Global Linear Motors Market - Key Trends & Drivers Summarized

Why Are Linear Motors Gaining Momentum Across Precision-Driven Industrial Applications?

Linear motors are rapidly gaining adoption across a wide spectrum of industries that demand high-precision, high-speed, and low-maintenance motion control systems. Unlike traditional rotary motors that rely on mechanical transmission elements like gears, screws, or belts, linear motors generate direct linear motion without intermediary components, thereby reducing mechanical losses and enabling superior accuracy. This direct-drive mechanism makes them ideal for high-end applications in semiconductor manufacturing, flat-panel display assembly, industrial automation, and advanced packaging systems. As these industries shift toward tighter tolerances, faster throughput, and reduced equipment wear, linear motors are being increasingly favored for their inherent ability to deliver frictionless, backlash-free motion.The rise of compact production lines and miniaturized components is further reinforcing the appeal of linear motors. Their compact profile and reduced moving parts make them suitable for cleanroom environments and space-constrained production facilities. In applications where even microscopic misalignments can compromise output - such as pick-and-place robotics, precision laser cutting, and coordinate measuring machines - linear motors deliver unmatched stability and repeatability. The elimination of traditional mechanical components also translates to reduced maintenance and higher long-term reliability, which is a key factor in industries prioritizing uptime and lean manufacturing practices.

How Are Technological Advances Enhancing Performance and System Integration?

Ongoing innovations in linear motor technology are significantly improving thermal management, energy efficiency, and integration with smart automation platforms. High-force linear motors with rare earth magnet assemblies are enabling rapid acceleration and deceleration, with some models reaching speeds exceeding 5 m/s and sub-micron positioning accuracy. These capabilities are crucial for next-generation industrial processes involving additive manufacturing, high-frequency part inspection, and laser micro-machining. Additionally, the integration of advanced cooling systems, such as liquid or thermoelectric modules, is allowing motors to operate at higher continuous duty cycles without overheating, expanding their suitability for heavy-load and high-duty environments.On the controls side, linear motors are being increasingly coupled with high-resolution encoders, multi-axis controllers, and AI-enabled predictive control algorithms that monitor load dynamics and adjust actuation parameters in real time. These intelligent systems not only improve responsiveness but also enhance system safety by preempting vibration or misalignment anomalies. In many installations, linear motors are being embedded into mechatronic modules that integrate sensors, drives, and actuators into compact plug-and-play assemblies. These modules simplify design and installation processes for OEMs and system integrators, reducing lead times and improving machine modularity.

What Market Segments and Compliance Trends Are Fueling Product Customization?

Diverse industry-specific requirements are driving significant customization in linear motor design. In semiconductor and electronics manufacturing, ultra-high precision and vibration-free operation are non-negotiable, prompting manufacturers to develop air-bearing or magnetic-levitation variants that operate in cleanroom-compatible configurations. In contrast, the automotive sector is adopting linear motors for high-speed battery assembly, welding automation, and end-of-line testing systems, where high thrust and ruggedness take precedence over ultra-fine accuracy. Meanwhile, the life sciences and medical devices industries are demanding sterilizable, low-noise motors for laboratory automation, diagnostic equipment, and surgical robotics.Compliance with sector-specific safety and performance standards is also shaping design and production strategies. In Europe, CE marking and machine directive adherence are critical, while North America emphasizes UL certification and safety interlock integration. Manufacturers are also increasingly offering motors with ingress protection ratings (IP65 and above) to address washdown and outdoor use cases. As linear motors become more prevalent in aerospace, defense, and logistics automation, manufacturers are expected to meet stringent traceability, EMI shielding, and environmental durability requirements, further propelling R&D investments in materials science, winding technologies, and magnetic flux optimization.

What Is Driving Sustained Growth Across the Linear Motors Market Globally?

The growth in the linear motors market is driven by several factors linked to automation expansion, manufacturing sophistication, and rising demand for dynamic motion control. A primary driver is the accelerated automation of precision manufacturing sectors, particularly in Asia-Pacific, where electronics, EV battery, and display panel industries are scaling rapidly. As manufacturers seek to enhance line efficiency, reduce operational variability, and scale up quality assurance, linear motors offer an ideal solution for fast, wear-resistant, and reliable actuation.Emerging use cases in intralogistics and smart warehousing are also fueling market growth. High-speed shuttles, robotic arms, and gantry systems powered by linear motors are increasingly used in fulfillment centers, allowing for precise, high-frequency sorting and goods transfer. Additionally, the growing adoption of additive manufacturing and 3D printing in industrial and healthcare settings is creating new avenues for precision motion systems, with linear motors playing a key role in synchronized multi-axis motion.

Energy savings and lifecycle cost reduction are additional growth catalysts, particularly in comparison to rotary motors with complex drive trains. Linear motors offer higher electrical-to-mechanical conversion efficiency and require minimal maintenance, appealing to manufacturers aiming to reduce total cost of ownership. Furthermore, the ongoing convergence of IoT, machine vision, and AI with industrial motion systems is expected to deepen market penetration, positioning linear motors as a foundational technology for the next generation of smart and adaptive manufacturing environments.

Report Scope

The report analyzes the Linear Motors market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Core (Iron Core, Coreless); Design (Flatbed, U-Channel, Cylindrical); Application (Assembly Machine, Machine Tooling, Medical Instrument, Optics & Photonics, Vacuum Process, Packaging & Labeling, Robotics, Electronics & Semiconductor Manufacturing, Other Applications); End-Use (Food & Beverages, Electronics & Semiconductor, Metals & Mining, Healthcare, Oil & Gas, Automotive & Transportation, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Iron Core segment, which is expected to reach US$2 Billion by 2030 with a CAGR of a 6.7%. The Coreless segment is also set to grow at 3.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $540.6 Million in 2024, and China, forecasted to grow at an impressive 9.3% CAGR to reach $567 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Linear Motors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Linear Motors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Linear Motors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A.N. Wallis & Co Ltd, ABB Ltd., Advanced Lightning Protection Systems Ltd, Alltec Corporation, Belkin International, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Linear Motors market report include:

- Allied Motion Technologies

- Bosch Rexroth AG

- ETEL S.A.

- FAULHABER Group

- H2W Technologies

- Hiwin Corporation

- Iris Dynamics Ltd.

- ITG Linear Motor Co., Ltd.

- Jenaer Antriebstechnik GmbH (JAT)

- KML Linear Motion Technology GmbH

- LinMot (NTI AG)

- Moog Inc.

- Nippon Pulse America, Inc.

- Parker Hannifin Corporation

- PiezoMotor Uppsala AB

- Prodrive Technologies

- Proterial, Ltd.

- Schaeffler Industrial Drives AG & Co. KG

- Siemens AG

- Yaskawa Electric Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Allied Motion Technologies

- Bosch Rexroth AG

- ETEL S.A.

- FAULHABER Group

- H2W Technologies

- Hiwin Corporation

- Iris Dynamics Ltd.

- ITG Linear Motor Co., Ltd.

- Jenaer Antriebstechnik GmbH (JAT)

- KML Linear Motion Technology GmbH

- LinMot (NTI AG)

- Moog Inc.

- Nippon Pulse America, Inc.

- Parker Hannifin Corporation

- PiezoMotor Uppsala AB

- Prodrive Technologies

- Proterial, Ltd.

- Schaeffler Industrial Drives AG & Co. KG

- Siemens AG

- Yaskawa Electric Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 490 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

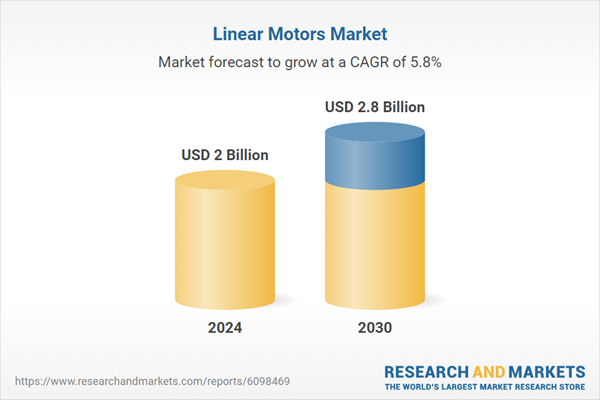

| Estimated Market Value ( USD | $ 2 Billion |

| Forecasted Market Value ( USD | $ 2.8 Billion |

| Compound Annual Growth Rate | 5.8% |

| Regions Covered | Global |