Global Superyachts Market - Key Trends & Drivers Summarized

Why Are Superyachts a Symbol of Ultra-Luxury, Technological Mastery, and Private Mobility?

Superyachts - typically defined as private vessels exceeding 24 meters in length - are among the most exclusive symbols of personal wealth and luxury. These custom-built vessels blend advanced naval engineering, interior design excellence, and cutting-edge entertainment systems to deliver unmatched privacy, comfort, and prestige on the water. For ultra-high-net-worth individuals (UHNWIs), superyachts offer a floating sanctuary that doubles as a mobile estate, business venue, and lifestyle statement.Demand is driven not only by the desire for exclusivity but also by the experiential value superyachts provide. Owners use them to access remote islands, host curated events, or conduct transcontinental voyages - all with the service standards of a five-star hotel. As discretionary spending among global elites continues to rise, superyachts remain a status-defining asset class that combines craftsmanship, customization, and mobility in one of the most private formats of luxury travel.

How Are Technology and Sustainability Shaping the Design and Operation of Next-Gen Superyachts?

Innovation in propulsion, energy efficiency, and materials is transforming the superyacht industry. Hybrid-electric propulsion systems, advanced hull designs, and dynamic positioning technology are improving fuel economy, reducing vibration, and enabling quieter, more sustainable voyages. Smart automation systems now manage everything from climate control to navigation and entertainment - enhancing onboard comfort and operational efficiency while minimizing crew workload.Sustainability is becoming central to yacht construction and ownership, with growing demand for eco-conscious design elements such as solar panels, waste heat recovery systems, low-emission engines, and sustainable interiors. Builders and naval architects are exploring alternative materials like recycled composites and teak alternatives, while regulatory frameworks such as IMO Tier III are driving compliance on emissions. As environmental scrutiny intensifies, sustainability is evolving from a differentiator into a necessity for securing long-term brand equity and market relevance.

Which Markets and Buyer Profiles Are Expanding Global Superyacht Demand?

Europe remains the global hub for superyacht construction, with Italy, the Netherlands, and Germany leading in custom builds and innovation. The U.S. is the largest ownership market, driven by generational wealth and strong charter demand. However, rapid wealth creation in Asia-Pacific, the Middle East, and parts of Eastern Europe is generating a new wave of first-time buyers seeking long-range, technologically advanced vessels for both leisure and prestige.The buyer demographic is also evolving. While legacy owners remain active, younger UHNWIs, particularly tech entrepreneurs and crypto millionaires, are entering the market with preferences for minimalist aesthetics, high-tech integration, and multi-functional layouts. Charter customers are influencing design trends as well, prompting demand for flexible configurations, spa-grade wellness zones, and immersive entertainment systems. These shifts are prompting builders to adapt yacht offerings to the lifestyle expectations of a more dynamic and diversified client base.

How Are Ownership Models, Customization Trends, and Post-Sales Services Impacting Market Structure?

The traditional full-ownership model is being supplemented by fractional ownership, charter-first strategies, and yacht management services that lower barriers to entry and streamline the ownership experience. High operating costs, crew management, and regulatory compliance have prompted many buyers to rely on yacht management firms for end-to-end logistics - from provisioning and maintenance to staffing and itinerary planning. These service ecosystems are critical in preserving yacht value and enhancing owner satisfaction.Customization remains a defining feature of the superyacht segment, with owners demanding bespoke interiors, purpose-built tenders, and signature design touches that reflect personal taste and global sensibilities. Collaborative design-build processes involving naval architects, interior designers, and shipyards are lengthening lead times but elevating product differentiation. After-delivery services, including refitting, class certification, and seasonal repositioning, are further reinforcing long-term client relationships and brand loyalty in a market where exclusivity is inseparable from experience.

What Are the Factors Driving Growth in the Superyachts Market?

Growth in the superyachts market is being driven by expanding global wealth, evolving luxury consumption patterns, and rising demand for private, secure, and ultra-personalized travel experiences. As new wealth segments enter the luxury marine market and expectations shift toward sustainability, innovation, and experience curation, superyachts are increasingly viewed not only as status symbols but as mobile assets delivering utility, investment potential, and lifestyle fulfillment.Looking ahead, the market's trajectory will depend on how effectively shipbuilders, designers, and service providers balance engineering ambition, environmental responsibility, and personalization. Whether the industry can scale innovation and sustainability without compromising exclusivity will determine the pace at which superyachts maintain their dominance as the ultimate expression of private luxury mobility in a post-pandemic, experience-driven global economy.

Report Scope

The report analyzes the Superyachts market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Size (30 - 80 Meters, Above 80 Meters); Propulsion Type (Motor, Sailing, Other Propulsion Types); Application (Private, Charter).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 30 - 80 Meters Yachts segment, which is expected to reach US$10.6 Billion by 2030 with a CAGR of a 6%. The Above 80 Meters Yachts segment is also set to grow at 10.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.3 Billion in 2024, and China, forecasted to grow at an impressive 11.8% CAGR to reach $3.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Superyachts Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Superyachts Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Superyachts Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aston Martin Lagonda Global Holdings plc, Bugatti Automobiles S.A.S., Czinger Vehicles Inc., Ferrari S.p.A., Gordon Murray Automotive and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Superyachts market report include:

- Abeking & Rasmussen

- Admiral Yachts

- Amels

- Azimut Yachts

- Baglietto

- Benetti

- Bilgin Yachts

- CRN

- Feadship

- Ferretti Yachts

- Fincantieri Yachts

- Heesen Yachts

- Horizon Yachts

- Lürssen

- Mangusta (Overmarine Group)

- Oceanco

- Princess Yachts

- Rossinavi

- Sanlorenzo

- Sunseeker International

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Abeking & Rasmussen

- Admiral Yachts

- Amels

- Azimut Yachts

- Baglietto

- Benetti

- Bilgin Yachts

- CRN

- Feadship

- Ferretti Yachts

- Fincantieri Yachts

- Heesen Yachts

- Horizon Yachts

- Lürssen

- Mangusta (Overmarine Group)

- Oceanco

- Princess Yachts

- Rossinavi

- Sanlorenzo

- Sunseeker International

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 368 |

| Published | February 2026 |

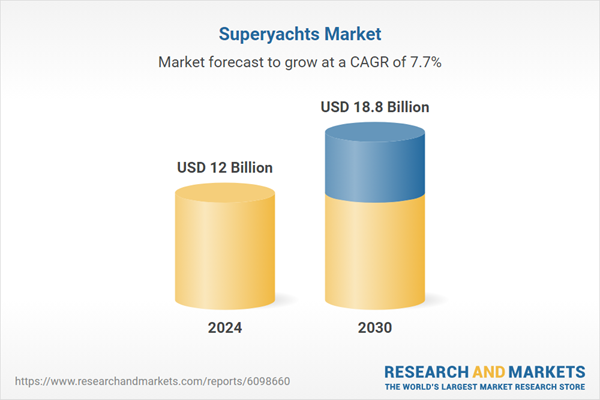

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12 Billion |

| Forecasted Market Value ( USD | $ 18.8 Billion |

| Compound Annual Growth Rate | 7.7% |

| Regions Covered | Global |