Global Network Detection and Response Market - Key Trends & Drivers Summarized

Why Is Network Detection and Response Emerging as a Cornerstone of Modern Cybersecurity Frameworks?

Network Detection and Response (NDR) is gaining prominence as enterprises face an onslaught of advanced persistent threats (APTs), lateral movement, and zero-day exploits that traditional perimeter-based defenses fail to detect. NDR platforms offer deep visibility into east-west network traffic by continuously monitoring metadata, flow records, and packets to identify abnormal behaviors, suspicious connections, and covert command-and-control activities. Unlike endpoint or signature-based detection, NDR operates in a context-aware, behavior-centric mode - making it indispensable in detecting stealthy, insider, or polymorphic threats.As enterprises embrace hybrid cloud, remote work, and mobile-first architectures, network perimeters are dissolving. In this context, NDR delivers a layer of continuous, passive, and non-intrusive inspection that augments SIEM and endpoint detection capabilities. By baselining normal traffic patterns and leveraging machine learning for anomaly detection, NDR tools empower security teams to detect and investigate threats that bypass traditional controls. This role is increasingly vital in achieving cyber resilience and regulatory compliance in sectors with sensitive, real-time, and high-value data flows.

How Are AI Algorithms, Decryption Capabilities, and Threat Intelligence Expanding NDR Efficacy?

Modern NDR solutions integrate AI and unsupervised machine learning to distinguish genuine threats from benign anomalies, reducing false positives and prioritizing high-risk alerts. These platforms analyze network metadata and full packet capture to uncover encrypted threat vectors, lateral movement, or protocol abuse. Some NDR tools offer SSL/TLS decryption, allowing for deeper inspection of encrypted traffic - while others use heuristic indicators to flag encrypted threats without violating privacy regulations.Contextual enrichment using threat intelligence feeds, MITRE ATT&CK mapping, and behavioral correlation engines allow NDR systems to attribute events to known threat actor tactics and techniques. Advanced NDR tools also support integration with SOAR platforms and extended detection and response (XDR) frameworks, enabling automated incident response workflows. As threat actors use evasive techniques such as DNS tunneling, encrypted payload delivery, or dormant command channels, the ability of NDR to detect behavioral outliers within the network layer is becoming critical to breach containment and forensic accuracy.

Which Enterprise Types and Regulatory Environments Are Driving NDR Adoption Worldwide?

Enterprises with large, distributed networks - such as financial institutions, critical infrastructure providers, healthcare systems, and manufacturing firms - are key adopters of NDR technologies. These organizations face heightened threat levels and compliance mandates such as GDPR, HIPAA, PCI-DSS, and CISA's zero-trust guidelines, all of which prioritize visibility, anomaly detection, and threat containment. For these users, NDR offers a scalable and non-disruptive approach to monitor network behaviors, correlate anomalous flows, and build forensic timelines.In high-assurance sectors such as defense, aerospace, and energy, NDR is increasingly mandated within secure enclave strategies, providing real-time visibility into air-gapped and segmented networks. Managed security service providers (MSSPs) and SOC-as-a-Service vendors are also leveraging NDR as part of their detection stack to enhance threat hunting capabilities and reduce dwell times. The growing adoption of cloud-native NDR solutions is enabling mid-sized enterprises to gain advanced detection capabilities without investing in extensive infrastructure or in-house expertise.

What Is Powering Long-Term Growth and Innovation in the Network Detection and Response Market?

The growth in the network detection and response market is powered by the convergence of advanced cyber threats, evolving IT architectures, and the need for holistic threat visibility beyond endpoints. As ransomware, fileless malware, and insider threats become more sophisticated, organizations are investing in tools that provide behavioral analysis and real-time network forensics. The increasing adoption of zero-trust architectures and microsegmentation strategies is also driving demand for granular, network-based threat detection.Innovation is being fueled by integration with cloud-native monitoring tools, sensorless NDR models using cloud flow logs, and the rise of open XDR ecosystems that incorporate NDR as a foundational telemetry source. NDR vendors are embedding explainable AI, automated incident correlation, and deception techniques to improve detection fidelity and analyst efficiency. As organizations seek unified visibility across their hybrid and multi-cloud environments, NDR platforms will continue to evolve as the neural layer of cybersecurity posture - enabling early threat interception, proactive response, and continuous threat hunting across all layers of the network.

Report Scope

The report analyzes the Network Detection and Response market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Component (Solutions, Services, Other Components); Deployment (Mode On-Premise, Cloud); Organization Size (SMEs, Large Enterprises); End-Use (Vertical BFSI, Government & Defense, Energy & Utilities, Healthcare, IT & Telecom, Retail & E-Commerce, Manufacturing, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Solutions Component segment, which is expected to reach US$4.4 Billion by 2030 with a CAGR of a 18.2%. The Services Component segment is also set to grow at 13.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $786.4 Million in 2024, and China, forecasted to grow at an impressive 22% CAGR to reach $1.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Network Detection and Response Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Network Detection and Response Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Network Detection and Response Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Accenture PLC, AppNeta, Broadcom Inc., Cisco Systems, Inc., Dell Technologies Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Network Detection and Response market report include:

- Arista Networks, Inc.

- BluVector

- Cisco Systems, Inc.

- Corelight, Inc.

- Darktrace plc

- ExtraHop Networks, Inc.

- FireEye, Inc. (now part of Mandiant)

- Flowmon Networks

- Fortinet, Inc.

- Gigamon Inc.

- Hillstone Networks

- IronNet, Inc.

- Juniper Networks, Inc.

- LinkShadow

- MixMode

- Palo Alto Networks, Inc.

- Plixer, LLC

- RSA Security LLC

- Stellar Cyber

- Vectra AI, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arista Networks, Inc.

- BluVector

- Cisco Systems, Inc.

- Corelight, Inc.

- Darktrace plc

- ExtraHop Networks, Inc.

- FireEye, Inc. (now part of Mandiant)

- Flowmon Networks

- Fortinet, Inc.

- Gigamon Inc.

- Hillstone Networks

- IronNet, Inc.

- Juniper Networks, Inc.

- LinkShadow

- MixMode

- Palo Alto Networks, Inc.

- Plixer, LLC

- RSA Security LLC

- Stellar Cyber

- Vectra AI, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 470 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

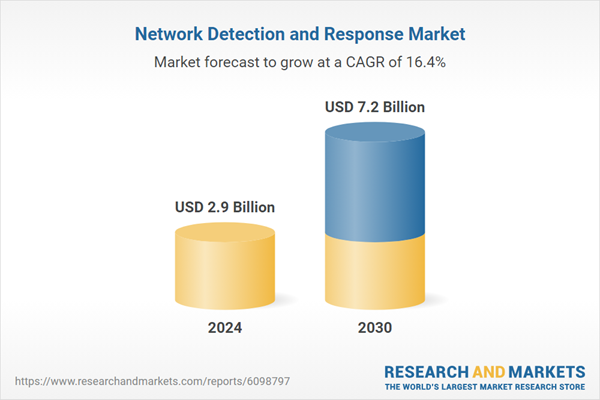

| Estimated Market Value ( USD | $ 2.9 Billion |

| Forecasted Market Value ( USD | $ 7.2 Billion |

| Compound Annual Growth Rate | 16.4% |

| Regions Covered | Global |