Global Fermented Products Market - Key Trends & Drivers Summarized

Why Are Fermented Products Taking Center Stage in Global Food and Health Trends?

The global fermented products market is experiencing a dramatic resurgence, driven by growing consumer awareness around gut health, immunity, and natural nutrition. Fermented foods and beverages - including yogurt, kimchi, sauerkraut, kefir, tempeh, kombucha, miso, and fermented dairy - are now widely recognized for their probiotic benefits and digestive support. These products contain beneficial microorganisms that contribute to a balanced gut microbiome, a factor increasingly linked to overall wellness, mental health, and disease prevention. The global shift toward natural, minimally processed foods has created fertile ground for fermented products to thrive, appealing to health-conscious consumers seeking alternatives to overly synthetic or fortified foodstuffs. This resurgence is not just health-driven but also deeply cultural and culinary, as global palates become more adventurous and open to diverse textures, sour profiles, and traditionally preserved foods. Moreover, as food sustainability becomes a major concern, fermentation is celebrated for extending shelf life, reducing food waste, and requiring fewer preservatives. Millennials and Gen Z are particularly influential in driving this demand, as they prioritize functional foods with clean labels, traceable origins, and cultural authenticity. Supermarkets, health food chains, and online platforms are rapidly expanding their fermented offerings, while restaurants and food service providers are using fermentation as a culinary technique to create unique, umami-rich menu items. This convergence of health, flavor, sustainability, and cultural appreciation is what's propelling fermented products from niche health foods into mainstream global consumption patterns.How Are Science and Technology Enhancing Fermentation Quality and Safety?

Technological advancements and scientific innovation are playing a crucial role in standardizing and scaling the production of fermented products. Traditionally home- or artisan-made, fermented foods are now subject to industrial processes that demand consistency, safety, and scalability without compromising health benefits. Controlled fermentation environments using precision fermentation techniques are enabling manufacturers to maintain stable pH levels, monitor microbial populations, and prevent contamination. This level of control not only ensures food safety but also enhances flavor, texture, and nutritional profiles. Starter cultures - customized microbial strains used to initiate fermentation - are now being developed and patented to target specific health outcomes, such as improved lactose digestion, anti-inflammatory properties, or enhanced mineral absorption. Additionally, advanced packaging technologies, including oxygen barrier films and active packaging with antimicrobial agents, help preserve live cultures and product freshness over extended shelf lives. Scientific validation is another key development, with many brands investing in clinical trials and microbiome research to substantiate their probiotic claims. This has helped differentiate high-quality products from generic offerings, improving consumer trust and regulatory compliance. Foodtech companies are also using biotechnology to explore postbiotic ingredients - non-living microbial byproducts that confer health benefits - thereby expanding the category beyond traditional live-culture products. AI and machine learning are being deployed to optimize fermentation time and monitor process variability in real-time, especially in high-volume operations. These innovations are crucial in making fermented products safer, more effective, and more appealing, while also enabling global scalability to meet rising demand.What Role Do Culture, Cuisine, and Consumer Behavior Play in Global Market Expansion?

The cultural richness and culinary diversity of fermented products are major catalysts for their growing appeal across global markets. Fermentation is one of the oldest food preservation methods, with deep roots in Asian, African, European, and Latin American traditions - each contributing a unique portfolio of flavors and formats to the global marketplace. The growing trend of cultural authenticity and culinary exploration has encouraged consumers to seek out traditional fermented items like Korean kimchi, Japanese natto, Ethiopian injera, and Indian dosa batter as part of a broader appreciation for world cuisines. The rise of foodie culture, food documentaries, and recipe content on digital platforms has introduced younger consumers to the global pantry of fermented delights, turning curiosity into consumption. Additionally, urban food trends, farmers' markets, and artisanal food movements are placing fermented products at the intersection of taste, tradition, and wellness. In the Western world, fermented foods have rapidly moved from specialty health stores into mainstream retail, reflecting their transition from alternative health products to everyday staples. Consumer preferences are also shifting toward snacks and convenience formats, prompting innovation in portable fermented foods such as drinkable yogurts, probiotic bars, and pickled vegetable snack packs. Vegan and plant-based lifestyles are further influencing product development, with tempeh, coconut kefir, and cashew-based cheeses gaining popularity as dairy-free, protein-rich alternatives. Moreover, consumer education around probiotics and gut health - supported by influencers, nutritionists, and health professionals - is fostering more informed purchasing behavior. These intersecting cultural and behavioral trends are not only expanding the global footprint of fermented products but also enabling nuanced localization strategies that cater to regional taste preferences and dietary needs.What's Powering the Sustained Growth in the Fermented Products Market?

The growth in the global fermented products market is driven by several factors rooted in health trends, food innovation, consumer demand shifts, and retail dynamics. First, the global prioritization of health and immunity - especially following the COVID-19 pandemic - has elevated the perceived value of probiotic-rich and microbiome-supportive foods. Fermented products are uniquely positioned to serve this need naturally, without the synthetic additives found in many supplements. Second, technological advancements in food science and manufacturing are allowing for consistent, scalable production that retains nutritional value while meeting global safety standards. The third key driver is the ongoing expansion of plant-based and flexitarian diets, which rely heavily on fermented ingredients for flavor depth, digestibility, and nutrient enrichment - especially in non-dairy and meat-alternative formats. Retail infrastructure is also evolving, with cold chain improvements and demand forecasting tools enabling the wider distribution of live-culture foods across urban and rural markets. E-commerce platforms and direct-to-consumer models are making small-batch and specialized fermented products accessible to a broader audience, often accompanied by educational content and community engagement that fosters brand loyalty. Additionally, investment from multinational food companies in startups and niche brands is fueling product innovation and global expansion. Regulatory support in the form of probiotic labeling standards and functional food classifications is also enabling clearer consumer communication and legal claims, further legitimizing the category. Finally, the versatility of fermentation - as a preservation method, a flavor enhancer, and a nutritional booster - ensures its relevance across product types and consumer needs. Together, these factors are shaping a global market that is not only growing rapidly but evolving in sophistication and reach, making fermented products a central force in the future of food.Report Scope

The report analyzes the Fermented Products market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Fermented Food, Fermented Beverage); Distribution Channel (Offline, Online); Application (Residential, Commercial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fermented Food segment, which is expected to reach US$40.2 Billion by 2030 with a CAGR of a 2.1%. The Fermented Beverage segment is also set to grow at 3.9% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $14.9 Billion in 2024, and China, forecasted to grow at an impressive 5.1% CAGR to reach $12.3 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fermented Products Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fermented Products Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fermented Products Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Arthrex, Inc., B. Braun Melsungen AG, Becton, Dickinson and Company (BD), Biomet, Inc., ConMed Corporation and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Fermented Products market report include:

- Ajinomoto Co., Inc.

- Arla Foods

- Bio-K Plus International Inc.

- Chr. Hansen Holding A/S

- Danone S.A.

- DuPont de Nemours, Inc.

- Fonterra Co-operative Group

- General Mills, Inc.

- Kerry Group plc

- Lactalis Group

- Lallemand Inc.

- Lesaffre

- Nestlé S.A.

- PepsiCo, Inc.

- Superbrewed Food

- The Coca-Cola Company

- The Kraft Heinz Company

- Unilever PLC

- Yakult Honsha Co., Ltd.

- Yili Group

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ajinomoto Co., Inc.

- Arla Foods

- Bio-K Plus International Inc.

- Chr. Hansen Holding A/S

- Danone S.A.

- DuPont de Nemours, Inc.

- Fonterra Co-operative Group

- General Mills, Inc.

- Kerry Group plc

- Lactalis Group

- Lallemand Inc.

- Lesaffre

- Nestlé S.A.

- PepsiCo, Inc.

- Superbrewed Food

- The Coca-Cola Company

- The Kraft Heinz Company

- Unilever PLC

- Yakult Honsha Co., Ltd.

- Yili Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 366 |

| Published | February 2026 |

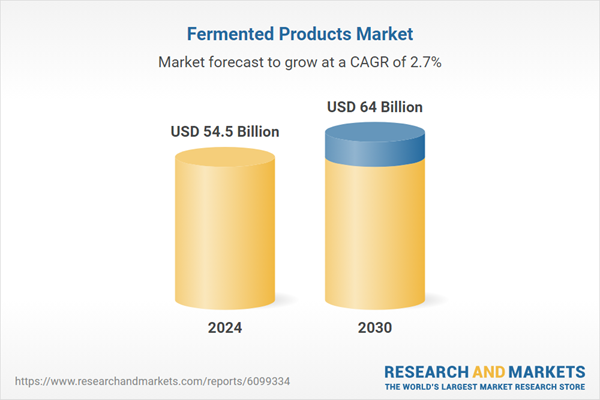

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 54.5 Billion |

| Forecasted Market Value ( USD | $ 64 Billion |

| Compound Annual Growth Rate | 2.7% |

| Regions Covered | Global |