Global Pet Tech Market - Key Trends & Drivers Summarized

Why Is Pet Tech Transforming the Way Owners Monitor, Engage With, and Care for Their Pets?

Pet tech - an emerging sector at the intersection of consumer electronics, wearables, and animal health - is reshaping the pet care landscape through smart devices that enhance how owners monitor, feed, train, and interact with their animals. With pets increasingly viewed as family members, owners are seeking solutions that offer the same digital convenience, data-driven insights, and health optimization previously reserved for humans. From GPS trackers and automatic feeders to health monitoring wearables and AI-enabled cameras, pet tech devices are redefining the standards of modern, connected pet parenting.Growing urbanization, longer work hours, and pet humanization trends have elevated demand for remote monitoring, behavioral analytics, and real-time notifications. Devices that provide insights into a pet's activity levels, eating patterns, or even emotional states are gaining traction among working professionals and tech-savvy households. With companion animals playing a larger role in emotional wellness and lifestyle routines, pet tech is emerging not as a luxury but as a digital extension of responsible pet care.

How Are Technological Innovations in IoT, AI, and Sensors Powering the Next Wave of Pet Tech Devices?

Technological advancements in low-power IoT, sensor miniaturization, and AI analytics are catalyzing rapid innovation in pet tech. GPS and RFID-based smart collars now come embedded with geofencing, health tracking, and temperature alerts, enabling proactive intervention for lost pets or health abnormalities. AI-powered cameras with motion detection, pet facial recognition, and two-way communication allow owners to interact with pets remotely, while also monitoring behavior and safety in real-time.Health-focused devices such as wearable biometric trackers and smart litter boxes are collecting data on heart rate, respiratory patterns, sleep cycles, urination, and defecation, providing early warnings for potential illnesses. Integration with mobile apps enables seamless syncing of this data with veterinary platforms, supporting preventive care and medication compliance. Voice assistants like Alexa and Google Home are also being integrated into pet tech ecosystems for hands-free control. These capabilities are turning pet tech from a novelty into a critical tool for wellness, behavior correction, and personalized care routines.

Which User Segments and Pet Categories Are Fueling Global Demand for Smart Pet Devices?

Millennials and Gen Z pet owners, who are digital natives and heavily invested in lifestyle personalization, are the primary adopters of pet tech products. This demographic tends to prioritize convenience, data transparency, and emotional engagement, making them more inclined to adopt subscription-based services, app-integrated devices, and smart home-compatible pet solutions. Dual-income households and pet parents with travel or long working hours also seek automated care options like smart feeders and activity cameras.Dogs account for the largest share of the pet tech market, especially in wearable and GPS tracking categories, followed by cats in the smart litter and feeding automation space. Specialty pets such as rabbits, birds, and reptiles are beginning to see niche device innovation, though the market remains fragmented. North America leads the market, driven by premium spending and early tech adoption. Europe follows closely with a focus on pet wellness and eco-conscious device design. Asia-Pacific, particularly China, Japan, and South Korea, is witnessing a surge in pet tech startups and urban pet care applications.

What Is Driving Long-Term Growth and Strategic Differentiation in the Pet Tech Market?

The growth in the pet tech market is driven by lifestyle digitization, growing veterinary awareness, and rising consumer willingness to invest in pet comfort and safety. As urban dwellers seek deeper engagement with their pets amid busy schedules, devices that offer real-time updates, remote interaction, and health insights are being seen as essential rather than optional. The rise in chronic pet illnesses and aging animal populations is also creating sustained demand for diagnostic and tracking tools.Strategically, manufacturers are integrating ecosystem thinking - offering bundled services such as tele-veterinary consultations, cloud-based health records, and AI-driven behavioral analytics. Partnerships with veterinary networks, insurance firms, and e-commerce platforms are expanding product reach and customer education. Open API architectures are enabling cross-device communication, facilitating smart home integration. As the convergence of human-grade tech and animal care continues, the pet tech market is poised to become a major vertical in the global consumer IoT landscape.

Report Scope

The report analyzes the Pet Tech market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product (Tracking Equipment, Monitoring Equipment, Entertainment Equipment, Feeding Equipment, Other Products); Application (Pet Healthcare, Pet Owner Convenience, Communication & Entertainment, Pet Safety); End-User (Household, Commercial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Tracking Equipment segment, which is expected to reach US$7 Billion by 2030 with a CAGR of a 12%. The Monitoring Equipment segment is also set to grow at 14.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.3 Billion in 2024, and China, forecasted to grow at an impressive 13% CAGR to reach $3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pet Tech Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pet Tech Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pet Tech Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 24Petwatch, AKC Reunite, Avid Identification Systems, Inc., Bio Medic Data Systems, Inc., Biomark, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Pet Tech market report include:

- Afimilk

- Animo

- Blue Buffalo

- Chewy

- CleverPet

- Dogtra

- DOGVACAY

- FitBark

- Garmin International

- GoPro

- Hill's Pet Nutrition

- IceRobotics

- iFetch LLC

- Mars Petcare

- Nestle Purina Petcare

- Petcube

- Scollar Personalized Pet Care

- Tractive

- Wagmo

- Whistle Labs

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Afimilk

- Animo

- Blue Buffalo

- Chewy

- CleverPet

- Dogtra

- DOGVACAY

- FitBark

- Garmin International

- GoPro

- Hill's Pet Nutrition

- IceRobotics

- iFetch LLC

- Mars Petcare

- Nestle Purina Petcare

- Petcube

- Scollar Personalized Pet Care

- Tractive

- Wagmo

- Whistle Labs

Table Information

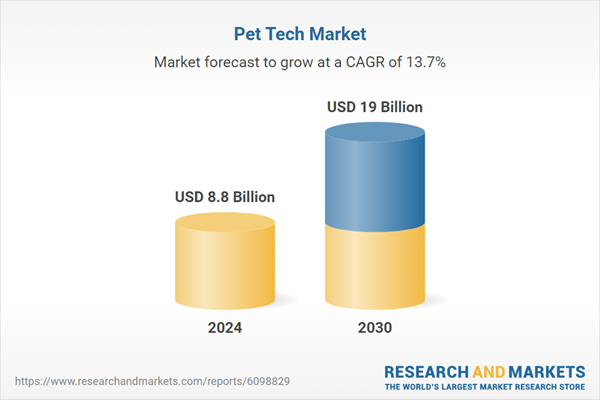

| Report Attribute | Details |

|---|---|

| No. of Pages | 178 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.8 Billion |

| Forecasted Market Value ( USD | $ 19 Billion |

| Compound Annual Growth Rate | 13.7% |

| Regions Covered | Global |