Global Drug Repurposing Market - Key Trends & Drivers Summarized

Why Is Drug Repurposing Gaining Renewed Attention in Modern Therapeutics?

Drug repurposing - also known as drug repositioning - involves identifying new therapeutic uses for existing or previously shelved drugs. This approach is experiencing a renaissance as pharmaceutical companies, researchers, and health authorities seek faster, more cost-effective pathways to address unmet medical needs. Traditional drug development can take over a decade and cost billions, with high rates of clinical failure. In contrast, repurposed drugs have already cleared significant safety and pharmacokinetic hurdles, enabling developers to bypass early-stage trials and significantly reduce time to market. This has made repurposing a highly attractive strategy, particularly in areas like rare diseases, oncology, neurodegenerative disorders, and infectious diseases.The COVID-19 pandemic further propelled interest in repurposing, as drugs like remdesivir, dexamethasone, and hydroxychloroquine were rapidly evaluated for efficacy against SARS-CoV-2. The crisis showcased how regulatory bodies could fast-track repurposed drugs through Emergency Use Authorizations (EUAs), highlighting a new precedent for accelerated pathways. Furthermore, the success of drugs such as thalidomide (reintroduced for multiple myeloma) and sildenafil (originally developed for hypertension, now widely used for erectile dysfunction) have demonstrated the broad clinical and commercial value of this strategy. These examples underscore why drug repurposing is increasingly viewed as a vital component of modern pharmaceutical R&D.

What Are the Emerging Trends Transforming the Drug Repurposing Landscape?

A major trend reshaping the repurposing market is the integration of artificial intelligence (AI) and machine learning (ML) into drug discovery pipelines. Computational models can now analyze massive datasets - ranging from genomic data to real-world evidence and electronic health records - to identify novel drug-disease relationships. AI-driven platforms are enabling in silico screening of compound libraries to prioritize candidates for preclinical and clinical evaluation. This is especially impactful in rare disease treatment and precision oncology, where traditional pipelines often struggle due to limited patient populations and high R&D costs.Collaborative consortia and public-private partnerships are also on the rise. Initiatives like the NIH's NCATS (National Center for Advancing Translational Sciences) and Open Targets are pooling data and resources across academia, industry, and government to accelerate repurposing efforts. Additionally, patent expiration of blockbuster drugs is fueling new interest in repurposing by generics and specialty pharma companies. Regulatory frameworks are evolving too - efforts to provide clearer guidance for 505(b)(2) approvals in the U.S. and adaptive licensing models in Europe are making it easier to navigate the intellectual property and clinical validation landscape. These trends are creating fertile ground for innovation, collaboration, and accelerated drug development across disease areas.

Which Therapeutic Areas Are Benefiting Most from Repurposing Strategies?

The impact of drug repurposing is most visible in complex and underserved therapeutic areas. In oncology, for instance, repurposed drugs are being explored as adjuvants or second-line treatments. Metformin (a diabetes drug), propranolol (a beta-blocker), and itraconazole (an antifungal) have shown anticancer potential in various studies. In neurodegenerative diseases like Alzheimer's and Parkinson's, drugs targeting inflammation, cholesterol metabolism, and mitochondrial function are being repositioned to slow disease progression - areas where novel therapies have struggled. This repurposing model offers new hope in high-failure domains by leveraging known pharmacodynamics to target secondary pathways.In infectious diseases, especially with rising antimicrobial resistance (AMR), repositioned antivirals and antibiotics are filling critical gaps. For example, certain anticancer agents have shown unexpected antibacterial or antifungal effects, while psychiatric drugs are being investigated for their immunomodulatory roles in viral infections. Autoimmune and inflammatory diseases, including lupus, rheumatoid arthritis, and multiple sclerosis, also stand to benefit, as researchers uncover overlapping pathways with other disease classes. Even mental health treatments are seeing cross-utility - ketamine's use in treatment-resistant depression is a prime example. These cross-therapeutic applications are broadening the value proposition of many legacy drugs, supporting their reintegration into modern treatment paradigms.

What Is Driving Growth and Strategic Investment in Drug Repurposing?

The growth in the drug repurposing market is driven by several factors related to technological enablement, regulatory facilitation, and evolving pharmaceutical strategies. AI and bioinformatics platforms are significantly improving the success rate of repurposing projects by predicting mechanisms of action and identifying off-target effects with high precision. The availability of large-scale biomedical datasets - including omics profiles, disease registries, and patient-level data - provides fertile ground for cross-indication mapping and drug efficacy modeling. These technologies reduce the risk, cost, and time traditionally associated with de novo drug development.End-use adoption is also accelerating. Biotechnology firms are increasingly pursuing repurposing as a core business model, while large pharma companies are integrating repurposing into life-cycle management to extend the value of off-patent or low-performing assets. Regulatory bodies are introducing streamlined pathways for approvals - such as the 505(b)(2) route in the U.S. - which allows developers to leverage existing safety and efficacy data while only requiring supplemental clinical evidence for new indications. This has created a favorable environment for licensing, joint ventures, and venture capital investment in repurposing ventures. Furthermore, patient advocacy groups and rare disease foundations are lobbying for and funding repurposing studies, driving both awareness and clinical momentum. These combined forces are ensuring that drug repurposing remains a strategic and rapidly growing pillar in the global pharmaceutical innovation ecosystem.

Report Scope

The report analyzes the Drug Repurposing market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Disease Indication (Oncology, CNS Diseases, Neurodegenerative Diseases, Other Disease Indications); Approach Type (Disease-Centric Approach, Target-Centric Approach, Drug-Centric Approach); End-Use (Hospitals & Clinics, Ambulatory Surgery Diseases, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Oncology Indication segment, which is expected to reach US$20.3 Billion by 2030 with a CAGR of a 4.4%. The CNS Diseases Indication segment is also set to grow at 4.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8 Billion in 2024, and China, forecasted to grow at an impressive 7.5% CAGR to reach $7.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Drug Repurposing Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Drug Repurposing Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Drug Repurposing Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Aeromon, ChampionX, DJI, FEDS Drone-powered Solutions and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 41 companies featured in this Drug Repurposing market report include:

- AbbVie Inc.

- Algernon Pharmaceuticals

- Amgen Inc.

- AstraZeneca PLC

- Biogen Inc.

- BioXcel Therapeutics Inc.

- Bristol-Myers Squibb Co.

- Every Cure

- Exscientia Ltd.

- GSK plc

- Healx Ltd.

- Johnson & Johnson

- Melior Discovery

- Novartis AG

- Pfizer Inc.

- Rejuvenate Biomed NV

- Retrotope Inc.

- SOM Biotech S.L.

- Tonix Pharmaceuticals

- United Therapeutics Corp.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AbbVie Inc.

- Algernon Pharmaceuticals

- Amgen Inc.

- AstraZeneca PLC

- Biogen Inc.

- BioXcel Therapeutics Inc.

- Bristol-Myers Squibb Co.

- Every Cure

- Exscientia Ltd.

- GSK plc

- Healx Ltd.

- Johnson & Johnson

- Melior Discovery

- Novartis AG

- Pfizer Inc.

- Rejuvenate Biomed NV

- Retrotope Inc.

- SOM Biotech S.L.

- Tonix Pharmaceuticals

- United Therapeutics Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 377 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

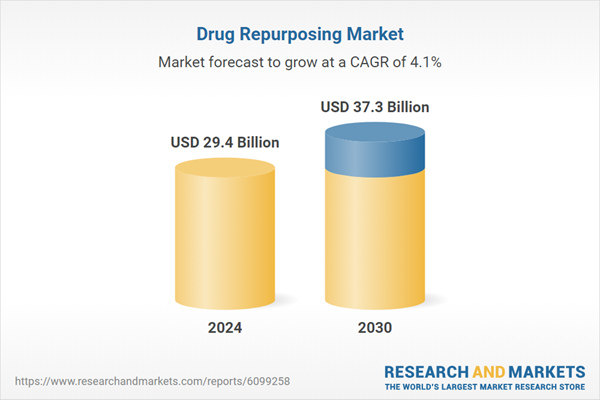

| Estimated Market Value ( USD | $ 29.4 Billion |

| Forecasted Market Value ( USD | $ 37.3 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |