Global LED Panel Lights Market - Key Trends & Drivers Summarized

Why Are Commercial and Institutional Spaces Transitioning to LED Panel Lights?

The increasing shift toward energy-efficient infrastructure has placed LED panel lights at the center of lighting upgrades in commercial, educational, and institutional environments. Unlike traditional fluorescent or incandescent fixtures, LED panel lights offer a uniform and glare-free lighting experience, making them ideal for indoor settings such as corporate offices, hospitals, classrooms, and libraries. These lights are designed to fit seamlessly into ceiling grids and are available in various form factors including square, rectangular, and circular configurations, enabling both retrofitting and new construction installations. Their ability to provide consistent lumen output across a wide surface area while maintaining low heat emission is particularly important in high-occupancy and temperature-sensitive spaces.Additionally, demand for flexible lighting control is driving the adoption of dimmable LED panel lights compatible with DALI, 0-10V, or smart wireless systems. These solutions not only enable daylight harvesting but also integrate with building management systems to optimize energy usage throughout the day. Institutions are increasingly embracing lighting-as-a-service (LaaS) models to upgrade to panel-based LED systems without the burden of upfront capital expenditure. These developments are aligned with global energy efficiency directives and green building standards, such as LEED and BREEAM, that reward the use of intelligent and sustainable lighting systems.

How Are Technological Enhancements Driving Product Innovation and Market Appeal?

LED panel lights are evolving beyond their original utilitarian function to become digitally enabled, multifunctional lighting solutions. Innovations in edge-lit and backlit panel architectures are improving light diffusion, reducing shadows, and enhancing visual comfort. Edge-lit panels use light guides and reflectors to spread light evenly, while backlit panels offer higher efficiency and better uniformity in deeper luminaires. These enhancements are particularly significant in applications like conference halls and healthcare facilities where precision illumination and aesthetic integration are critical.Smart integration is another pivotal trend, with panel lights now incorporating occupancy sensors, circadian rhythm programming, and color temperature tunability. Tunable white panels, for example, allow users to adjust lighting from warm to cool tones based on time of day or activity, supporting occupant well-being and productivity. Some advanced models feature embedded IoT sensors that track room utilization and environmental parameters, adding value for facilities looking to optimize space usage and operational efficiency. These intelligent panel lights are increasingly being integrated into connected lighting ecosystems that support cloud-based analytics, predictive maintenance, and remote monitoring across multi-building facilities.

What Regulatory Pressures and Sustainability Goals Are Shaping Market Demand?

Global policies aimed at phasing out inefficient lighting systems are accelerating the replacement of older fluorescent ceiling fixtures with LED panel lights. Governments across regions including the EU, North America, and parts of Asia have implemented stringent energy labeling requirements, minimum efficacy thresholds, and hazardous material restrictions such as RoHS (Restriction of Hazardous Substances). These regulations are pushing facility managers and property developers to upgrade to compliant lighting solutions, of which panel LEDs are often the preferred choice due to their high efficacy and long service life.Sustainability initiatives are also playing a decisive role. As corporations and public institutions race to meet ESG goals and carbon reduction commitments, LED panel lights offer a credible pathway to reduce Scope 2 emissions from building operations. The availability of products with Environmental Product Declarations (EPDs) and third-party green certifications is simplifying procurement for projects seeking LEED points or other environmental performance benchmarks. Manufacturers are responding with recyclable housings, modular repairable designs, and reduced packaging waste, aligning product development with circular economy principles and lowering the lifecycle environmental impact.

What Is Fueling Global Growth Across the LED Panel Lights Market?

The growth in the LED panel lights market is driven by several factors tied to urban infrastructure development, smart building proliferation, and heightened end-user awareness of lighting quality. One of the most influential drivers is the wave of building renovations in the post-pandemic era, where lighting upgrades are considered low-hanging fruit for improving energy performance, visual comfort, and employee wellness. This trend is particularly strong in sectors such as co-working spaces, government buildings, and higher education campuses, which are investing in adaptive and cost-effective lighting systems.The rapid rise of smart cities and digital workplaces is also driving demand for intelligent panel lighting solutions that support advanced controls, real-time data integration, and occupant-centric lighting schemes. Coupled with the increasing adoption of wireless protocols such as Zigbee, BLE Mesh, and Wi-Fi 6, these systems allow seamless retrofitting in both old and modern infrastructure. In retail and hospitality, panel lights are gaining popularity for their sleek design, uniform ambiance, and ability to enhance customer experience through dynamic lighting setups.

Another growth vector stems from emerging markets, where expanding commercial real estate and policy-led energy conservation programs are boosting large-scale installations. Utility rebate programs and energy performance contracts (EPCs) are further lowering barriers to adoption. Meanwhile, ongoing innovation in low-cost, high-performance LEDs and optical materials is enabling manufacturers to offer high-quality panel lighting at increasingly competitive price points. Altogether, these factors are consolidating LED panel lights as the preferred lighting solution in commercial environments globally.

Report Scope

The report analyzes the LED Panel Lights market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Recessed LED, Surface Mounted LED); Voltage (Below 10 V, 10 - 15 V, Above 15 V); Distribution Channel (Online, Offline); Application (Commercial / Industrial, Residential).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Recessed LED segment, which is expected to reach US$36 Billion by 2030 with a CAGR of a 13.4%. The Surface Mounted LED segment is also set to grow at 17.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $7.1 Billion in 2024, and China, forecasted to grow at an impressive 19.6% CAGR to reach $12.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global LED Panel Lights Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global LED Panel Lights Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global LED Panel Lights Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Absen, Barco NV, Clear Channel Outdoor, Daktronics, Inc., Diamond Vision (Mitsubishi Electric) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this LED Panel Lights market report include:

- Acuity Brands, Inc.

- Cree Lighting

- Eaton Corporation

- Epistar Corporation

- Everlight Electronics Co., Ltd.

- GE Lighting

- Havells India Ltd.

- LG Innotek Co., Ltd.

- Nichia Corporation

- NVC Lighting Technology Corporation

- Opple Lighting Co., Ltd.

- OSRAM Licht AG

- Panasonic Corporation

- Philips Lighting (Signify)

- Samsung Electronics Co., Ltd.

- Seoul Semiconductor Co., Ltd.

- Syska LED

- Toshiba Lighting & Technology Corp.

- Wipro Lighting

- Zumtobel Group AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acuity Brands, Inc.

- Cree Lighting

- Eaton Corporation

- Epistar Corporation

- Everlight Electronics Co., Ltd.

- GE Lighting

- Havells India Ltd.

- LG Innotek Co., Ltd.

- Nichia Corporation

- NVC Lighting Technology Corporation

- Opple Lighting Co., Ltd.

- OSRAM Licht AG

- Panasonic Corporation

- Philips Lighting (Signify)

- Samsung Electronics Co., Ltd.

- Seoul Semiconductor Co., Ltd.

- Syska LED

- Toshiba Lighting & Technology Corp.

- Wipro Lighting

- Zumtobel Group AG

Table Information

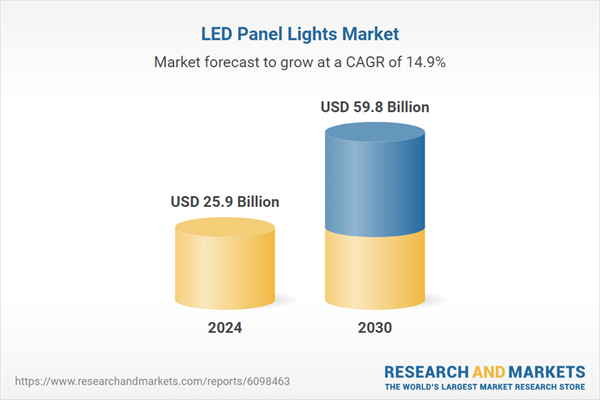

| Report Attribute | Details |

|---|---|

| No. of Pages | 452 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 25.9 Billion |

| Forecasted Market Value ( USD | $ 59.8 Billion |

| Compound Annual Growth Rate | 14.9% |

| Regions Covered | Global |