Global Early Production Facility Market - Key Trends & Drivers Summarized

Why Are Early Production Facilities Becoming Critical in Oil and Gas Strategy?

Early Production Facilities (EPFs) are modular, fast-track systems deployed in upstream oil and gas projects to initiate production before the completion of permanent infrastructure. They play a vital role in enabling cash flow generation, data gathering, and reservoir evaluation during the early development phase. EPFs are especially valuable in remote or deepwater fields where building full-scale facilities would require significant time and capital investment. By expediting first oil output, operators can reduce financial risk, support field appraisal, and secure market commitments sooner.In regions such as West Africa, Latin America, and Southeast Asia, EPFs are gaining traction as national governments push for faster monetization of hydrocarbon resources. These systems are also being used in shale basins and marginal fields where traditional production economics are less favorable. Their flexible design allows adaptation to changing production profiles and eventual integration into permanent processing units.

What Technologies and Design Trends Are Enhancing EPF Efficiency?

The latest generation of EPFs incorporates modular skid-based designs that reduce construction timelines and simplify transport and installation. These units often include crude stabilization, gas separation, water treatment, and flare systems - configured to meet the specific needs of each reservoir. Advanced process simulation software is now used in the design phase to optimize flow assurance, reduce equipment size, and predict performance under varied well conditions.Additionally, digital automation and remote monitoring systems are being embedded into EPFs, enabling real-time data acquisition and centralized control. This not only improves operational safety and efficiency but also supports predictive maintenance strategies. Mobile or re-deployable EPFs are becoming popular in multi-field or short-life operations, with reusable components that reduce lifecycle costs and environmental impact.

Where Is Adoption Accelerating and Who Are the Key Stakeholders?

Adoption is increasing in offshore frontier regions, brownfield expansions, and unconventional resource developments. National oil companies and independents alike are deploying EPFs to gain early insight into reservoir performance and guide full-field development planning. In the Middle East and Sub-Saharan Africa, joint ventures between service providers and state operators are resulting in the deployment of customized EPFs tailored to regulatory and logistical constraints.Service providers specializing in oilfield infrastructure are expanding their EPF offerings through integrated engineering, procurement, construction, and commissioning (EPCC) contracts. Financing partnerships between equipment vendors and exploration firms are also enabling smaller operators to deploy EPFs without incurring large upfront costs, making the business model more accessible across the industry.

What Is Driving Growth in the Early Production Facility Market?

The growth in the early production facility market is driven by several critical industry dynamics. The need for faster return on investment, especially amid volatile oil prices, is prompting operators to adopt EPFs as a risk mitigation and cash flow acceleration tool. Technological advances in modularization and automation are making EPFs more versatile and cost-effective, while allowing for better integration with permanent facilities.Increasing exploration activity in high-potential but infrastructure-poor regions is also fueling demand, as EPFs enable rapid resource monetization. Furthermore, regulatory pressure in many countries to localize production and minimize flaring is supporting the deployment of modular systems with environmental safeguards. These combined forces are positioning EPFs as a strategic enabler of early-stage production and long-term development planning in oil and gas.

Report Scope

The report analyzes the Early Production Facility market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: System (Two & Three Phase Separation, Gas Dehydration, Gas Sweetening, Dew Point Control Unit, Oil Dehydration & Desalting & Heating, Produced Water Treatment, Flare System, Other Systems); Capacity (Up to 10,000 BOPD, 10,001-30,000 BOPD, 30,001-50,000 BOPD); Application (Onshore, Offshore).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Two & Three Phase Separation segment, which is expected to reach US$5.9 Billion by 2030 with a CAGR of a 1%. The Gas Dehydration segment is also set to grow at 2.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4.9 Billion in 2024, and China, forecasted to grow at an impressive 1.7% CAGR to reach $3.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Early Production Facility Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Early Production Facility Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Early Production Facility Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Early Production Facility market report include:

- CECO Environmental

- CPPE (Canadian Petroleum Processing Equipment Inc.)

- EN-FAB Inc.

- Expro Group

- Frames Group

- Global Process Systems

- Halliburton Company

- Huichuan International

- NRG MED Srl

- OilSERV

- Penspen Limited

- Petrocil Engineers and Consultants Pvt. Ltd.

- Pyramid E&C

- Roska DBO Inc.

- Schlumberger Limited (SLB)

- SMIP

- Specialist Services (a Centurion company)

- TETRA Technologies, Inc.

- Weatherford International plc

- Wison Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- CECO Environmental

- CPPE (Canadian Petroleum Processing Equipment Inc.)

- EN-FAB Inc.

- Expro Group

- Frames Group

- Global Process Systems

- Halliburton Company

- Huichuan International

- NRG MED Srl

- OilSERV

- Penspen Limited

- Petrocil Engineers and Consultants Pvt. Ltd.

- Pyramid E&C

- Roska DBO Inc.

- Schlumberger Limited (SLB)

- SMIP

- Specialist Services (a Centurion company)

- TETRA Technologies, Inc.

- Weatherford International plc

- Wison Group

Table Information

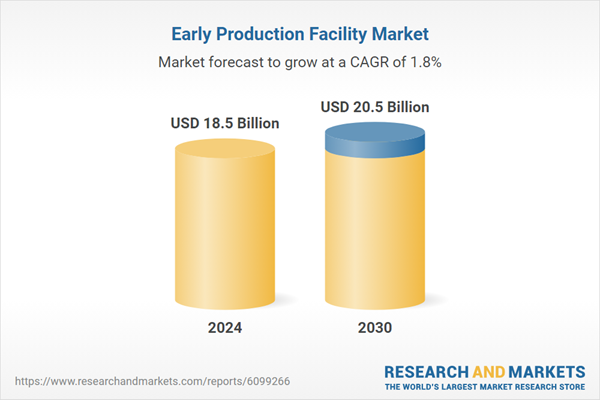

| Report Attribute | Details |

|---|---|

| No. of Pages | 234 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 18.5 Billion |

| Forecasted Market Value ( USD | $ 20.5 Billion |

| Compound Annual Growth Rate | 1.8% |

| Regions Covered | Global |