Global Dental Dams Market - Key Trends & Drivers Summarized

Is This the Shield Behind the Smile? Exploring the Dental Dams Market

Dental dams, also known as rubber dams, have seen a resurgence in clinical adoption, particularly amid growing awareness around infection control and procedural isolation. Initially reserved primarily for endodontic treatments, dental dams are now utilized more broadly across operative and cosmetic dentistry, driven by updated clinical guidelines and heightened demand for aseptic techniques. The COVID-19 pandemic acted as a major catalyst, reinforcing the need for effective barrier protection during aerosol-generating procedures. This has notably influenced regulatory bodies and dental associations to recommend or mandate the use of rubber dams for a broader range of treatments.Material innovation is also reshaping the market. Traditional latex dams, while cost-effective and flexible, are increasingly being replaced by non-latex alternatives, such as nitrile or polyisoprene variants, which offer hypoallergenic properties and superior tear resistance. These innovations cater to both patient sensitivity concerns and institutional mandates for allergen-free environments. Additionally, pre-framed dental dams, offering faster setup and ease of use, are gaining popularity in high-volume practices and teaching clinics. Integration of dental dam use into digital training modules and dental school curricula is further expanding their adoption, embedding them as a standard tool in the next generation of dental professionals.

Why Is Innovation in Material Science Crucial to This Market?

Advancements in polymer chemistry and thin-film engineering have played a pivotal role in broadening the utility of dental dams. Next-generation dam materials now feature anti-reflective surfaces and translucent tints that improve intraoral visibility without compromising isolation. Some brands have introduced scented or flavored dams to enhance patient comfort - especially in pediatric settings - addressing one of the long-standing barriers to patient acceptance. The trend toward color-coded, multi-size dental dams is another innovation streamlining the workflow for clinicians, making selection quicker and more intuitive.Furthermore, manufacturers are incorporating tear-resistant zones and improved puncture guides into dam sheets, reducing clinical failures and improving efficiency. Combined with user-friendly dam clamps and frame designs, these features make it easier for practitioners to isolate treatment areas quickly, even in cases with restricted access or malocclusion. Importantly, biodegradable and recyclable dental dam products are beginning to enter the market, aligning with the environmental and waste reduction goals of dental practices pursuing green certifications or ESG reporting. These innovations underscore the market's commitment to balancing performance, patient comfort, and sustainability.

What Are the Key Adoption Patterns and Use-Case Evolutions?

Adoption patterns of dental dams vary significantly across end-use environments. In private dental clinics, usage is often tied to the dentist's training background, but this is shifting as patient safety becomes a core tenet of dental marketing and patient retention strategies. In group dental practices and DSOs, standardized treatment protocols are accelerating dental dam usage across all practitioners, embedding it into workflows for composite fillings, bleaching, and crown placements, in addition to root canals.Academic institutions and teaching hospitals are pivotal in normalizing dam usage, incorporating practical training and examination requirements around rubber dam isolation techniques. Specialized practices such as prosthodontics and pediatric dentistry are also exhibiting increased usage, driven by the need for enhanced moisture control during impression-taking and behavior management. Regulatory backing from professional associations in Europe, North America, and Australia is pushing compliance in favor of barrier protocols that include dental dams, particularly in the wake of airborne disease awareness. Furthermore, NGOs and mobile dentistry units targeting underserved populations are including low-cost, disposable dental dam kits to uphold treatment quality without increasing cross-infection risks.

What's Driving the Future Growth in This Market?

The growth in the dental dams market is driven by several factors directly tied to material innovation, infection control mandates, end-use expansion, and sustainability trends. First, the increasing adoption of non-latex and allergy-free materials has unlocked access to previously underserved patient segments, such as those with hypersensitivity or latex allergies. Additionally, the inclusion of dental dams in national dental treatment guidelines and their promotion by global oral health bodies is embedding them into routine care protocols, particularly in root canal and restorative dentistry.The shift toward group practices and corporate dental chains is fostering standardized procurement and usage of dental dam kits, which has led to greater bulk purchasing and integration into SOPs. This is further supported by rising dental tourism in countries such as India, Hungary, and Mexico, where advanced clinics are showcasing barrier use as part of their premium service offering. Growing pediatric and geriatric dental care - two segments where moisture control is essential - is also contributing to demand for flavored, flexible, and easy-to-install dental dam products. Lastly, environmental trends are beginning to influence buyer choices, with eco-conscious clinics favoring recyclable and biodegradable dam products. These combined factors point to a market that is growing not just in volume but in clinical significance.

Report Scope

The report analyzes the Dental Dams market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Latex Dental Dams, Non-latex Dental Dams, Flavored Dental Dams, Adhesive Dental Dams, Other Product Types); Application Type (Patient Hygiene, Surgery, Restorative Treatment, Respiratory Disease Treatment, Other Application Types); Distribution Channel (Online, Offline).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Latex Dental Dams segment, which is expected to reach US$95.7 Million by 2030 with a CAGR of a 6.4%. The Non-latex Dental Dams segment is also set to grow at 4.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $39.6 Million in 2024, and China, forecasted to grow at an impressive 9.6% CAGR to reach $42.3 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Dental Dams Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Dental Dams Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Dental Dams Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A-dec Inc., Air Techniques, Aixin Medical Equipment Co., Ltd, Anest Iwata USA, Inc., Atlas Copco AB and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Dental Dams market report include:

- Ansell Healthcare

- COLTENE Group

- Den-Mat Holdings, LLC

- Dentsply Sirona

- Elastomade Accessories Sdn. Bhd.

- Hager & Werken

- Hedy Canada (AMD Medicom Inc.)

- Hu-Friedy Mfg. Co.

- Hygenic Corporation

- Kulzer GmbH

- Omni Technologies

- Patterson Dental

- Premier Dental Products Co.

- Prime-Dent® (PrimaDent)

- Sanctuary Dental Dam Systems

- Stanley Gomez Sdn. Bhd.

- Sultan Healthcare

- Top Glove Corporation Bhd

- Ultradent Products, Inc.

- Zirc Dental Products

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ansell Healthcare

- COLTENE Group

- Den-Mat Holdings, LLC

- Dentsply Sirona

- Elastomade Accessories Sdn. Bhd.

- Hager & Werken

- Hedy Canada (AMD Medicom Inc.)

- Hu-Friedy Mfg. Co.

- Hygenic Corporation

- Kulzer GmbH

- Omni Technologies

- Patterson Dental

- Premier Dental Products Co.

- Prime-Dent® (PrimaDent)

- Sanctuary Dental Dam Systems

- Stanley Gomez Sdn. Bhd.

- Sultan Healthcare

- Top Glove Corporation Bhd

- Ultradent Products, Inc.

- Zirc Dental Products

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 384 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

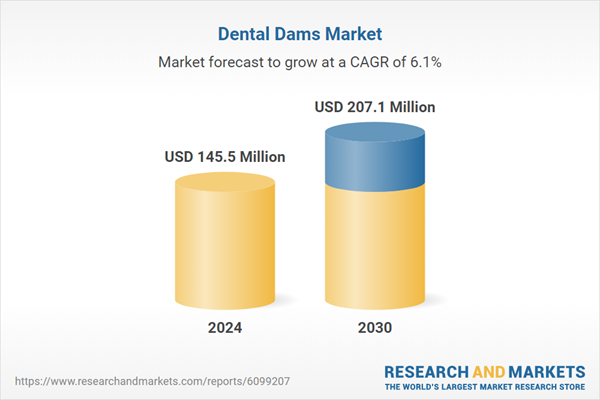

| Estimated Market Value ( USD | $ 145.5 Million |

| Forecasted Market Value ( USD | $ 207.1 Million |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |