Global Sump Pumps Market - Key Trends & Drivers Summarized

Why Are Sump Pumps Essential for Water Management in Residential, Commercial, and Industrial Infrastructure?

Sump pumps serve as critical components in water control systems, preventing basement flooding, groundwater accumulation, and structural damage by actively removing excess water from sump pits typically located in building basements or crawl spaces. Their role is especially vital in regions prone to heavy rainfall, high water tables, or poor drainage. In residential applications, sump pumps protect against property damage, mold growth, and foundation weakening, offering homeowners a first line of defense against water intrusion.In commercial and industrial facilities, sump pumps contribute to broader flood prevention strategies and environmental compliance by managing runoff, containment system overflows, and stormwater infiltration. Their deployment in warehouses, utility plants, and construction sites helps maintain operational safety and equipment integrity. As weather patterns become more unpredictable and urban development accelerates, the demand for reliable groundwater mitigation solutions is rising, reinforcing the centrality of sump pumps in modern water infrastructure planning.

How Are Technological Innovations Improving Pump Efficiency, Reliability, and Automation?

Recent innovations in sump pump design have focused on energy efficiency, motor durability, and automated operation. High-efficiency submersible and pedestal pumps equipped with thermally protected motors and corrosion-resistant materials are delivering extended service life and improved hydraulic performance. Variable speed motors, sealed bearings, and non-clogging impellers are being adopted to enhance pumping capacity and reduce maintenance frequency in demanding applications.Smart sump pumps featuring Wi-Fi connectivity, app-based monitoring, and predictive failure diagnostics are gaining traction among tech-savvy homeowners and facility managers. These systems allow real-time tracking of water levels, pump cycles, and system health, enabling timely interventions and remote alerts. Integration with home automation and building management systems is further enhancing proactive water damage prevention. Battery backup and dual-pump configurations are also being increasingly adopted to ensure continuous protection during power outages or high-flow events.

Which End-User Segments and Environmental Conditions Are Driving Sump Pump Demand?

Residential basements remain the largest end-use segment, with new home construction and retrofits both contributing to market growth. Homeowners in flood-prone zones or older neighborhoods with aging drainage systems are increasingly installing sump pumps as a preventive investment. In multifamily housing and mixed-use buildings, centralized sump pump systems are used to manage runoff and safeguard below-grade parking and mechanical rooms from water accumulation.Commercial users - including hotels, hospitals, data centers, and retail complexes - are deploying sump pumps to protect critical infrastructure from water damage. Industrial sites such as power plants, manufacturing facilities, and chemical processing units rely on heavy-duty sump systems to manage wastewater, equipment cooling discharge, and emergency spills. Geographic regions with frequent storms, poor drainage infrastructure, or rising sea levels are seeing higher demand for both portable and permanent sump pump installations as climate resilience becomes a priority.

How Are Product Selection Criteria, Regulatory Compliance, and Installer Expertise Influencing Market Adoption?

Purchasing decisions for sump pumps are shaped by factors such as flow rate, head height, material compatibility, and ease of installation. Buyers assess long-term maintenance needs, pump activation reliability, and compatibility with existing drainage systems. As sump pump installations must often comply with building codes, environmental discharge regulations, and insurance requirements, product certification (e.g., UL, CSA) and local code adherence are key selection criteria - particularly in commercial and industrial contexts.Professional installation is critical for ensuring sump pump effectiveness and regulatory compliance. Contractors are increasingly offering turnkey packages that include pit excavation, backup systems, check valves, and discharge routing. As flooding-related insurance claims rise, builders and property managers are prioritizing quality installation to mitigate liability. Manufacturers that support contractors with design guidance, modular systems, and extended warranties are enhancing market penetration and brand loyalty through installer networks.

What Are the Factors Driving Growth in the Sump Pumps Market?

Growth in the sump pumps market is being driven by increasing climate-related flooding risks, urban infrastructure expansion, and rising awareness of property protection among residential and commercial stakeholders. Technological enhancements in pump durability, automation, and real-time monitoring are expanding adoption across both retrofit and new construction projects. At the same time, regulatory mandates and insurance incentives are reinforcing the value of proactive water management systems.Looking ahead, market momentum will hinge on how effectively manufacturers can balance system performance, smart functionality, and affordability. As climate adaptation strategies gain urgency and demand for resilient infrastructure accelerates, sump pumps are poised to remain indispensable tools in flood mitigation - ensuring operational continuity, asset protection, and peace of mind across built environments worldwide.

Report Scope

The report analyzes the Sump Pumps market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Submersible Sump Pumps, Pedestal Sump Pumps); Capacity (Low, Medium, High); End-User (Residential, Commercial, Industrial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Submersible Sump Pumps segment, which is expected to reach US$38.3 Billion by 2030 with a CAGR of a 18.5%. The Pedestal Sump Pumps segment is also set to grow at 13.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $5.5 Billion in 2024, and China, forecasted to grow at an impressive 22.8% CAGR to reach $11.7 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Sump Pumps Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Sump Pumps Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Sump Pumps Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AirSpade, Ditch Witch, Force One Ltd, Gerotto Federico S.r.l., Hüdig GmbH & Co. KG and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Sump Pumps market report include:

- Baker Hughes Company

- Dover Corporation

- Ebara Corporation

- Excellence Pump Industry Co., Ltd.

- Flowserve Corporation

- Franklin Electric Co., Inc.

- Grundfos Pumps Corporation

- ITT Goulds Pumps

- KSB SE & Co. KGaA

- Leo Group Co., Ltd.

- Liberty Pumps, Inc.

- Pentair plc

- Shijiazhuang Industrial Pump Factory Co., Ltd.

- Sulzer Ltd

- Tsurumi Manufacturing Co., Ltd.

- Wayne Pumps

- Weir Group PLC

- WILO SE

- Xylem Inc.

- Zoeller Pump Company

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Baker Hughes Company

- Dover Corporation

- Ebara Corporation

- Excellence Pump Industry Co., Ltd.

- Flowserve Corporation

- Franklin Electric Co., Inc.

- Grundfos Pumps Corporation

- ITT Goulds Pumps

- KSB SE & Co. KGaA

- Leo Group Co., Ltd.

- Liberty Pumps, Inc.

- Pentair plc

- Shijiazhuang Industrial Pump Factory Co., Ltd.

- Sulzer Ltd

- Tsurumi Manufacturing Co., Ltd.

- Wayne Pumps

- Weir Group PLC

- WILO SE

- Xylem Inc.

- Zoeller Pump Company

Table Information

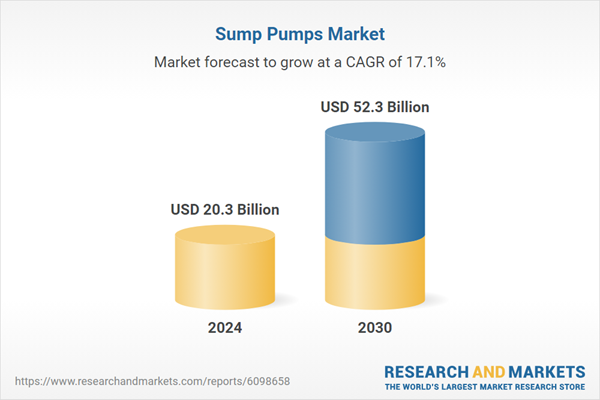

| Report Attribute | Details |

|---|---|

| No. of Pages | 372 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 20.3 Billion |

| Forecasted Market Value ( USD | $ 52.3 Billion |

| Compound Annual Growth Rate | 17.1% |

| Regions Covered | Global |