Global Base Station Antennas Market - Key Trends & Drivers Summarized

Why Are Base Station Antennas at the Core of Next-Generation Mobile Network Deployment and Radio Access Optimization?

Base station antennas are essential infrastructure components enabling the transmission and reception of radio frequency signals between mobile devices and network base stations. As telecommunications providers accelerate 5G rollout and prepare for 6G research, the strategic importance of high-performance antennas has increased significantly. These antennas serve as the physical layer interface of mobile networks, supporting multi-band operations, advanced beamforming, and spatial multiplexing to enhance coverage, capacity, and user experience.Demand for data-intensive applications - ranging from video streaming and IoT connectivity to real-time navigation and autonomous vehicle communications - is driving unprecedented pressure on cellular network capacity. Base station antennas equipped with Massive MIMO (multiple-input, multiple-output) and beam-steering technologies are enabling dynamic signal targeting and interference reduction across high-density urban and suburban environments. Their role is critical in delivering consistent connectivity, especially in areas with variable topographies, high user volumes, or strict latency requirements.

The antenna landscape is also evolving to support increased spectrum diversity, including low-, mid-, and mmWave frequency bands. Operators are deploying multiband and integrated antenna systems (IAS) to consolidate tower space, reduce site leasing costs, and optimize network performance. As network densification becomes the new standard for 5G and beyond, base station antennas are emerging as the pivotal link between digital transformation ambitions and real-world mobile service delivery.

How Are Technological Innovations in Antenna Architecture, Materials, and Integration Enhancing Network Agility and Throughput?

Advancements in antenna design are pushing the boundaries of form factor, frequency range, and signal optimization. Hybrid antenna arrays that combine active and passive elements are being deployed to support both legacy and next-generation radio access technologies. High-gain panel antennas, adaptive array configurations, and sector-splitting architectures are enabling operators to fine-tune coverage zones and increase spectral efficiency without overhauling tower infrastructure.Material science innovations - such as lightweight composites, weather-resistant enclosures, and low-loss dielectric substrates - are improving durability, reducing tower loads, and enabling flexible deployment across varying climatic conditions. Compact radome designs are also enhancing wind resistance and aesthetic integration, particularly in urban environments where zoning constraints and visual pollution regulations affect site acceptance. These materials support not only structural reliability but also sustained signal performance over time.

Increased emphasis on integration is reshaping antenna deployment strategies. Vendors are offering pre-integrated radio and antenna units (Active Antenna Systems or AAS) that combine beamforming, digital signal processing, and remote electrical tilt (RET) features within a single enclosure. This integration simplifies installation, reduces latency, and supports software-defined control for real-time optimization. As networks become more software-driven and virtualization-ready, integrated antenna systems are becoming key enablers of agile, scalable, and cloud-native RAN architectures.

Which Network Architectures, Deployment Scenarios, and Operator Strategies Are Driving Base Station Antenna Demand?

Macro cells remain the primary deployment scenario for base station antennas, particularly in high-demand corridors, suburban expansions, and rural coverage mandates. However, the rise of small cell and heterogeneous network architectures is driving the proliferation of compact, high-frequency antennas for localized densification. These deployments support enhanced mobile broadband (eMBB) use cases and enable faster network responses in low-latency, high-throughput applications such as smart city systems and connected mobility.Operators are leveraging site modernization programs to replace legacy antennas with multiband units capable of supporting 4G, 5G, and in some cases, forward-compatible configurations for future spectrum use. Co-location strategies - where multiple operators share tower infrastructure - are amplifying demand for antennas that can support dual- or tri-sector configurations, adjustable beamwidth, and shared frequency planning. This trend aligns with regulatory pushes for efficient spectrum use and infrastructure rationalization.

Regionally, antenna deployment is being shaped by spectrum allocation policies, urbanization rates, and investment cycles. Asia-Pacific leads in base station antenna volume, driven by large-scale 5G rollouts in China, South Korea, and Japan. North America and Western Europe are advancing in active antenna integration and Massive MIMO trials, while emerging markets in Latin America, Africa, and Southeast Asia are focusing on multiband macro cell coverage to bridge the digital divide. Customized antenna strategies are being adopted to match each region's spectrum mix, topographic complexity, and regulatory landscape.

How Are Vendor Strategies, Cost-Performance Dynamics, and Supply Chain Factors Influencing Market Evolution?

Vendors are increasingly differentiating through turnkey solutions that combine antennas, radios, and management software into unified offerings. Tier 1 suppliers are focusing on R&D investments in mmWave optimization, AI-driven beam management, and open RAN compatibility to meet evolving operator specifications. Strategic partnerships with telecom operators are fostering co-development of custom antenna products that align with network blueprints and long-term capital efficiency goals.Cost-performance optimization remains a core decision criterion, particularly in markets with ARPU constraints or stringent CAPEX budgets. Operators are balancing coverage requirements, backhaul availability, and long-term OPEX with the technical attributes of base station antennas, including gain, sidelobe suppression, and RET capabilities. Modular designs and field-upgradable architectures are gaining popularity for their ability to future-proof deployments while preserving existing infrastructure investment.

Global supply chain dynamics - particularly raw material availability, semiconductor component sourcing for active units, and cross-border logistics - are influencing lead times, procurement strategies, and regional manufacturing localization. Antenna manufacturers are diversifying production footprints, investing in regional assembly hubs, and adopting digital twin technologies for performance validation and remote configuration. These shifts are enhancing operational agility and ensuring more resilient go-to-market strategies in a post-disruption landscape.

What Are the Factors Driving Growth in the Base Station Antennas Market?

The base station antennas market is expanding as mobile network operators accelerate 5G rollouts, densify coverage footprints, and prepare for ultra-reliable, high-capacity next-generation networks. These antennas are foundational to supporting massive device connectivity, improved data throughput, and flexible deployment models.Key growth drivers include the adoption of Massive MIMO and active antenna systems, spectrum diversification, macro and small cell co-deployment, and increasing demand for integrated, multi-band antenna solutions. Material innovation, software-defined tuning, and supply chain localization are further shaping competitive dynamics.

As wireless networks become increasingly complex, virtualized, and user-centric, could base station antennas redefine their role - not simply as passive components, but as intelligent, adaptive interfaces powering the future of connected infrastructure at scale?

Report Scope

The report analyzes the Base Station Antennas market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Offering (Hardware, Services); Technology (4G / LTE, 5G, 3G); Application (Mobile Communication, Intelligent Transport, Military & Defense, Industrial IoT, Smart City, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Hardware Component segment, which is expected to reach US$14.7 Billion by 2030 with a CAGR of a 14%. The Services Component segment is also set to grow at 18.5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.6 Billion in 2024, and China, forecasted to grow at an impressive 20.3% CAGR to reach $4.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Base Station Antennas Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Base Station Antennas Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Base Station Antennas Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AlphaCard, Barcodes, Inc., CardLogix Corporation, CardPrinting.com, CPI Card Group Inc. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Base Station Antennas market report include:

- Ace Technologies Corporation

- Airgain Inc.

- Alpha Wireless Ltd.

- Amphenol Antenna Solutions

- Amphenol Procom

- Baylin Technologies Inc.

- CellMax Technologies AB

- Chelton Limited

- Comba Telecom Systems Holdings Ltd.

- CommScope Holding Company, Inc.

- Ericsson (KATHREIN-Werke)

- FiberHome Technologies Group

- Galtronics USA Inc.

- Guangdong Kenbotong Technology Co., Ltd.

- Huawei Technologies Co., Ltd.

- Kaelus Inc.

- Laird Connectivity

- Luxshare Precision Industry Co., Ltd.

- MagicRF Technology Co., Ltd.

- Molex LLC

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Ace Technologies Corporation

- Airgain Inc.

- Alpha Wireless Ltd.

- Amphenol Antenna Solutions

- Amphenol Procom

- Baylin Technologies Inc.

- CellMax Technologies AB

- Chelton Limited

- Comba Telecom Systems Holdings Ltd.

- CommScope Holding Company, Inc.

- Ericsson (KATHREIN-Werke)

- FiberHome Technologies Group

- Galtronics USA Inc.

- Guangdong Kenbotong Technology Co., Ltd.

- Huawei Technologies Co., Ltd.

- Kaelus Inc.

- Laird Connectivity

- Luxshare Precision Industry Co., Ltd.

- MagicRF Technology Co., Ltd.

- Molex LLC

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 382 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

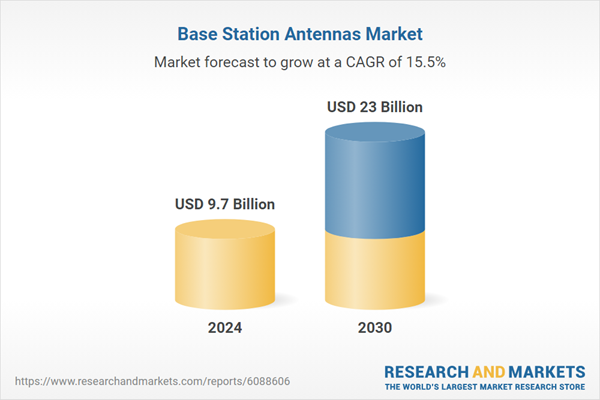

| Estimated Market Value ( USD | $ 9.7 Billion |

| Forecasted Market Value ( USD | $ 23 Billion |

| Compound Annual Growth Rate | 15.5% |

| Regions Covered | Global |