Global Pharmaceutical Suspension Market - Key Trends & Drivers Summarized

Why Are Pharmaceutical Suspensions Gaining Traction Across Pediatric, Geriatric, and Specialty Drug Formulations?

Pharmaceutical suspensions - heterogeneous liquid dosage forms in which active pharmaceutical ingredients (APIs) are dispersed in a suitable vehicle - are vital for drugs with poor solubility or stability in solution. These formulations are especially important for pediatric and geriatric patients who may have difficulty swallowing solid dosage forms. Unlike tablets or capsules, suspensions offer dosage flexibility, taste masking, and ease of swallowing, making them a preferred format for patient-centric drug delivery across several therapeutic categories.The resurgence of interest in poorly water-soluble drugs and biopharmaceutical actives is pushing formulators to explore advanced suspension technologies. Suspensions provide an effective medium for delivering long-acting APIs, enhancing bioavailability and improving patient adherence. In therapeutic areas such as antibiotics, antacids, antipyretics, corticosteroids, and antipsychotics, suspensions offer tailored drug release, reduced gastrointestinal irritation, and better control over pharmacokinetics. As personalized medicine and pediatric care gain momentum, suspensions are re-emerging as a key strategy for achieving accurate, patient-adapted dosing.

How Are Formulation Techniques and Delivery Technologies Improving Suspension Stability and Efficacy?

Modern pharmaceutical suspensions are leveraging micro- and nano-suspension techniques to improve drug dispersion, prevent sedimentation, and enhance absorption. Controlled particle size reduction through jet milling, high-pressure homogenization, and ultrasonication is enabling stable, bioavailable suspensions with prolonged shelf-life and consistent dose uniformity. Use of suspending agents such as xanthan gum, carboxymethyl cellulose, and colloidal silicon dioxide, combined with wetting agents and stabilizers, ensures rheological control and prevents caking during storage.Advanced delivery formats such as extended-release oral suspensions, reconstitutable powder-for-suspension kits, and mucoadhesive nasal suspensions are expanding formulation options for challenging APIs. Packaging innovations - such as dual-chamber bottles, calibrated dosing cups, and anti-microbial closures - are supporting improved patient adherence and minimizing dosing errors. Regulatory guidelines from the FDA and EMA are evolving to accommodate complex suspension matrices, requiring robust stability data, microbial validation, and taste optimization for pediatric use. These advancements are making suspensions safer, more effective, and increasingly aligned with modern drug delivery needs.

Which Therapeutic Segments and Demographics Are Accelerating Demand for Suspension-Based Drug Products?

Pediatric and geriatric populations are the largest end-users of suspension formulations due to swallowing limitations and the need for flexible dosing. In pediatrics, oral suspensions dominate antibiotics, analgesics, antipyretics, and anti-parasitic treatments. Geriatric patients benefit from suspensions for conditions such as osteoporosis, Parkinson's disease, and hypertension, particularly when dysphagia or polypharmacy necessitates simplified medication routines. Suspensions are also gaining traction in veterinary medicine, where ease of administration and palatability are crucial.Pharmaceutical companies are increasingly formulating long-acting injectable suspensions for therapeutic areas such as schizophrenia, hormone replacement, contraception, and oncology. These depot injections provide sustained drug release over weeks or months, improving patient compliance and treatment continuity. Geographically, the U.S. and Europe lead in suspension-based drug approvals and pediatric-focused R&D. Emerging markets in Asia, Africa, and Latin America are seeing growing demand for reconstitutable and stable suspensions in public health programs targeting malaria, tuberculosis, and neglected tropical diseases.

What Is Driving Long-Term Growth and Innovation in the Pharmaceutical Suspension Market?

The growth in the pharmaceutical suspension market is driven by the need for patient-centric formulations, increased focus on solubility enhancement, and advances in drug delivery science. Suspensions offer an effective pathway for formulating poorly soluble actives and delivering controlled-release profiles, while also meeting the growing demand for child-friendly and geriatric-friendly therapies. As pharmacological research targets underserved patient segments, suspension formats provide the flexibility and bioavailability needed for safe and effective treatment.Strategically, pharma companies are investing in suspension-specific R&D, taste-masking technologies, and modular manufacturing systems that support both batch and continuous production. Licensing deals for nano-suspension technologies, collaborations with pediatric hospitals, and co-development with CDMOs are fueling innovation. Regulatory authorities are also incentivizing pediatric and orphan drug development, encouraging use of suspension formats with faster approval pathways and exclusivity incentives. As the market moves toward tailored therapeutics, suspensions will remain a foundational platform for both conventional and next-generation pharmaceutical delivery.

Report Scope

The report analyzes the Pharmaceutical Suspension market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Oral, Parenteral, Other Types); Indication (Infectious Diseases, Cancer, Gastrointestinal, Neurological, Other Indications); Distribution Channel (Hospital Pharmacies, Drug Stores & Retail Pharmacies, Online Providers); End-Use (Hospitals & Clinics, Home Care Settings, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Oral Suspension segment, which is expected to reach US$39.2 Billion by 2030 with a CAGR of a 2.9%. The Parenteral Suspension segment is also set to grow at 3.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $15.9 Billion in 2024, and China, forecasted to grow at an impressive 5.9% CAGR to reach $13.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pharmaceutical Suspension Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pharmaceutical Suspension Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pharmaceutical Suspension Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Adelphi Healthcare Packaging, APG Pharma, Bormioli Pharma, Corning Incorporated, Frontier Glass and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Pharmaceutical Suspension market report include:

- AbbVie Inc.

- Amneal Pharmaceuticals LLC

- ANI Pharmaceuticals Inc.

- Aristopharma Ltd.

- AstraZeneca plc

- Bayer AG

- Bristol Myers Squibb Company

- Eli Lilly and Company

- GlaxoSmithKline plc

- Glenmark Pharmaceuticals Ltd.

- Hikma Pharmaceuticals PLC

- Johnson & Johnson

- Lupin Limited

- Merck & Co., Inc.

- Novartis AG

- Otsuka Pharmaceutical Co., Ltd.

- Padagis LLC

- Pfizer Inc.

- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie Inc.

- Amneal Pharmaceuticals LLC

- ANI Pharmaceuticals Inc.

- Aristopharma Ltd.

- AstraZeneca plc

- Bayer AG

- Bristol Myers Squibb Company

- Eli Lilly and Company

- GlaxoSmithKline plc

- Glenmark Pharmaceuticals Ltd.

- Hikma Pharmaceuticals PLC

- Johnson & Johnson

- Lupin Limited

- Merck & Co., Inc.

- Novartis AG

- Otsuka Pharmaceutical Co., Ltd.

- Padagis LLC

- Pfizer Inc.

- Sanofi S.A.

- Teva Pharmaceutical Industries Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 467 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

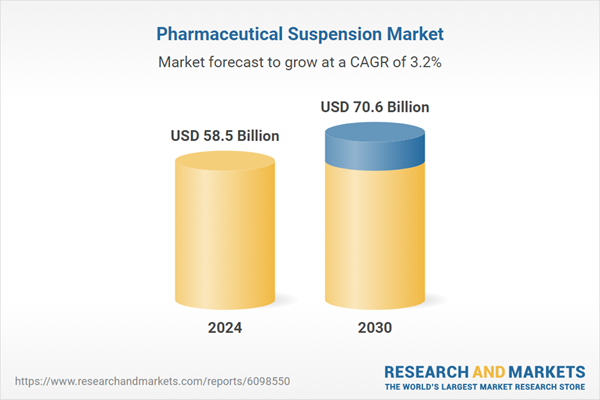

| Estimated Market Value ( USD | $ 58.5 Billion |

| Forecasted Market Value ( USD | $ 70.6 Billion |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | Global |