Global Staple Food Market - Key Trends & Drivers Summarized

Why Do Staple Foods Remain the Cornerstone of Global Dietary and Food Security Systems?

Staple foods - including grains, legumes, roots, and tubers - form the primary caloric and nutritional foundation for billions of people across diverse geographic and economic contexts. Rice, wheat, maize, potatoes, and pulses serve as affordable, accessible, and culturally embedded dietary staples that support both subsistence consumption and mass-scale food processing. Their role as essential commodities underpins national food security, supply chain stability, and nutrition policy frameworks worldwide.Staples are also critical in buffering against economic shocks and food inflation, particularly in low- and middle-income countries where household food budgets are dominated by core staple categories. As such, governments invest heavily in subsidized procurement, distribution programs, and domestic production of staple crops to reduce import dependency and safeguard population resilience. The persistent demand for staple foods, irrespective of market volatility or dietary trends, ensures their central role in both humanitarian and commercial food systems.

How Are Agricultural Innovations and Climate Adaptation Measures Shaping Staple Food Supply Chains?

To address growing challenges related to climate variability, water stress, and land degradation, agricultural innovation is playing a central role in securing staple food supply chains. The adoption of climate-resilient seed varieties, precision farming techniques, and regenerative soil practices is improving yield reliability and reducing input dependency. Governments and research institutions are actively investing in drought-tolerant, pest-resistant, and nutrient-enriched crop strains that support long-term staple crop sustainability.Digital farming platforms, satellite monitoring, and smart irrigation systems are also enhancing field-level productivity and resource efficiency, especially in emerging markets. These technologies allow for better prediction of crop health and harvest cycles, enabling more efficient distribution and price stabilization in staple food markets. Additionally, supply chain digitization - through blockchain traceability and inventory management - supports transparency and risk mitigation in commodity trading and public procurement.

Which Consumer Demographics and Regional Markets Are Influencing Demand Patterns in Staple Foods?

While staple foods are universal, demand intensity and composition vary by region. In Asia, rice continues to dominate as a primary staple, while maize holds prominence across Sub-Saharan Africa and Latin America. Wheat consumption remains highest in Europe, Central Asia, and the Middle East, where it is foundational in both fresh and processed forms such as bread, pasta, and baked goods. Regional preferences also shape the structure of processing, packaging, and retail models surrounding staple food distribution.Urbanization, income growth, and changing household structures are subtly altering staple food demand in emerging economies. As lifestyles shift, there is rising interest in value-added, fortified, and convenience-oriented formats of traditional staples - such as ready-to-cook rice, instant noodles, parboiled grains, and blended flours. Middle-income consumers are driving growth in packaged and branded staples, while rural populations continue to rely heavily on bulk, unpackaged supply chains. These dual-track consumption patterns are reshaping investment priorities for food manufacturers and public agencies alike.

How Are Sustainability, Trade Dynamics, and Food Policy Interventions Impacting Market Structure?

Global staple food markets are increasingly influenced by environmental sustainability mandates and geopolitical trade dynamics. Export restrictions, stockpile strategies, and subsidy realignments have become common tools used by governments to manage food security during crises. As climate-related disruptions impact production in key exporting countries, global supply imbalances are becoming more frequent - leading to price volatility and heightened interest in regional self-sufficiency.At the same time, sustainability imperatives are pushing for reduced post-harvest losses, lower carbon footprints, and more water-efficient production practices. Public-private partnerships are emerging to improve cold storage, grain warehousing, and local milling infrastructure. Additionally, food policy is evolving to support nutrition-sensitive agriculture, where staples are enhanced with vitamins, minerals, and bioavailable nutrients to address hidden hunger. These shifts are transforming how staple food systems are financed, regulated, and governed at both local and global levels.

What Are the Factors Driving Growth in the Staple Food Market?

The staple food market continues to grow due to the non-discretionary nature of its demand, reinforced by population growth, urban migration, and persistent reliance on core food commodities in emerging markets. As countries strengthen domestic food production systems and improve access through targeted subsidies, fortified options, and public distribution channels, the role of staple foods as nutritional and economic anchors remains undisputed. Even amid diversification of diets, staples retain cultural, functional, and policy significance.The forward trajectory of the market will be shaped by how effectively stakeholders can address challenges around climate risk, trade volatility, and nutritional adequacy - while innovating within traditional food systems. Whether governments, agribusinesses, and development agencies can modernize staple food value chains without undermining affordability and accessibility will determine how sustainably this foundational sector supports global food security in the years ahead.

Report Scope

The report analyzes the Staple Food market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Cereals, Sugar, Roots & Tubers, Fruits, Vegetables, Oil, Other Product Types); Nature (Organic, Conventional); Distribution Channel (Wholesale Distributors, Online Retailers, Direct-to-Consumer, Retail Stores, Other Distribution Channels).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Cereals segment, which is expected to reach US$782.7 Billion by 2030 with a CAGR of a 7.5%. The Sugar segment is also set to grow at 4.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $485 Billion in 2024, and China, forecasted to grow at an impressive 9.2% CAGR to reach $507.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Staple Food Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Staple Food Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Staple Food Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

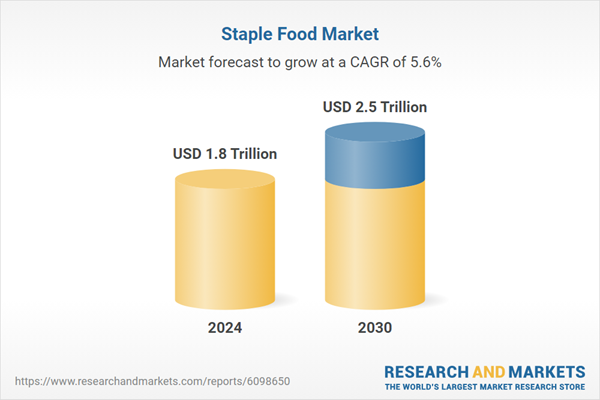

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as American Stained Glass Company, Anything in Stained Glass, Bendheim, Castle Studio Stained Glass, Conrad Schmitt Studios and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 33 companies featured in this Staple Food market report include:

- ADM (Archer Daniels Midland)

- Associated British Foods

- Bunge Limited

- Cargill

- Charoen Pokphand Foods

- Conagra Brands

- Danone

- General Mills

- Grupo Bimbo

- Hormel Foods

- Kellogg Company

- Mars, Incorporated

- Mondelez International

- Nestlé

- PepsiCo

- Premier Foods

- The Kraft Heinz Company

- Unilever

- Wilmar International

- Yili Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADM (Archer Daniels Midland)

- Associated British Foods

- Bunge Limited

- Cargill

- Charoen Pokphand Foods

- Conagra Brands

- Danone

- General Mills

- Grupo Bimbo

- Hormel Foods

- Kellogg Company

- Mars, Incorporated

- Mondelez International

- Nestlé

- PepsiCo

- Premier Foods

- The Kraft Heinz Company

- Unilever

- Wilmar International

- Yili Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 381 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.8 Trillion |

| Forecasted Market Value ( USD | $ 2.5 Trillion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | Global |