Global Gang Drilling Machines Market - Key Trends & Drivers Summarized

Why Are Gang Drilling Machines Regaining Importance in Precision Manufacturing?

Gang drilling machines are experiencing renewed relevance in modern manufacturing, particularly in industries that demand high-speed, repetitive, and multi-hole drilling operations. These machines consist of multiple drilling heads mounted on a single table, enabling the simultaneous drilling of several holes with precision and uniformity. Their application is most significant in sectors such as automotive, aerospace, electronics, and metal fabrication, where throughput efficiency and part consistency are critical. The resurgence in demand is largely attributed to their cost-effectiveness for medium to high-volume production compared to CNC machines, especially when complex programmability is not a necessity. Furthermore, the rise in lean manufacturing practices has placed a premium on time-efficient, robust machinery that minimizes downtime - conditions under which gang drilling excels. With the global push toward localized and agile manufacturing, particularly in emerging economies, gang drilling machines offer a compelling solution for facilities looking to scale quickly without the steep capital investment often required for fully automated systems. Their mechanical simplicity also makes them easier to maintain and operate, reducing training requirements and enhancing workshop adaptability in diverse industrial environments.How Are Material Advancements and Automation Enhancing Machine Performance?

Recent technological progress has significantly improved the design and functionality of gang drilling machines, transforming them into high-performance workhorses for specialized applications. The incorporation of high-strength alloys and wear-resistant coatings in machine components has extended operational life and reduced the need for frequent maintenance. At the same time, hybrid models now incorporate servo motors, pneumatic clamps, and automated feeding systems, allowing for semi-automated operation while retaining the cost benefits of manual systems. Vibration control technologies, improved coolant delivery systems, and spindle speed optimization have enhanced both the quality and efficiency of drilling, particularly when working with difficult materials such as hardened steels, composites, or heat-treated alloys. Manufacturers are also integrating sensors and digital monitoring systems to provide real-time feedback on tool condition, machine wear, and process deviations - enabling predictive maintenance and quality assurance. Furthermore, modularity has become a key design trend, allowing end-users to customize drilling head configurations and tooling setups based on project-specific requirements. These advancements are making gang drilling machines not only more efficient but also more versatile and future-ready in hybrid and smart manufacturing settings.What Market Pressures and End-User Demands Are Shaping Industry Trends?

The global demand for gang drilling machines is being significantly shaped by evolving production strategies and the specialized needs of end-users. In the automotive sector, for instance, the shift toward electric vehicle (EV) production has led to increased demand for customized components, many of which require precise, repeatable drilling operations on lightweight materials. Similarly, the electronics and telecommunications industries are seeing increased miniaturization of components, necessitating high-accuracy drilling solutions that gang drills can deliver efficiently. Meanwhile, small and medium enterprises (SMEs), particularly in developing countries, are gravitating toward gang drilling machines due to their lower cost of ownership and ease of deployment. Supply chain disruptions and rising operational costs have also forced manufacturers to invest in machines that offer both productivity and cost efficiency without heavy reliance on digital infrastructure. Additionally, the growing emphasis on quality control and compliance in global supply chains means that even simple machinery like gang drills is being evaluated for consistency and process stability. As end-users seek scalable solutions that can be integrated into hybrid production lines, the role of gang drilling machines as an intermediate but essential technology is becoming increasingly prominent.What Are the Principal Drivers Fueling Growth in the Gang Drilling Machines Market?

The growth in the gang drilling machines market is driven by several factors associated with industrial demand dynamics, technological improvements, and manufacturing practices. A primary driver is the resurgence of interest in mid-range automation solutions that balance speed and precision without the complexity or cost of full CNC systems. The proliferation of component manufacturing in industries like automotive, aerospace, and electronics - where multiple, identical holes are often required - has strengthened the demand for gang drilling setups. Manufacturers are also increasingly looking to reconfigure or upgrade existing machinery to meet evolving part specifications, for which gang drills offer a flexible and low-cost option. In parallel, advancements in tooling materials, such as carbide and polycrystalline diamond (PCD), have allowed gang drills to handle a wider array of materials with improved performance. The rise in domestic manufacturing initiatives and import substitution policies in several countries is further boosting equipment investments, especially in sectors where mass part replication is common. Additionally, increased adoption of smart maintenance protocols, modular tooling systems, and integration into semi-automated workflows is pushing gang drills into the modern production ecosystem. Collectively, these developments underscore the machine's relevance as a cost-effective, durable, and adaptable solution in a fast-evolving global manufacturing landscape.Report Scope

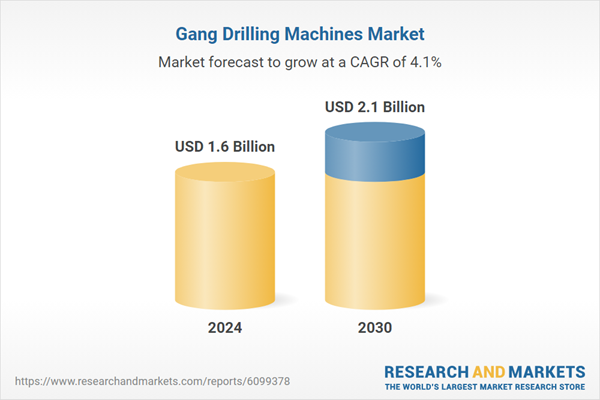

The report analyzes the Gang Drilling Machines market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Single Gang Drill, Multiple Gang Drill); Layout (Horizontal, Vertical); Mode (Semi-Automatic, Automatic); End-Use (Automotive, Aerospace, Metal Fabrication, Electronics, Construction, General Manufacturing, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Single Gang Drill segment, which is expected to reach US$1.3 Billion by 2030 with a CAGR of a 4.9%. The Multiple Gang Drill segment is also set to grow at 2.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $445.8 Million in 2024, and China, forecasted to grow at an impressive 7.7% CAGR to reach $428.1 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Gang Drilling Machines Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Gang Drilling Machines Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Gang Drilling Machines Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Advanced Measurement Technology, AMETEK, Inc. (Ortec), ANTECH, Atomtex SPE, Baltic Scientific Instruments and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Gang Drilling Machines market report include:

- AutoDrill

- Chester Machine Tools

- E-Z Drill, Inc.

- EIFCO Machine Tools

- HELTOS a.s.

- Itco Indian Engg Corp

- Kalika Engineers

- KOR-IT, Inc.

- KTK Machines

- Laxmi Metal & Machines

- Muraki Co., Ltd.

- NS Machine Corp

- Reliance High Tech Ltd

- Sandvik Coromant

- Siddhapura Engineering Works

- Siddhapura Sales Corporation

- Simplex Machines

- Sugino Machine Limited

- WMW Machinery Company

- Willis Machinery & Tools Co.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AutoDrill

- Chester Machine Tools

- E-Z Drill, Inc.

- EIFCO Machine Tools

- HELTOS a.s.

- Itco Indian Engg Corp

- Kalika Engineers

- KOR-IT, Inc.

- KTK Machines

- Laxmi Metal & Machines

- Muraki Co., Ltd.

- NS Machine Corp

- Reliance High Tech Ltd

- Sandvik Coromant

- Siddhapura Engineering Works

- Siddhapura Sales Corporation

- Simplex Machines

- Sugino Machine Limited

- WMW Machinery Company

- Willis Machinery & Tools Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 468 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.6 Billion |

| Forecasted Market Value ( USD | $ 2.1 Billion |

| Compound Annual Growth Rate | 4.1% |

| Regions Covered | Global |