Global Advanced Wound Care Management Market - Key Trends & Drivers Summarized

Why Is Advanced Wound Care Management Becoming Central to Modern Clinical Practice and Long-Term Recovery?

Advanced wound care management refers to the comprehensive use of specialized techniques, products, and clinical protocols designed to optimize healing outcomes in complex, slow-healing, or chronic wounds. This approach encompasses advanced dressings, wound bed preparation strategies, infection control protocols, exudate management, and adjunctive therapies such as negative pressure wound therapy (NPWT), hyperbaric oxygen therapy (HBOT), and bioengineered skin substitutes. The growing incidence of chronic wounds including diabetic foot ulcers, pressure injuries, and venous leg ulcers driven by aging populations, rising diabetes prevalence, obesity, and vascular diseases, is transforming wound care into a global healthcare priority.In clinical practice, traditional wound treatments are often inadequate for addressing the multifactorial challenges posed by non-healing wounds. Advanced wound care management, by contrast, integrates evidence-based decision-making with tailored therapeutic regimens, helping reduce wound chronicity, minimize infection risks, and prevent amputations. It also plays a key role in post-operative recovery, trauma rehabilitation, and long-term care especially in high-risk populations such as the elderly, immobile patients, and those with compromised immunity. As healthcare systems pivot toward value-based care, the adoption of structured, multidisciplinary wound management strategies is gaining strong institutional and policy-level support worldwide.

How Are Product Innovations, Diagnostic Tools, and Multimodal Therapies Reshaping the Wound Care Paradigm?

The evolution of wound care management is being driven by innovation across wound dressing materials, assessment tools, and therapeutic adjuncts. Advanced wound dressings now include moisture-retentive options such as hydrogels, alginates, foam dressings, and hydrocolloids, as well as antimicrobial variants embedded with silver, iodine, or PHMB to control bioburden. Bioactive dressings that incorporate collagen, growth factors, or extracellular matrix components are also helping stimulate cellular regeneration and wound remodeling. These products provide a controlled healing environment that balances moisture, oxygenation, and protection crucial for chronic or high-risk wounds.Technology is playing a transformative role through the adoption of digital wound imaging systems, AI-powered wound measurement tools, and remote monitoring solutions. These tools enable clinicians to track wound progression objectively, reduce variability in assessments, and support.

What Care Delivery Trends, Economic Pressures, and Patient Expectations Are Driving Market Momentum?

The economic burden of chronic wounds driven by prolonged treatment durations, hospitalizations, and the high cost of complications has spurred hospitals, payers, and long-term care facilities to adopt more aggressive and outcome-oriented wound management models. With chronic wounds often requiring months of care, early intervention with advanced wound therapies is being recognized as essential to lowering total cost of treatment. Payers are increasingly aligning reimbursements with clinical outcomes, promoting adherence to standardized care pathways and documentation practices that support advanced interventions.Patients today expect faster healing, less pain, fewer dressing changes, and the flexibility to receive treatment outside traditional hospital environments. This shift has expanded demand for home-based wound care services, ambulatory wound clinics, and telehealth-supported models. Advanced wound care management enables the continuity of care across settings from surgical suites and ICUs to skilled nursing facilities and patient homes supported by mobile health apps and cloud-based documentation systems. Health systems are also investing in wound care training programs, multidisciplinary wound teams, and digital platforms to ensure consistent quality across diverse provider networks.

What Is Driving the Growth of the Advanced Wound Care Management Market Across Regions and Patient Populations?

The growth in the advanced wound care management market is driven by rising chronic disease burden, aging demographics, expanding surgical volumes, and increasing healthcare access globally. In North America, especially the U.S., the market is supported by advanced wound care centers, well-established reimbursement frameworks, and widespread adoption of NPWT, bioactive dressings, and electronic documentation tools. In Europe, aging populations and a strong public health focus on pressure injury prevention and post-operative care are fueling demand, with countries like Germany, the UK, and the Nordics at the forefront of standardized wound care protocols.Asia-Pacific is emerging as a high-growth region due to rapid urbanization, increasing diabetes prevalence, and healthcare system expansion. China, India, and Southeast Asia are witnessing greater investments in wound care education, hospital infrastructure, and specialty clinics, backed by government-led initiatives in chronic disease management. Latin America and the Middle East are expanding their advanced wound care capabilities through public-private hospital upgrades and increased awareness of evidence-based wound management practices.

Segment-wise, diabetic foot ulcers and surgical wounds represent the highest demand, followed by pressure ulcers and burns. Hospital inpatient settings remain the dominant channel for initial interventions, but outpatient wound care centers, home health providers, and long-term care facilities are driving high-volume, high-frequency utilization. As global healthcare systems strive to reduce complications, accelerate healing, and improve patient quality of life, the advanced wound care management market is set for sustained growth anchored in clinical innovation, integrated care delivery, and the shifting economics of chronic disease treatment.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Moist Wound Dressings segment, which is expected to reach US$6.1 Billion by 2030 with a CAGR of a 5.0%. The Antimicrobial Dressings segment is also set to grow at 5.0% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.3 Billion in 2024, and China, forecasted to grow at an impressive 8.2% CAGR to reach $3.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Advanced Wound Care Management Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Advanced Wound Care Management Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Advanced Wound Care Management Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M, Advanced Medical Solutions Group plc, Advancis Medical, Aroa Biosurgery, and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Advanced Wound Care Management market report include:

- 3M

- Advanced Medical Solutions Group plc

- Advancis Medical

- Aroa Biosurgery

- B. Braun Melsungen AG

- BSN medical (now part of Essity)

- Cardinal Health

- Coloplast A/S

- ConvaTec Group plc

- DeRoyal Industries

- Ethicon (Johnson & Johnson)

- Fidia Farmaceutici

- Hartmann Group

- Hollister Incorporated

- Integra LifeSciences

- Kerecis

- Lohmann & Rauscher

- Medline Industries

- Medtronic plc

- MiMedx Group

This edition integrates the latest global trade and economic shifts as of June 2025 into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes segmentation by product, technology, type, material, distribution channel, application, and end-use, with historical analysis since 2015.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

- Complimentary Update: Buyers receive a free July 2025 update with finalized tariff impacts, new trade agreement effects, revised projections, and expanded country-level coverage.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M

- Advanced Medical Solutions Group plc

- Advancis Medical

- Aroa Biosurgery

- B. Braun Melsungen AG

- BSN medical (now part of Essity)

- Cardinal Health

- Coloplast A/S

- ConvaTec Group plc

- DeRoyal Industries

- Ethicon (Johnson & Johnson)

- Fidia Farmaceutici

- Hartmann Group

- Hollister Incorporated

- Integra LifeSciences

- Kerecis

- Lohmann & Rauscher

- Medline Industries

- Medtronic plc

- MiMedx Group

Table Information

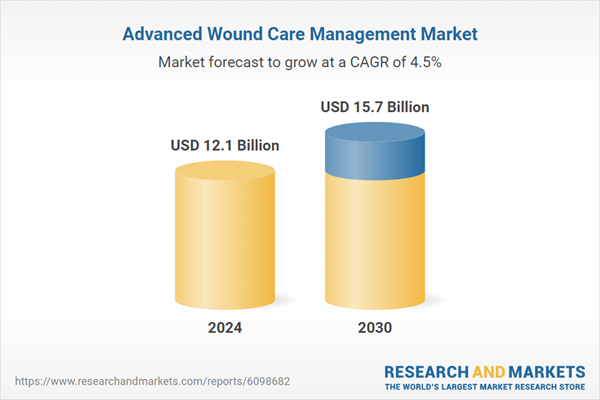

| Report Attribute | Details |

|---|---|

| No. of Pages | 372 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 12.1 Billion |

| Forecasted Market Value ( USD | $ 15.7 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |