Global Fluid Sensors Market - Key Trends & Drivers Summarized

Why Are Fluid Sensors Playing a Central Role in Smart System Monitoring?

Fluid sensors have become a critical component in modern automated systems across industries, driven by the need for precise, real-time monitoring of liquid flow, levels, pressure, and quality. These sensors are vital in ensuring operational efficiency, safety, and regulatory compliance in sectors such as automotive, water treatment, chemical processing, oil and gas, food and beverage, pharmaceuticals, and HVAC systems. As industries adopt increasingly intelligent and interconnected systems, fluid sensors are being deployed to detect leaks, prevent contamination, maintain optimal flow rates, and support predictive maintenance protocols. Their ability to deliver accurate and continuous data has made them indispensable in scenarios where manual monitoring is either impractical or hazardous. Additionally, the integration of Industry 4.0 technologies - including IoT, AI, and big data analytics - has significantly enhanced the functionality and importance of fluid sensors. These sensors now not only report data but can also trigger automated responses or contribute to larger decision-making frameworks within smart manufacturing and infrastructure systems. The growing demand for automation, coupled with rising environmental and safety standards, is cementing fluid sensors as a cornerstone of digital transformation across technical ecosystems.How Are Advancements in Sensor Technologies Reshaping the Market?

The fluid sensors market is undergoing rapid transformation thanks to continuous innovations in sensing technologies, miniaturization, and material science. Traditional mechanical float-based systems are being replaced with advanced electronic sensors that utilize ultrasonic, capacitive, optical, and electromagnetic principles for greater precision and versatility. These newer technologies allow for non-invasive, contactless monitoring, making them ideal for sterile environments or corrosive media. MEMS (Micro-Electro-Mechanical Systems) technology has enabled the development of ultra-small sensors with enhanced sensitivity and integration capabilities, suitable for medical devices and compact industrial equipment. Furthermore, wireless connectivity - such as Bluetooth, Zigbee, and Wi-Fi - has expanded the usability of fluid sensors by facilitating remote monitoring and real-time data sharing. This is particularly valuable in large-scale operations like municipal water treatment or oil pipeline networks. Additionally, sensors with self-diagnostic features and embedded microcontrollers are emerging, capable of calibrating themselves and alerting operators to faults or maintenance requirements. As energy efficiency becomes a key consideration, low-power and energy-harvesting sensors are also gaining traction, especially in remote or battery-operated systems. These technological breakthroughs are not only broadening the application base of fluid sensors but also enhancing their reliability, lifespan, and integration into next-generation smart systems.Which Industries and Global Markets Are Leading the Surge in Demand?

The application of fluid sensors spans a broad spectrum of industries, each with distinct needs driving tailored innovation and adoption. In the automotive sector, fluid sensors are extensively used to monitor engine oil, fuel, coolant, and brake fluid levels to ensure vehicle performance and safety. The water and wastewater management industry relies on fluid sensors for flow measurement, leakage detection, and regulatory reporting, especially in urban infrastructure and smart city projects. In healthcare, medical-grade fluid sensors are crucial for infusion pumps, dialysis equipment, and diagnostic machines where even slight fluid imbalances can be critical. The chemical and pharmaceutical sectors require highly accurate sensors to manage corrosive or reactive fluids under strict safety standards. Food and beverage manufacturers employ hygienic fluid sensors for monitoring liquid ingredients in automated processing lines. Geographically, North America and Europe lead the market in terms of innovation and regulatory adoption, with the U.S., Germany, and the U.K. being major players. Meanwhile, Asia-Pacific is emerging as a high-growth region due to rapid industrialization, expanding water management infrastructure, and a booming automotive and electronics manufacturing base, especially in China, Japan, South Korea, and India. The Middle East and Africa are gradually adopting fluid sensor technologies in response to increasing infrastructure development and water conservation initiatives, indicating an expanding global footprint across industry sectors and regions.What Are the Primary Factors Accelerating Growth in the Fluid Sensors Market?

The growth in the fluid sensors market is driven by several factors rooted in technological innovation, rising automation, environmental compliance, and the digitization of critical infrastructure. First, the global push toward smart industry and IoT-enabled operations has made fluid sensors indispensable tools for achieving real-time system visibility and control. Second, growing regulatory demands across sectors - including water quality laws, emissions controls, and process safety standards - are compelling manufacturers and utilities to implement precise fluid monitoring solutions. Third, the increasing complexity of modern machinery and infrastructure has elevated the importance of predictive maintenance, with fluid sensors enabling early detection of wear, leakage, or contamination that could otherwise lead to costly failures. Fourth, the expansion of renewable energy systems - such as hydropower, solar thermal, and bioenergy - has introduced new applications for fluid sensors in monitoring cooling, heating, and fluid transfer systems. Fifth, the continued miniaturization of electronic components has allowed for cost-effective integration of fluid sensors in consumer electronics, healthcare devices, and compact machinery. Furthermore, the rise of wireless sensor networks and cloud-based analytics platforms has made it easier for industries to scale sensor deployment and manage data across distributed operations. Lastly, as sustainability goals become a global imperative, fluid sensors are playing a key role in resource optimization, leak prevention, and waste reduction, making them a strategic component in meeting environmental and operational objectives alike.Report Scope

The report analyzes the Fluid Sensors market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Pressure Sensor Product Type, Temperature Sensor Product Type, Flow Sensor Product Type, Level Sensor Product Type); Detection Medium (Liquid Detection Medium, Gas Detection Medium, Plasma Detection Medium); Measurement Type (Contact Measurement Type, Non-contact Measurement Type); End-Use (Oil & Gas End-Use, Chemical End-Use, Power Generation End-Use, Food & Beverages End-Use, Water & Wastewater Treatment End-Use, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Pressure Sensor segment, which is expected to reach US$10.5 Billion by 2030 with a CAGR of a 10.7%. The Temperature Sensor segment is also set to grow at 9.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $4 Billion in 2024, and China, forecasted to grow at an impressive 14.5% CAGR to reach $5.5 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Fluid Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Fluid Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Fluid Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ado Urban Furniture, S.L., Amop Synergies, Ashley Furniture Industries, Crescent Garden, East Jordan Plastics, Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Fluid Sensors market report include:

- ABB Ltd.

- Baumer Group

- Bosch Rexroth AG

- Dwyer Instruments, Inc.

- Emerson Electric Co.

- Endress+Hauser Group

- First Sensor AG

- Gems Sensors & Controls

- Honeywell International Inc.

- IDEX Corporation

- IFM Electronic GmbH

- KROHNE Messtechnik GmbH

- OMRON Corporation

- Parker Hannifin Corporation

- Pepperl+Fuchs SE

- Schneider Electric SE

- Sensata Technologies

- SICK AG

- Siemens AG

- Trafag AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Baumer Group

- Bosch Rexroth AG

- Dwyer Instruments, Inc.

- Emerson Electric Co.

- Endress+Hauser Group

- First Sensor AG

- Gems Sensors & Controls

- Honeywell International Inc.

- IDEX Corporation

- IFM Electronic GmbH

- KROHNE Messtechnik GmbH

- OMRON Corporation

- Parker Hannifin Corporation

- Pepperl+Fuchs SE

- Schneider Electric SE

- Sensata Technologies

- SICK AG

- Siemens AG

- Trafag AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 472 |

| Published | February 2026 |

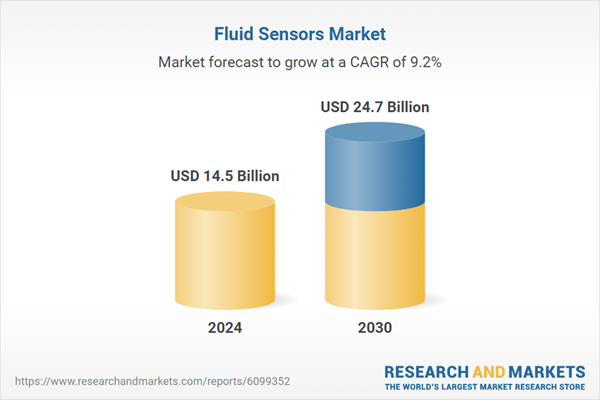

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 14.5 Billion |

| Forecasted Market Value ( USD | $ 24.7 Billion |

| Compound Annual Growth Rate | 9.2% |

| Regions Covered | Global |