Global Surface Drilling Rigs Market - Key Trends & Drivers Summarized

Why Are Surface Drilling Rigs Critical to Mining, Construction, and Resource Extraction Operations?

Surface drilling rigs are essential equipment for creating boreholes and blast holes in open-pit mining, quarrying, infrastructure development, and exploration projects. These rigs enable precision drilling in varying rock formations, supporting controlled blasting, foundation preparation, and geological analysis. Whether in mineral extraction or road and tunnel construction, the reliability and accuracy of surface drilling equipment directly influence project efficiency, safety, and cost.Their versatility allows deployment across diverse terrains and drilling requirements, ranging from shallow blast holes to deep exploration drilling. The integration of high-torque rotary heads, hydraulic systems, and stabilizing platforms allows rigs to operate effectively in harsh and remote environments. As global demand for minerals, aggregates, and energy infrastructure continues to rise, surface drilling rigs are increasingly viewed as foundational assets in resource-intensive operations.

How Are Automation, Digital Integration, and Equipment Efficiency Transforming Rig Performance?

Technological advances in rig automation, GPS navigation, and remote monitoring are significantly enhancing drilling precision, operator safety, and productivity. Automated drilling cycles, real-time data logging, and remote-controlled operations are reducing human error, optimizing fuel consumption, and enabling continuous monitoring of performance metrics. These capabilities are particularly valuable in hazardous or high-altitude zones where manual operation poses increased risk.Modern rigs are also incorporating predictive maintenance systems that use machine learning to anticipate component failures, minimize downtime, and reduce maintenance costs. Energy-efficient powertrains, advanced dust suppression systems, and noise reduction technologies are making surface drilling more environmentally compliant. These innovations are allowing operators to scale operations while meeting stricter sustainability and safety standards - accelerating the shift toward fully digital, operator-assisted surface drilling ecosystems.

Which End-Use Sectors and Regional Markets Are Driving Demand for Surface Drilling Rigs?

The mining sector remains the largest end user, with extensive use of surface drilling rigs in the extraction of coal, iron ore, copper, gold, and industrial minerals. Large-scale open-pit mining projects rely on fleets of blast-hole rigs for material fragmentation and bench development. Quarrying operations for aggregates and dimension stones also drive steady demand, particularly in fast-urbanizing regions where road and housing construction are accelerating.Infrastructure development, especially in Asia-Pacific, Latin America, and Africa, is driving additional demand as governments invest in roadways, tunnels, dams, and renewable energy foundations. Surface drilling rigs are also utilized in geothermal exploration, water well drilling, and hydropower development - further broadening their application scope. As resource exploration expands into remote and less-explored areas, mobility, fuel efficiency, and machine versatility are becoming key purchase considerations.

How Are Procurement Models, Operator Skill Gaps, and Lifecycle Costs Influencing Market Adoption?

Capital intensity and site-specific customization requirements make equipment selection and procurement strategy central to drilling project economics. While large mining operators often invest in owned fleets, smaller contractors increasingly prefer leasing or renting rigs with maintenance contracts to reduce upfront costs and improve fleet flexibility. Availability of aftermarket support, spare parts, and telematics integration often influence brand preference and procurement decisions.Skill shortages in qualified rig operators and technicians are prompting a shift toward operator-assist and autonomous solutions that reduce training time and enhance drilling consistency. OEMs are investing in simulators, e-learning platforms, and AI-based operator guidance systems to address workforce limitations. Total cost of ownership - including fuel efficiency, component wear rates, and ease of serviceability - is playing a decisive role in equipment lifecycle planning, particularly for multi-rig operations in remote or high-utilization environments.

What Are the Factors Driving Growth in the Surface Drilling Rigs Market?

The surface drilling rigs market is growing as mining, infrastructure, and exploration industries scale operations to meet rising global demand for raw materials, energy access, and transportation networks. Technological innovation, environmental compliance pressures, and a shift toward data-driven drilling processes are reinforcing the strategic role of high-performance, automated rigs in achieving project targets efficiently and sustainably.As resource extraction becomes more complex and competitive, future market growth will depend on how effectively manufacturers can deliver adaptable, intelligent, and fuel-efficient drilling solutions that address site-specific challenges and evolving workforce dynamics. Whether surface drilling rigs can continue to evolve into safer, smarter, and more cost-effective platforms will shape their role in enabling resilient growth across the global construction and mining value chain.

Report Scope

The report analyzes the Surface Drilling Rigs market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Rotary Drills, Boom Drills); Sales Type (New Sales, Aftermarket); Application (Mining, Quarrying, Construction, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Rotary Drills segment, which is expected to reach US$1.7 Billion by 2030 with a CAGR of a 2.4%. The Boom Drills segment is also set to grow at 4.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $638.7 Million in 2024, and China, forecasted to grow at an impressive 5.7% CAGR to reach $549.4 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Surface Drilling Rigs Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Surface Drilling Rigs Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Surface Drilling Rigs Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Anaplan Inc., Avetta LLC, Cloudleaf Inc., Coupa Software Inc., CURA Software Solutions and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Surface Drilling Rigs market report include:

- Atlas Copco AB

- BAUER Maschinen GmbH

- Boart Longyear Ltd.

- Caterpillar Inc.

- China National Petroleum Corporation (CNPC)

- Drillmec Inc.

- Epiroc AB

- Furukawa Rock Drill Co., Ltd.

- Gill Rock Drill Company, Inc.

- Herrenknecht AG

- Komatsu Ltd.

- Mobile Drill International

- Nabors Industries Ltd.

- National Oilwell Varco (NOV Inc.)

- Revathi Equipment Ltd.

- Sandvik AB

- Schlumberger Limited

- Sinocoredrill Group Co., Ltd.

- Sunward Intelligent Equipment Co., Ltd.

- Vermeer Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Atlas Copco AB

- BAUER Maschinen GmbH

- Boart Longyear Ltd.

- Caterpillar Inc.

- China National Petroleum Corporation (CNPC)

- Drillmec Inc.

- Epiroc AB

- Furukawa Rock Drill Co., Ltd.

- Gill Rock Drill Company, Inc.

- Herrenknecht AG

- Komatsu Ltd.

- Mobile Drill International

- Nabors Industries Ltd.

- National Oilwell Varco (NOV Inc.)

- Revathi Equipment Ltd.

- Sandvik AB

- Schlumberger Limited

- Sinocoredrill Group Co., Ltd.

- Sunward Intelligent Equipment Co., Ltd.

- Vermeer Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 372 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

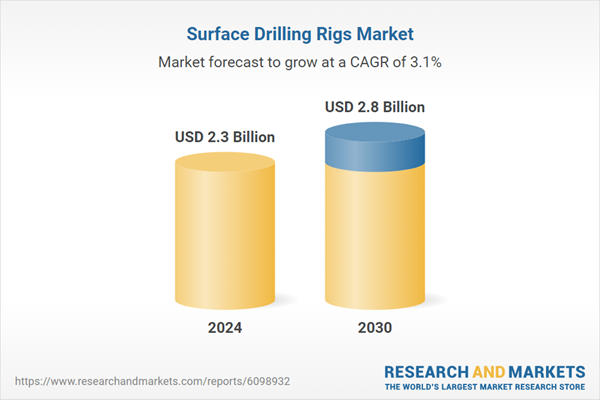

| Estimated Market Value ( USD | $ 2.3 Billion |

| Forecasted Market Value ( USD | $ 2.8 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |