Global Hardbanding Services Market - Key Trends & Drivers Summarized

Why Are Hardbanding Services Critical to the Longevity and Performance of Drill Strings?

Hardbanding services have become an essential element of modern oilfield operations, particularly in drilling environments that demand extended equipment life and high resistance to wear and tear. Hardbanding involves applying a wear-resistant alloy to drill pipe tool joints, stabilizers, and heavy-weight drill pipe (HWDP) to protect them from abrasive wear, friction, and mechanical stress encountered during drilling. As drilling activity increasingly targets deeper, high-pressure, and high-temperature formations - especially in shale, offshore, and horizontal wells - the need for robust wear protection has grown significantly.Without hardbanding, the tool joints and other vulnerable sections of the drill string experience rapid wear, leading to frequent replacements, elevated operational costs, and increased downtime. Furthermore, hardbanding plays a vital role in preventing casing wear, which is critical to maintaining well integrity and meeting safety regulations. As exploration and production (E&P) companies aim to optimize asset lifecycles and minimize non-productive time (NPT), hardbanding has emerged as a cost-effective preventive maintenance solution.

How Are Technology Advancements and Material Innovations Shaping the Hardbanding Landscape?

The hardbanding industry has witnessed significant technological evolution, particularly in the development of advanced alloys, automated application systems, and inspection tools. Modern hardbanding wires - such as non-cracking and casing-friendly alloys - are engineered to balance hardness with ductility, allowing for both tool joint protection and minimal casing wear. Key players offer proprietary alloys like Duraband®, Tuffband®, and ARNCO series that deliver enhanced wear resistance in abrasive, corrosive, or high-torque drilling environments.Automated hardbanding systems are now equipped with digital controls, real-time monitoring, and robotic precision to ensure consistent alloy deposition, uniform coverage, and minimal heat-affected zones. These systems are particularly valuable in remote and offshore rigs where quality assurance and speed of service are critical. Additionally, non-destructive testing (NDT) tools - such as ultrasonic and electromagnetic inspection - are integrated with hardbanding workflows to assess wear levels and determine optimal reapplication schedules, helping operators make data-driven maintenance decisions.

Which End-Use Markets and Geographies Are Driving the Demand for Hardbanding Services?

The oil and gas industry, particularly the upstream drilling segment, is the principal end-user of hardbanding services. Demand is strongest in regions with extensive horizontal drilling and shale activity, such as North America (especially the U.S. Permian Basin, Bakken, and Eagle Ford), the Middle East, and parts of Latin America. Offshore markets, including the North Sea, West Africa, and Southeast Asia, also represent high-value markets where tool joint integrity and casing protection are paramount due to operational complexity and cost sensitivity.Drilling contractors, equipment rental companies, and E&P operators are increasingly investing in hardbanding as part of their integrated drilling support services. These stakeholders often outsource hardbanding to mobile service providers or oilfield equipment maintenance specialists that can deliver on-site or near-site application and reapplication services. Meanwhile, national oil companies (NOCs) and international oil companies (IOCs) are standardizing hardbanding requirements in their drilling contracts, further embedding it into global well-construction protocols.

The Growth in the Hardbanding Services Market Is Driven by Several Factors…

The growth in the hardbanding services market is driven by several factors directly related to technology innovation, drilling intensity, and asset integrity management. Technologically, advancements in alloy formulations, automated application units, and NDT-integrated monitoring systems are enhancing service precision, performance reliability, and safety compliance. The development of casing-friendly hardbanding materials is also widening market adoption, particularly for high-speed and extended-reach drilling operations.From an end-use perspective, increased horizontal and directional drilling activity, longer lateral sections, and deeper wells are creating sustained demand for tool joint wear protection. The rising value of drill string components and the emphasis on minimizing downtime and maintenance costs are making hardbanding a strategic investment across the oilfield lifecycle. Additionally, the growth of rig automation, digital oilfield technologies, and performance-based drilling contracts is encouraging more predictive and proactive maintenance practices - further reinforcing the role of hardbanding services in modern drilling environments. As E&P operations become more technically demanding, the global hardbanding services market is set to expand in scale, specialization, and regional coverage.

Report Scope

The report analyzes the Hardbanding Services market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Tungsten Carbide, Chromium Carbide, Titanium Carbide, Niobium Boride, Titanium Boride, Other Types); Drilling Type (Open Hole, Cased Hole); Application (Drill Pipe, Drill Collar, Tool Joint, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Tungsten Carbide segment, which is expected to reach US$2.5 Billion by 2030 with a CAGR of a 3.1%. The Chromium Carbide segment is also set to grow at 5.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.5 Billion in 2024, and China, forecasted to grow at an impressive 7.4% CAGR to reach $2.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Hardbanding Services Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Hardbanding Services Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Hardbanding Services Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as A.B Seas, Abacus Row, Alex Monroe, Ananda Khalsa, Catbird NYC and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Hardbanding Services market report include:

- Arnco Technology

- Bandit Tech Oilfield Services

- Baker Hughes

- Castolin Eutectic

- Crusade Services

- D/F Machine Specialties, Inc.

- Denimex

- Eurotechnology International

- Halliburton

- Hard Band Industries Inc.

- Hardbanding Solutions (Postle Industries)

- Inspection Oilfield Services (IOS)

- Knight Energy Services

- National Oilwell Varco (NOV)

- NTS Amega Global

- Oceaneering International, Inc.

- Premium Inspection Company

- Pro-Tech Hardbanding Services

- RedRiver Oilfield Services

- Sharpe Engineering

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Arnco Technology

- Bandit Tech Oilfield Services

- Baker Hughes

- Castolin Eutectic

- Crusade Services

- D/F Machine Specialties, Inc.

- Denimex

- Eurotechnology International

- Halliburton

- Hard Band Industries Inc.

- Hardbanding Solutions (Postle Industries)

- Inspection Oilfield Services (IOS)

- Knight Energy Services

- National Oilwell Varco (NOV)

- NTS Amega Global

- Oceaneering International, Inc.

- Premium Inspection Company

- Pro-Tech Hardbanding Services

- RedRiver Oilfield Services

- Sharpe Engineering

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 390 |

| Published | February 2026 |

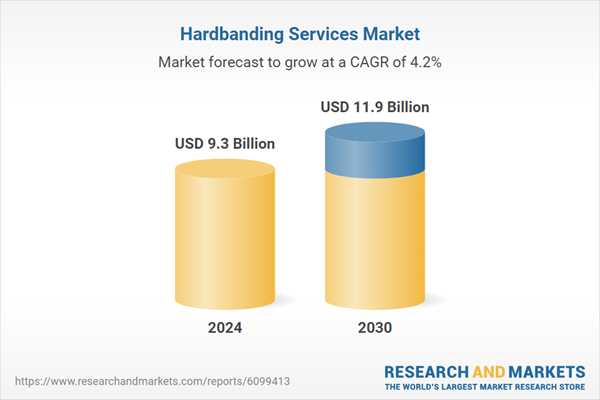

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9.3 Billion |

| Forecasted Market Value ( USD | $ 11.9 Billion |

| Compound Annual Growth Rate | 4.2% |

| Regions Covered | Global |