Global “RF Chip Inductors” Market - Key Trends & Drivers Summarized

What Makes RF Chip Inductors Indispensable In High-Frequency Design?

RF chip inductors, integral to modern high-frequency electronic circuits, are meticulously engineered passive components that manage electromagnetic interference and optimize signal integrity across radio frequencies. These inductors are pivotal in a wide array of communication systems, ensuring functionality in everything from smartphones and satellite receivers to Wi-Fi modules and GPS devices. Their small size, low-profile packaging, and high Q factor make them ideal for miniaturized applications in dense circuit layouts. Typically fabricated using ceramic or ferrite materials, RF chip inductors are designed to withstand harsh temperature ranges and provide stable inductance values even under varying frequencies. With frequencies ranging from a few MHz up to several GHz, these components support a vast span of wireless communication bands. They are vital for impedance matching, filtering, and energy storage within oscillators and tuning circuits. Innovations in materials science have led to the development of ultra-high frequency (UHF) inductors that extend operational efficiency and durability. Manufacturers are constantly innovating to reduce losses and improve signal transmission efficiency, which is critical in 5G and upcoming 6G systems. The rise in Internet of Things (IoT) devices, which require compact, efficient RF solutions, has further underscored the value of RF chip inductors in modern design. Their adaptability to both analog and digital transmission environments makes them universally applicable across industries. Applications have also spread into automotive radar systems, wearable tech, and medical telemetry, each with unique performance requirements. Furthermore, their compatibility with SMT (surface-mount technology) supports automated high-volume production, keeping pace with global consumer electronics demand.Can The Push Towards Miniaturization Sustain Innovation In RF Chip Inductors?

The global demand for smaller, smarter electronic devices has sparked a revolution in RF chip inductor design, compelling manufacturers to innovate without sacrificing performance. Miniaturization, now a dominant trend in electronics, requires components that are not only compact but also capable of operating at higher frequencies with reduced losses. RF chip inductors are meeting this challenge through advancements in multilayer ceramic technologies and precision photolithography, allowing for more accurate coil structuring at microscopic levels. High-density packaging (HDP) is another emerging trend enabling integration of these inductors into tiny modules without affecting impedance characteristics. Moreover, 3D inductor structures and nanomaterial-enhanced substrates are pushing the performance envelope further by increasing Q factor while minimizing electromagnetic coupling. In consumer electronics, where aesthetics and space-saving are key, miniaturized inductors help achieve sleeker form factors without compromising signal clarity. Meanwhile, wearable technology - like fitness trackers and medical implants - benefits from these components' ability to function reliably in constrained environments. In aerospace and defense, rugged miniaturized inductors are critical for lightweight yet powerful radar and telemetry systems. Environmental and sustainability concerns are also shaping miniaturization, as less material use and longer lifespans contribute to greener production footprints. The balance between footprint reduction and inductance stability remains an active area of research, especially as frequencies reach millimeter-wave bands in advanced 5G and satellite applications. While smaller sizes pose thermal and current handling limitations, innovations in material coatings and cooling mechanisms are emerging to address these. The future of RF chip inductors lies in how efficiently manufacturers can miniaturize while scaling up performance for increasingly demanding applications.How Are Industry Verticals And Application Diversity Fueling Technological Advancement?

The broad applicability of RF chip inductors across diverse industry sectors continues to drive robust innovation and specialization. Telecommunications remains the cornerstone market, with RF chip inductors ensuring seamless function in cellular base stations, modems, and next-gen transceivers. As the telecom sector transitions to 5G and envisions 6G frameworks, the need for ultra-low-loss, temperature-stable inductors has become paramount. Simultaneously, the automotive sector is leveraging RF chip inductors in advanced driver-assistance systems (ADAS), in-vehicle infotainment systems, and electric vehicle (EV) powertrains. The precision and frequency control provided by these inductors enable vehicle radar systems to operate accurately under high-speed and variable temperature conditions. In the realm of consumer electronics, RF chip inductors are vital in Bluetooth modules, NFC devices, and wireless charging systems, where performance must not waver despite rapid size reduction. Healthcare, an emerging growth arena, is employing RF chip inductors in diagnostic imaging devices, wireless implants, and portable monitoring equipment, highlighting the need for high-reliability components under critical usage. Industrial automation and robotics also rely on these inductors for precise signal processing in wireless control systems and remote-sensing applications. Military and aerospace programs require RF components with extreme tolerance and radiation resistance, fueling demand for custom and hybrid inductor solutions. Furthermore, research institutions and labs are increasingly deploying tunable RF inductors in advanced quantum computing and AI-driven sensor networks. As application breadth widens, manufacturers are adopting AI-based simulation and modeling tools to preemptively design inductors that meet both standard and niche requirements. The ability to tailor performance to specific environmental or functional conditions is now a key differentiator in the market, elevating the role of RF chip inductors across the technological spectrum.The Growth In The RF Chip Inductors Market Is Driven By Several Factors…

The expansion of the RF chip inductors market is being propelled by precise and interconnected technological and industry-specific growth drivers. Foremost among them is the rapid global deployment of 5G networks, demanding ultra-high-frequency components with low signal degradation, which RF chip inductors are uniquely positioned to provide. In parallel, the surge in IoT adoption across smart homes, factories, and cities necessitates compact RF modules, fueling demand for miniature yet powerful inductors. Consumer behavior is increasingly skewed toward multifunctional and compact devices, placing pressure on OEMs to integrate high-efficiency inductors into ever-smaller PCBs. The automotive sector's transition to electric vehicles and autonomous technologies is also a significant catalyst, with RF chip inductors vital for sensor fidelity and electromagnetic compatibility in ADAS and V2X systems. Another key driver is the rise of remote healthcare and wearable medical devices, which require stable high-frequency operation in constrained, portable formats. Additionally, the proliferation of satellite-based internet systems and low Earth orbit (LEO) communication constellations is accelerating the need for space-grade, temperature-resilient RF inductors. On the manufacturing side, advancements in semiconductor and PCB fabrication techniques - such as system-in-package (SiP) and heterogeneous integration - are enabling better inductor performance at reduced form factors. Regionally, booming electronics manufacturing in Asia-Pacific and increased R&D investments in North America and Europe are contributing to a healthy demand curve. Finally, stringent electromagnetic interference (EMI) regulations and growing complexity in RF design are compelling engineers to rely more on advanced, precision-tuned inductors. This confluence of application-driven needs, technological advances, and evolving end-user expectations ensures the RF chip inductors market remains on an aggressive growth trajectory.Report Scope

The report analyzes the RF Chip Inductors market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Ceramic RF Chip Inductor, Ferrite RF Chip Inductor); Structure Type (Film Structure Type, Wire Wound Structure Type, Multilayer Structure Type, Air Core Structure Type); Application (Infotainment Systems Application, Smartphones Application, Portable Electronics Application, Broadband Application, Computer Peripherals Application, RFIDs Application, RF Transceivers Application, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Ceramic RF Chip Inductor segment, which is expected to reach US$813.1 Million by 2030 with a CAGR of a 4.9%. The Ferrite RF Chip Inductor segment is also set to grow at 8.2% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $271.5 Million in 2024, and China, forecasted to grow at an impressive 9.6% CAGR to reach $290.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global RF Chip Inductors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global RF Chip Inductors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global RF Chip Inductors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Abracon LLC, Alaris Antennas, Amkor Technology, Anritsu Corporation, Antenna Company and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this RF Chip Inductors market report include:

- Abracon LLC

- Ampleon

- Bourns, Inc.

- Coilcraft, Inc.

- Coilmaster Electronics

- Delta Electronics, Inc.

- Johanson Technology Inc.

- Knowles Precision Devices

- Kyocera AVX

- Laird Connectivity

- Littelfuse, Inc.

- MaxLinear, Inc.

- Maxscend Microelectronics

- Murata Manufacturing Co.

- Nordic Semiconductor

- Pulse Electronics

- Taiyo Yuden Co., Ltd.

- TDK Corporation

- Vishay Intertechnology

- Würth Elektronik

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abracon LLC

- Ampleon

- Bourns, Inc.

- Coilcraft, Inc.

- Coilmaster Electronics

- Delta Electronics, Inc.

- Johanson Technology Inc.

- Knowles Precision Devices

- Kyocera AVX

- Laird Connectivity

- Littelfuse, Inc.

- MaxLinear, Inc.

- Maxscend Microelectronics

- Murata Manufacturing Co.

- Nordic Semiconductor

- Pulse Electronics

- Taiyo Yuden Co., Ltd.

- TDK Corporation

- Vishay Intertechnology

- Würth Elektronik

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 390 |

| Published | February 2026 |

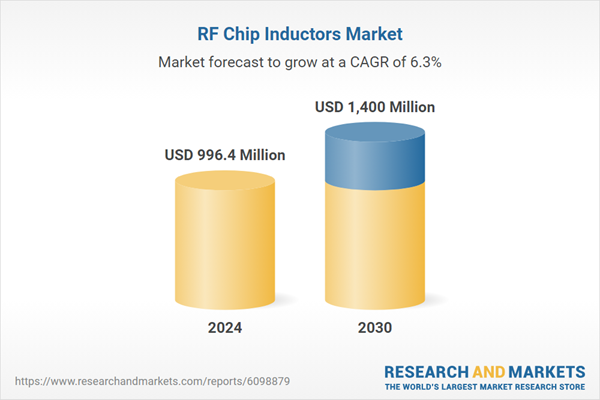

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 996.4 Million |

| Forecasted Market Value ( USD | $ 1400 Million |

| Compound Annual Growth Rate | 6.3% |

| Regions Covered | Global |