Global 5G Towers and Cables Market - Key Trends & Drivers Summarized

Why Are 5G Towers and Cables Foundational to the Global Rollout of High-Capacity Wireless Networks?

5G towers and cables represent the structural and connective backbone of fifth-generation mobile networks, playing a pivotal role in delivering the ultra-low latency, high data throughput, and massive device connectivity required by modern digital ecosystems. Towers - ranging from traditional macro towers to new-age small cell structures - host 5G radios and antennas that transmit and receive signals across varying frequency bands, including low-band, mid-band, and high-band (mmWave). Cables, particularly fiber optic and coaxial, are essential for fronthaul, midhaul, and backhaul transmission, connecting baseband units, antennas, and core networks while ensuring stable, high-speed data transfer with minimal signal loss.The densification required for 5G, especially in urban centers, demands a far greater number of towers and small cell sites than previous generations. Meanwhile, the need for ultra-reliable connectivity in autonomous systems, smart cities, and industrial automation makes high-bandwidth, low-latency cable infrastructure indispensable. Together, 5G towers and cables form the physical layer that enables software-defined, virtualized, and cloud-native wireless infrastructure - supporting everything from real-time streaming and remote healthcare to autonomous transport and immersive digital services.

How Are Tower Designs and Cabling Technologies Evolving to Meet 5G Network Demands?

Technological innovation in tower and cable architecture is rapidly advancing to support higher frequencies, dense deployment, and multi-vendor environments. For towers, there is growing adoption of lightweight, modular structures such as monopoles, camouflaged poles, rooftop installations, and integrated street furniture (e.g., smart lampposts) to minimize visual impact and enable flexible placement in urban landscapes. Small cell towers, often installed on utility poles and building facades, are being designed with integrated radio units and compact footprints to facilitate rapid deployment in high-traffic zones.On the cabling front, fiber optics dominate due to their superior bandwidth, low attenuation, and scalability. Fiber-to-the-tower (FTTT) and fiber-to-the-antenna (FTTA) installations are standard in most modern 5G deployments, enabling centralized baseband processing and support for distributed units (DUs). New developments in hybrid cables - combining power and fiber lines in a single sheath - are helping reduce installation complexity and cost, especially in dense urban or rooftop environments. Ruggedized and weather-resistant cable designs are also supporting 5G infrastructure in harsh environments, including remote or coastal regions. Advanced cable management systems, including pre-terminated connectors and plug-and-play modules, are streamlining site construction and maintenance - accelerating time to market for 5G services.

What Deployment Strategies, Operator Priorities, and Urban Infrastructure Policies Are Driving Market Expansion?

The global race to deploy 5G networks is compelling telecom operators, tower companies, and infrastructure providers to aggressively invest in tower densification and cable upgrades. Macro cell deployments continue to anchor rural and suburban rollouts, but dense urban areas rely heavily on small cell proliferation to meet performance standards, especially for mid-band and mmWave frequencies. This requires operators to negotiate access to public infrastructure such as streetlights, utility poles, and rooftops, prompting new policies and public-private partnerships aimed at easing zoning, right-of-way, and permitting regulations.Network-sharing agreements and tower co-location strategies are also gaining traction to reduce deployment costs and environmental impact. Many operators are leveraging neutral host models and leasing arrangements with tower companies to speed up site access and optimize capital expenditure. On the cable side, dark fiber leasing, municipal fiber access, and strategic fiber backbone expansion are enabling carriers to rapidly extend high-speed connectivity to new 5G base stations. In-building cabling solutions, including passive DAS and distributed fiber networks, are further enhancing 5G signal penetration in malls, airports, and commercial campuses - where indoor coverage is a key differentiator.

What Is Driving the Growth of the 5G Towers and Cables Market Across Regions and Infrastructure Segments?

The growth in the 5G towers and cables market is driven by rising mobile data consumption, aggressive national 5G rollouts, and the diversification of wireless use cases across sectors. In Asia-Pacific, China leads the market in both tower deployment and fiber network buildout, driven by strong government support, local manufacturing capacity, and a massive subscriber base. South Korea and Japan are also investing in small cell expansion and urban densification, supported by advanced public infrastructure and tech-forward regulatory environments. India is entering a rapid deployment phase with a focus on macro towers, fiber deployment, and shared infrastructure models to improve rural and Tier-II city coverage.North America is witnessing robust demand for both towers and cables as carriers expand C-band and mmWave infrastructure. Tower companies in the U.S. are actively scaling small cell deployments to support edge computing, private 5G networks, and fixed wireless access (FWA). Meanwhile, ongoing fiber densification efforts are reinforcing fronthaul and backhaul capabilities. In Europe, the rollout is supported by spectrum auctions, digital transformation initiatives, and greenfield tower developments across Germany, the UK, France, and the Nordics. The region is also embracing Open RAN strategies and cross-border infrastructure collaboration to reduce latency and improve resilience.

Segment-wise, macro towers continue to dominate in revenue terms, but small cells, rooftop towers, and associated cable installations are growing fastest due to their alignment with urban connectivity needs and private 5G initiatives. As network operators pursue nationwide 5G coverage, and enterprise use cases push demand for low-latency edge infrastructure, the 5G towers and cables market is poised for sustained, multi-phase growth - anchored by its foundational role in enabling real-time, high-capacity, and resilient wireless communication across both public and private networks.

Report Scope

The report analyzes the 5G Towers and Cables market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Component (Towers, Cables); Deployment (Urban Areas, Suburban Areas, Rural Areas); End-Use (Telecommunications, Government & Defense, Transportation, Energy & Utilities, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Some of the 34 companies featured in this 5G Towers and Cables market report include -

- ADVA Optical Networking

- AFL Global

- American Tower Corporation

- Cellnex Telecom S.A.

- China Tower Corporation

- CommScope Inc.

- Corning Incorporated

- Crown Castle International Corp.

- Ericsson

- FiberHome Telecommunication Technologies Co., Ltd.

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- Helios Towers plc

- Hexatronic Group AB

- Huawei Technologies Co., Ltd.

- IHS Towers

- Indus Towers Limited

- Infinera Corporation

- LS Cable & System Ltd.

- NEC Corporation

Key Insights:

- Market Growth: Understand the significant growth trajectory of the 5G Towers segment, which is expected to reach US$79.3 Billion by 2030 with a CAGR of a 40.3%. The 5G Cables segment is also set to grow at 32% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.2 Billion in 2024, and China, forecasted to grow at an impressive 35.6% CAGR to reach $16.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global 5G Towers and Cables Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global 5G Towers and Cables Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global 5G Towers and Cables Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Analog Devices, Inc., Apple Inc., Arcadyan Technology Corp., ASR Microelectronics, Broadcom Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 34 Featured):

- ADVA Optical Networking

- AFL Global

- American Tower Corporation

- Cellnex Telecom S.A.

- China Tower Corporation

- CommScope Inc.

- Corning Incorporated

- Crown Castle International Corp.

- Ericsson

- FiberHome Telecommunication Technologies Co., Ltd.

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- Helios Towers plc

- Hexatronic Group AB

- Huawei Technologies Co., Ltd.

- IHS Towers

- Indus Towers Limited

- Infinera Corporation

- LS Cable & System Ltd.

- NEC Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ADVA Optical Networking

- AFL Global

- American Tower Corporation

- Cellnex Telecom S.A.

- China Tower Corporation

- CommScope Inc.

- Corning Incorporated

- Crown Castle International Corp.

- Ericsson

- FiberHome Telecommunication Technologies Co., Ltd.

- Fujikura Ltd.

- Furukawa Electric Co., Ltd.

- Helios Towers plc

- Hexatronic Group AB

- Huawei Technologies Co., Ltd.

- IHS Towers

- Indus Towers Limited

- Infinera Corporation

- LS Cable & System Ltd.

- NEC Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 168 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

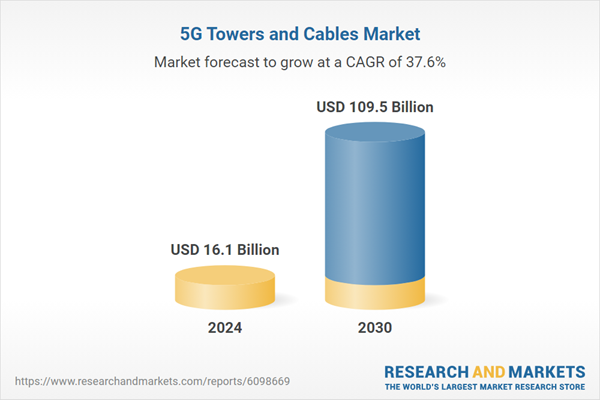

| Estimated Market Value ( USD | $ 16.1 Billion |

| Forecasted Market Value ( USD | $ 109.5 Billion |

| Compound Annual Growth Rate | 37.6% |

| Regions Covered | Global |