Global Enhanced Geothermal Systems (EGS) Market - Key Trends & Drivers Summarized

How Are Enhanced Geothermal Systems Unlocking New Frontiers in Clean Energy?

Enhanced Geothermal Systems (EGS) are a next-generation geothermal technology designed to access the Earth's thermal energy in locations where natural hydrothermal resources are insufficient or absent. Unlike conventional geothermal, EGS involves creating engineered reservoirs by injecting water into deep, hot, dry rock formations to stimulate fractures, thus enabling heat extraction and conversion to electricity. This approach dramatically expands geothermal viability beyond tectonically active zones, positioning it as a scalable, dispatchable baseload power source with near-zero emissions.Governments and energy developers are increasingly investing in EGS due to its vast potential to provide 24/7 renewable energy with a minimal surface footprint. The U.S. Department of Energy, for example, is funding initiatives like FORGE (Frontier Observatory for Research in Geothermal Energy) to validate EGS feasibility. Technological advances in deep directional drilling, seismic mapping, fracture stimulation, and corrosion-resistant materials are making it more practical to extract heat from granitic and metamorphic rock at depths exceeding 4-5 km. Private sector interest is also growing, with companies like Fervo Energy and AltaRock Energy piloting EGS projects integrated with fiber-optic sensing, machine learning, and real-time reservoir modeling.

Which Regions and Use Cases Are Catalyzing EGS Deployment?

EGS development is strongest in North America and parts of Europe, where high energy demand, carbon reduction mandates, and drilling technology expertise converge. In the U.S., particularly in western states with existing geothermal infrastructure, EGS is being explored as a way to repurpose depleted oil and gas wells for renewable energy generation. Iceland, France, and Germany are also active in EGS research and demonstration projects, focusing on integrating geothermal energy into national baseload capacity. Additionally, Australia and Japan are investigating EGS to diversify their clean energy mix and reduce dependence on imported fossil fuels.Potential use cases extend beyond grid electricity. Industrial applications - such as direct heating, district energy networks, and green hydrogen production - can leverage EGS for high-temperature process heat. Military bases, remote mining operations, and desalination plants are exploring off-grid EGS as a sustainable power source. As countries look to pair geothermal energy with energy storage, carbon capture, and flexible grid assets, EGS offers a path to long-duration, weather-independent power - especially valuable in regions where solar and wind are intermittent.

The Growth in the Enhanced Geothermal Systems Market Is Driven by Several Factors…

The growth in the enhanced geothermal systems market is driven by deep drilling innovations, improved reservoir engineering techniques, and policy momentum supporting firm renewable energy sources. Advances in closed-loop geothermal systems, hydraulic stimulation, and fiber-optic reservoir characterization are reducing project risk, improving heat recovery rates, and extending operational life. High-temperature materials and downhole monitoring systems are further enabling EGS in geologically complex environments.From an application perspective, rising demand for clean baseload power, the electrification of heat-intensive industries, and grid reliability concerns are fueling interest in EGS. Government support via R&D funding, tax incentives, and decarbonization mandates is encouraging pilot-scale commercialization in the U.S., EU, and Asia-Pacific. As global utilities and energy developers diversify their portfolios beyond wind and solar, EGS offers a promising avenue for round-the-clock zero-carbon energy. These technology- and end-use-driven dynamics are positioning enhanced geothermal systems as a transformative force in the future of sustainable energy infrastructure.

Report Scope

The report analyzes the Enhanced Geothermal Systems market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Resource Type (Hot Dry Rock, Sedimentary Basin, Radiogenic, Molten Magma); Depth (Shallow, Deep); Simulation Method (Hydraulic, Chemical, Thermal); End-Use (Residential, Commercial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hot Dry Rock Resource segment, which is expected to reach US$1.6 Billion by 2030 with a CAGR of a 3.7%. The Sedimentary Basin Resource segment is also set to grow at 1.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $795.9 Million in 2024, and China, forecasted to grow at an impressive 5.1% CAGR to reach $661.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Enhanced Geothermal Systems Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Enhanced Geothermal Systems Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Enhanced Geothermal Systems Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Arc Healthcare Solutions, AT-OS, Belimed AG, Cantel Medical (now part of STERIS), Capsa Healthcare and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 32 companies featured in this Enhanced Geothermal Systems market report include:

- Aboitiz Power Corporation

- AltaRock Energy, Inc.

- Ansaldo Energia S.p.A.

- BESTEC GmbH

- Calpine Corporation

- Eavor Technologies Inc.

- Enel S.p.A.

- Energy Development Corporation

- Fervo Energy

- First Gen Corporation

- Fuji Electric Co., Ltd.

- Geothermal Technologies Inc.

- GreenFire Energy Inc.

- Innergex Renewable Energy Inc.

- Kenya Electricity Generating Company

- Mitsubishi Heavy Industries, Ltd.

- Ormat Technologies, Inc.

- Polaris Renewable Energy Inc.

- Quaise Energy

- Toshiba Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aboitiz Power Corporation

- AltaRock Energy, Inc.

- Ansaldo Energia S.p.A.

- BESTEC GmbH

- Calpine Corporation

- Eavor Technologies Inc.

- Enel S.p.A.

- Energy Development Corporation

- Fervo Energy

- First Gen Corporation

- Fuji Electric Co., Ltd.

- Geothermal Technologies Inc.

- GreenFire Energy Inc.

- Innergex Renewable Energy Inc.

- Kenya Electricity Generating Company

- Mitsubishi Heavy Industries, Ltd.

- Ormat Technologies, Inc.

- Polaris Renewable Energy Inc.

- Quaise Energy

- Toshiba Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 458 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

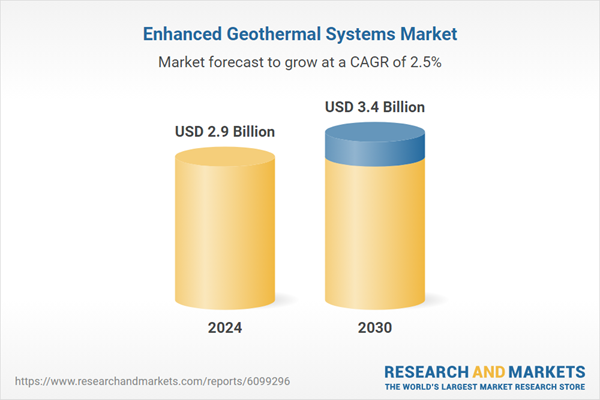

| Estimated Market Value ( USD | $ 2.9 Billion |

| Forecasted Market Value ( USD | $ 3.4 Billion |

| Compound Annual Growth Rate | 2.5% |

| Regions Covered | Global |