across both developed and developing markets.With road rehabilitation cycles tightening and sustainability imperatives intensifying, manufacturers that can deliver machines with flexible configurations, lower emissions, and digitally enhanced operating capabilities are positioned for long-term relevance. The ability of the sector to align machinery innovation with infrastructure funding, regional emission mandates, and contractor productivity needs will determine how well the market capitalizes on the persistent global demand for durable, smart, and resource-efficient road maintenance solutions.

Report Scope

The report analyzes the Cold Milling Machines market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Drum-Type Cold Milling Machine, Crawler-Type Cold Milling Machine, Wheel-Type Cold Milling Machine); Engine Power (Below 155 Kw, 155 - 300 Kw, Above 300 Kw); Application (Asphalt Pavement, Concrete Pavement, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Drum-Type Cold Milling Machine segment, which is expected to reach US$1.7 Billion by 2030 with a CAGR of a 5.1%. The Crawler-Type Cold Milling Machine segment is also set to grow at 3.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $612.9 Million in 2024, and China, forecasted to grow at an impressive 8.3% CAGR to reach $610.7 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Cold Milling Machines Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Cold Milling Machines Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Cold Milling Machines Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BeStar Electronics Co., Ltd., Camelion Batteries GmbH, Chongqing VDL Electronics, Duracell Inc., Energizer Holdings, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Cold Milling Machines market report include:

- Astec Industries, Inc.

- BOMAG GmbH

- Caterpillar Inc.

- CMI Roadbuilding Limited

- Dynapac

- Fayat Group

- GOMACO Corporation

- Huatong Kinetics Co., Ltd.

- John Deere

- LiuGong Machinery Co., Ltd.

- Roadtec (a part of Astec Industries)

- SANY Group

- Shantui Construction Machinery Co., Ltd.

- Terex Corporation

- Volvo Construction Equipment

- Wirtgen GmbH (Part of Wirtgen Group)

- XCMG (Xuzhou Construction Machinery Group)

- Xi'an Hongda Road Machinery Co., Ltd.

- XRMC (Xi'an Road Construction Machinery Co., Ltd.)

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Astec Industries, Inc.

- BOMAG GmbH

- Caterpillar Inc.

- CMI Roadbuilding Limited

- Dynapac

- Fayat Group

- GOMACO Corporation

- Huatong Kinetics Co., Ltd.

- John Deere

- LiuGong Machinery Co., Ltd.

- Roadtec (a part of Astec Industries)

- SANY Group

- Shantui Construction Machinery Co., Ltd.

- Terex Corporation

- Volvo Construction Equipment

- Wirtgen GmbH (Part of Wirtgen Group)

- XCMG (Xuzhou Construction Machinery Group)

- Xi'an Hongda Road Machinery Co., Ltd.

- XRMC (Xi'an Road Construction Machinery Co., Ltd.)

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 377 |

| Published | February 2026 |

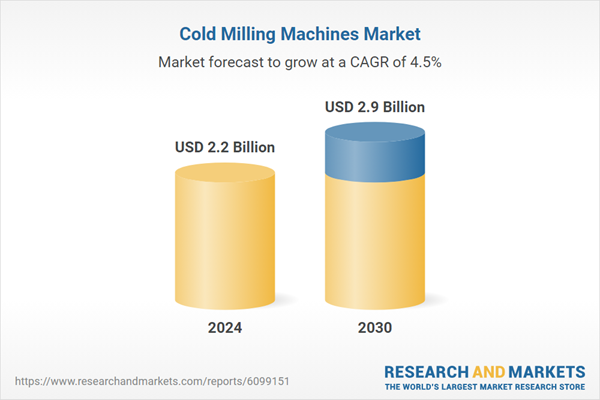

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.2 Billion |

| Forecasted Market Value ( USD | $ 2.9 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |