Global High Voltage Direct Current (HVDC) Transmission Market - Key Trends & Drivers Summarized

Why Is HVDC Transmission Becoming Vital in the Global Energy Transition?

High Voltage Direct Current (HVDC) transmission systems are rapidly emerging as a foundational component of the global energy infrastructure due to their ability to transmit large amounts of electricity over long distances with minimal losses. Unlike alternating current (AC) systems, HVDC lines offer higher efficiency, better grid stability, and lower transmission losses - especially useful for cross-border interconnections, offshore wind farms, and remote renewable energy sites. As energy systems transition to decentralized, low-carbon models, HVDC plays a key role in connecting generation to demand centers.In modern grid networks, HVDC is increasingly used to link asynchronous AC grids, stabilize frequency fluctuations, and integrate intermittent renewables like wind and solar. Urban megacities, island nations, and regions with geographically dispersed generation assets (like hydropower in mountainous zones) depend on HVDC for economic and reliable power delivery. It is also ideal for undersea and underground power cables, which are less feasible with traditional AC technologies due to capacitance-related energy losses.

How Are Technological Advancements Expanding HVDC System Capabilities?

Recent technological innovations have significantly enhanced the efficiency, cost-effectiveness, and deployment flexibility of HVDC systems. Voltage Source Converters (VSC) have emerged as a game-changer, enabling compact, modular HVDC systems suited for dynamic load balancing and urban integration. Compared to classic Line Commutated Converters (LCC), VSC-HVDC systems support black-start capability, bi-directional flow control, and integration with weak or small grids.Advances in materials, like supergrid-ready insulated cables, silicon carbide (SiC) power semiconductors, and smart switchgear, are improving the performance and lifespan of HVDC systems. Digital twins, grid modeling software, and AI-based predictive maintenance tools are also being incorporated into HVDC stations for enhanced monitoring and grid optimization. The development of multi-terminal and hybrid AC/DC grids is expanding the applicability of HVDC beyond point-to-point transmission.

Which Projects and Regions Are Leading HVDC Deployment?

Mega infrastructure projects are fueling HVDC demand globally. Notable examples include China's State Grid ultra-high-voltage corridors, India's renewable integration corridors, and Europe's North Sea offshore wind connections. Countries like Brazil and Canada are using HVDC to transport hydropower over thousands of kilometers to dense urban markets. Additionally, interconnectors such as the UK-Norway “North Sea Link” and Germany-Denmark “Kriegers Flak” are setting the benchmark for cross-border HVDC integration.Asia-Pacific currently leads in terms of HVDC installations, with China alone operating several of the world's highest-capacity systems. Europe follows, driven by interconnection needs and renewable targets under EU energy policy. North America is expanding HVDC for grid modernization and renewable energy transmission in remote regions. The Middle East and Africa are emerging markets where HVDC is being explored to enhance cross-border electricity trade and improve rural grid access.

The Growth in the HVDC Transmission Market Is Driven by Several Factors…

The growth in the HVDC transmission market is driven by several factors linked to renewable energy integration, grid modernization efforts, and cross-border power trading. Technological advancements in converter technology, insulation materials, and modular system design have expanded HVDC's applicability in both bulk power transmission and urban grid support. The shift toward hybrid and smart grids is further catalyzing the adoption of flexible, digital-ready HVDC infrastructure.From an end-use standpoint, the rise in offshore wind, utility-scale solar, and hydropower generation in remote or offshore locations is creating sustained demand for long-distance, low-loss transmission. Government-backed investments in interregional and international grid connectivity - aligned with decarbonization goals - are accelerating HVDC deployment. As global electricity demand rises and networks become more decentralized and renewable-heavy, HVDC is set to become a core architecture of future power systems.

Report Scope

The report analyzes the High Voltage Direct Current Transmissions market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Technology (Voltage Source Converters, Line Commutated Converters, Capacitor Commutated Converters); Transmission Type (Submarine, Overhead, Underground); Application (Bulk Power Transmission, Interconnecting Grids, Infeed Urban Areas).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Some of the 48 companies featured in this High Voltage Direct Current Transmissions market report include -

- ABB Ltd.

- Adani Transmission Ltd.

- Alstom SA

- China Electric Power Equipment and Technology Co., Ltd.

- General Electric Company

- Hitachi Energy Ltd.

- Hyosung Heavy Industries Corporation

- Jiangnan Group Limited

- LS Electric Co., Ltd.

- Mitsubishi Electric Corporation

- Nexans S.A.

- NR Electric Co., Ltd.

- NKT A/S

- Power Grid Corporation of India Ltd.

- Prysmian Group

- Schneider Electric SE

- Siemens Energy AG

- Sumitomo Electric Industries, Ltd.

- TBEA Co., Ltd.

- Toshiba Energy Systems & Solutions Corporation

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Voltage Source Converters segment, which is expected to reach US$9 Billion by 2030 with a CAGR of a 5.1%. The Line Commutated Converters segment is also set to grow at 6.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $3.3 Billion in 2024, and China, forecasted to grow at an impressive 9.2% CAGR to reach $3.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global High Voltage Direct Current Transmissions Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global High Voltage Direct Current Transmissions Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global High Voltage Direct Current Transmissions Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ACC Limited, BASF SE, CEMEX S.A.B. de C.V., Clayton Block Co., CRH plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Select Competitors (Total 48 Featured):

- ABB Ltd.

- Adani Transmission Ltd.

- Alstom SA

- China Electric Power Equipment and Technology Co., Ltd.

- General Electric Company

- Hitachi Energy Ltd.

- Hyosung Heavy Industries Corporation

- Jiangnan Group Limited

- LS Electric Co., Ltd.

- Mitsubishi Electric Corporation

- Nexans S.A.

- NR Electric Co., Ltd.

- NKT A/S

- Power Grid Corporation of India Ltd.

- Prysmian Group

- Schneider Electric SE

- Siemens Energy AG

- Sumitomo Electric Industries, Ltd.

- TBEA Co., Ltd.

- Toshiba Energy Systems & Solutions Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Adani Transmission Ltd.

- Alstom SA

- China Electric Power Equipment and Technology Co., Ltd.

- General Electric Company

- Hitachi Energy Ltd.

- Hyosung Heavy Industries Corporation

- Jiangnan Group Limited

- LS Electric Co., Ltd.

- Mitsubishi Electric Corporation

- Nexans S.A.

- NR Electric Co., Ltd.

- NKT A/S

- Power Grid Corporation of India Ltd.

- Prysmian Group

- Schneider Electric SE

- Siemens Energy AG

- Sumitomo Electric Industries, Ltd.

- TBEA Co., Ltd.

- Toshiba Energy Systems & Solutions Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 381 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

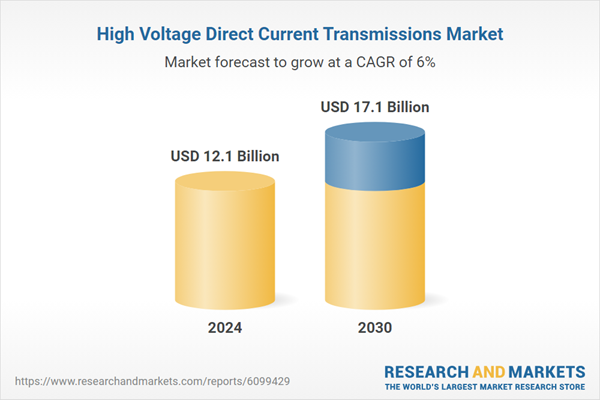

| Estimated Market Value ( USD | $ 12.1 Billion |

| Forecasted Market Value ( USD | $ 17.1 Billion |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Global |