Global Electrostatic Chucks Market - Key Trends & Drivers Summarized

Why Are Electrostatic Chucks Gaining Strategic Importance in Semiconductor Manufacturing?

Electrostatic chucks (ESCs) are critical components in the fabrication of semiconductors, enabling precise wafer clamping during high-vacuum processes such as plasma etching, ion implantation, and wafer lithography. These devices use electrostatic forces to hold silicon wafers firmly in place without mechanical contact, reducing the risk of contamination or warping during high-precision and high-temperature operations. As device geometries shrink and wafer sizes increase, ESCs provide the uniform clamping force and thermal stability required for sub-10nm and 3D chip architectures.Recent innovations are focusing on enhancing clamping efficiency, heat dissipation, and material durability. New-generation ESCs utilize advanced ceramic materials such as aluminum nitride (AlN) or silicon carbide (SiC) with high dielectric strength and thermal conductivity. Bipolar and unipolar ESC configurations are being optimized for different etching and deposition tools, while dual-zone and active thermal control chucks are improving temperature uniformity across large-diameter wafers. Industry leaders including SHINKO, Kyocera, Applied Materials, and TOTO are investing heavily in custom ESC solutions compatible with EUV lithography, advanced packaging, and backside power delivery applications.

Which Segments and Technology Nodes Are Driving Adoption?

The demand for electrostatic chucks is concentrated in front-end semiconductor processing, particularly in etch, CVD, ALD, and lithography equipment used in advanced foundries and logic/memory fabs. Leading-edge nodes (5nm, 3nm, and below) require extreme precision and low-defect wafer handling, pushing chipmakers to invest in high-performance ESCs that support ultra-flat clamping and real-time thermal management. Memory manufacturers (DRAM and NAND) and logic IC foundries (e.g., TSMC, Samsung, Intel) are key buyers driving market demand through new fab construction and process upgrades.Geographically, Asia-Pacific remains the dominant market due to concentrated semiconductor manufacturing in Taiwan, South Korea, Japan, and China. North America and Europe are also seeing increased ESC demand as Intel, GlobalFoundries, and European fabs expand domestic chip production under government-supported semiconductor sovereignty initiatives. ESCs are also being adopted in wafer-level packaging and metrology systems, where precise and repeatable wafer positioning is essential. With increasing complexity in chip stacking and heterogeneous integration, ESC usage is expanding beyond traditional litho-etch workflows.

The Growth in the Electrostatic Chucks Market Is Driven by Several Factors…

The growth in the electrostatic chucks market is driven by technological advancements and end-use trends tied directly to next-generation semiconductor processing. On the technology front, innovations in high-purity ceramics, ESC surface coatings, and integrated temperature control systems are enabling higher plasma resistance, lower wafer contamination, and better thermal uniformity - all essential for maintaining yield in advanced process nodes. ESCs with embedded sensors for temperature, voltage, and clamping force are also improving process control and equipment uptime.From the application side, the aggressive scaling of chip designs, the move to 3D architectures (FinFET, GAA, HBM), and the proliferation of EUV lithography tools are fueling demand for advanced ESCs that can support high-vacuum, high-power environments. As fabs move toward larger wafer diameters (300mm, with early R&D on 450mm), ESCs must deliver uniform electrostatic force across a broader surface without inducing particle generation or thermal gradients. Additionally, the rise of localized semiconductor manufacturing and fab expansions globally is driving equipment procurement, with ESCs as a fundamental component in nearly every wafer process module. These cumulative developments are positioning electrostatic chucks as an indispensable element of the semiconductor equipment ecosystem.

Report Scope

The report analyzes the Electrostatic Chucks market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Columbic / Coulomb Chucks, Johnsen-Rahbek Chucks); Application (Semiconductor Manufacturing, Electronics, Optics, Other Applications); End-User (Wafer Fabrication Facilities, Microelectronics Facilities, Research Laboratories, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Columbic / Coulomb Chucks segment, which is expected to reach US$120.2 Million by 2030 with a CAGR of a 4.9%. The Johnsen-Rahbek Chucks segment is also set to grow at 2.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $35 Million in 2024, and China, forecasted to grow at an impressive 8% CAGR to reach $34.2 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Electrostatic Chucks Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Electrostatic Chucks Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Electrostatic Chucks Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Admiralty Maritime Data Solutions, American Nautical Services, Inc., ChartCo Limited, ChartWorld International, C-MAP (Navico) and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Electrostatic Chucks market report include:

- Advanced Energy Industries, Inc.

- Applied Materials, Inc.

- Beijing U-PRECISION TECH CO., LTD.

- Calitech Co., Ltd.

- Creative Technology Corporation

- Entegris, Inc.

- Fraunhofer-Gesellschaft

- Gripping Power, Inc.

- Kyocera Corporation

- Lam Research Corporation

- MiCo Co., Ltd.

- NGK Insulators, Ltd.

- NTK CERATEC Co., Ltd.

- SHINKO ELECTRIC INDUSTRIES CO., LTD.

- Sumitomo Osaka Cement Co., Ltd.

- Technetics Group

- TOMOEGAWA CO., LTD.

- TOTO Ltd.

- TSUKUBASEIKO Co., Ltd.

- Valley Design Corp.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Advanced Energy Industries, Inc.

- Applied Materials, Inc.

- Beijing U-PRECISION TECH CO., LTD.

- Calitech Co., Ltd.

- Creative Technology Corporation

- Entegris, Inc.

- Fraunhofer-Gesellschaft

- Gripping Power, Inc.

- Kyocera Corporation

- Lam Research Corporation

- MiCo Co., Ltd.

- NGK Insulators, Ltd.

- NTK CERATEC Co., Ltd.

- SHINKO ELECTRIC INDUSTRIES CO., LTD.

- Sumitomo Osaka Cement Co., Ltd.

- Technetics Group

- TOMOEGAWA CO., LTD.

- TOTO Ltd.

- TSUKUBASEIKO Co., Ltd.

- Valley Design Corp.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 380 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

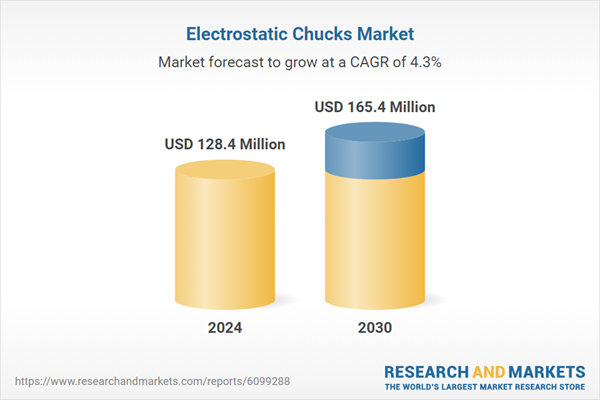

| Estimated Market Value ( USD | $ 128.4 Million |

| Forecasted Market Value ( USD | $ 165.4 Million |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |