Global Driveline Additives Market - Key Trends & Drivers Summarized

What's Driving the Rising Demand for Driveline Additives Across Automotive and Industrial Sectors?

Driveline additives play a critical role in enhancing the performance, longevity, and reliability of transmission fluids, axle lubricants, and gear oils used across automotive, commercial, and industrial equipment. These specialized chemical compounds are designed to reduce friction, wear, and thermal degradation while improving fuel efficiency and maintaining consistent performance under varying loads and temperatures. The global market for driveline additives is witnessing robust growth, propelled by increasingly stringent emissions regulations, the proliferation of advanced transmission systems, and the shift toward fuel-efficient and electrified vehicles.Key trends include the growing demand for low-viscosity lubricants that require advanced additive packages to ensure film strength and oxidative stability. As automatic, dual-clutch, and continuously variable transmissions become more common, formulators are designing additives that address complex lubrication needs such as synchronized shifting, high shear resistance, and component cleanliness. Furthermore, the rise of synthetic and semi-synthetic lubricants has led to an increased need for tailored additive solutions that can maintain stability under extreme conditions. OEM specifications are becoming increasingly detailed, driving collaboration between lubricant manufacturers and additive suppliers to meet evolving performance requirements.

How Are Electrification and Emission Regulations Reshaping Additive Development?

The global automotive industry's transition toward electrification is fundamentally reshaping the driveline additives landscape. Electric and hybrid vehicles still require lubricants for e-axles, reduction gears, and cooling systems, but these fluids must operate under different thermal and mechanical loads compared to internal combustion engines. As a result, new additive formulations are being developed to meet the requirements of high-speed electric motors, reduced component wear, and compatibility with materials used in battery systems. These include enhanced anti-wear agents, corrosion inhibitors, and dielectric additives that ensure electrical insulation and thermal conductivity.Simultaneously, tightening environmental regulations - especially in Europe, North America, and Asia-Pacific - are pushing manufacturers to reduce carbon emissions, boost fuel efficiency, and extend vehicle service intervals. Driveline additives that help reduce frictional losses and thermal degradation are playing a critical role in achieving these targets. Friction modifiers, viscosity index improvers, and oxidation inhibitors are now essential components in lubricant formulations that support lower greenhouse gas emissions and improved drivetrain performance. Furthermore, environmental standards such as REACH and GHS are influencing the selection of raw materials, encouraging the development of eco-friendly and ashless additive chemistries.

What Technological Innovations Are Enhancing the Functional Value of Driveline Additives?

Technological advancements in driveline additive chemistry are expanding their functionality and enabling lubricant formulators to cater to increasingly diverse applications. One of the most significant developments is the use of advanced friction modifiers based on molybdenum compounds, esters, and polymers that deliver smoother gear transitions and reduced torque loss. Similarly, anti-wear additives - such as ZDDP (zinc dialkyldithiophosphate) replacements and phosphorus-free compounds - are being optimized to provide strong boundary film protection without compromising catalytic converter performance.Another area of innovation is thermal stability. Additives that prevent varnish formation and oxidative sludge are crucial for maintaining lubricant cleanliness and ensuring long-term efficiency in high-performance drivetrains. Additionally, multi-functional additive packages are being created to reduce the total treat rate while maintaining or improving protection across shear stability, foaming control, and metal passivation. Nanotechnology is also being explored, with nano-additives showing promise in reducing friction and enhancing load-carrying capacity, though commercial application remains limited. In industrial applications, the integration of smart sensors and lubricant condition monitoring is increasing the demand for additives that offer predictable degradation profiles and compatibility with condition-based maintenance strategies.

Why Is the Driveline Additives Market Poised for Sustained Expansion?

The growth in the driveline additives market is driven by several factors related to evolving automotive technologies, lubrication system complexity, and broader industrial machinery demands. The increasing adoption of advanced transmission systems - such as dual-clutch and automated manual transmissions - is requiring more sophisticated lubricant formulations that rely on high-performance additive packages. The global expansion of vehicle fleets, particularly in emerging economies, is also contributing to long-term volume growth, especially in the aftermarket segment.Furthermore, the rapid development of electric vehicles is opening new avenues for driveline-specific fluids and the additives that optimize them. Even as powertrain architectures evolve, the need for thermal management, material compatibility, and wear resistance remains, reinforcing the centrality of additives in performance design. Industrial sectors - including mining, construction, and manufacturing - are also driving demand, as heavy-duty machinery increasingly depends on gear oils and transmission fluids formulated with robust additive systems to withstand extreme operating environments. Lastly, the emphasis on sustainability, energy efficiency, and regulatory compliance is creating strong incentives for continual innovation in additive chemistry, ensuring the market's ongoing evolution and growth.

Report Scope

The report analyzes the Driveline Additives market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Transmission Fluid Additives, Gear Oil Additives); Application (Passenger Cars, Commercial Vehicles, Off-highway Vehicles).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Transmission Fluid Additives segment, which is expected to reach US$8.5 Billion by 2030 with a CAGR of a 3.9%. The Gear Oil Additives segment is also set to grow at 6.4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.7 Billion in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $2.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Driveline Additives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Driveline Additives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Driveline Additives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Baker Hughes, Boart Longyear, Epiroc AB, Halliburton Company, Helmerich & Payne, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Driveline Additives market report include:

- Afton Chemical Corporation

- Allegheny Petroleum

- BASF SE

- BG Products, Inc.

- Brenntag AG

- Chevron Oronite Company LLC

- Clariant AG

- Colonial Chemical, Inc.

- Croda International plc

- Evonik Industries AG

- Infineum International Limited

- LANXESS AG

- Liqui Moly GmbH

- Lubrication Specialties, Inc.

- The Lubrizol Corporation

- Nelson Brothers, Inc.

- Petronas Lubricants International

- Shell Global

- TotalEnergies SE

- XADO Chemical Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Afton Chemical Corporation

- Allegheny Petroleum

- BASF SE

- BG Products, Inc.

- Brenntag AG

- Chevron Oronite Company LLC

- Clariant AG

- Colonial Chemical, Inc.

- Croda International plc

- Evonik Industries AG

- Infineum International Limited

- LANXESS AG

- Liqui Moly GmbH

- Lubrication Specialties, Inc.

- The Lubrizol Corporation

- Nelson Brothers, Inc.

- Petronas Lubricants International

- Shell Global

- TotalEnergies SE

- XADO Chemical Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 278 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

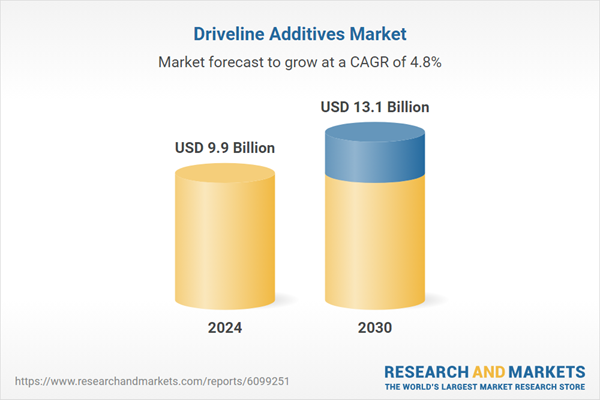

| Estimated Market Value ( USD | $ 9.9 Billion |

| Forecasted Market Value ( USD | $ 13.1 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |