Global Precision Meters Market - Key Trends & Drivers Summarized

Why Are Precision Meters Critical to Industrial Accuracy, Compliance, and Efficiency?

Precision meters are advanced measuring instruments designed to deliver high-accuracy readings across a variety of parameters such as flow rate, temperature, pressure, electrical current, and volumetric measurements. These meters are fundamental in sectors that require exacting standards-such as pharmaceuticals, chemical processing, power generation, automotive manufacturing, aerospace, and food & beverage production. Inaccuracy or inconsistency in measurements in these domains can lead to production inefficiencies, quality control issues, safety hazards, or regulatory non-compliance.Unlike standard meters, precision meters are built to perform under stringent tolerance levels and environmental conditions. They are essential for process control, instrumentation, calibration, research testing, and metrology labs. Whether monitoring the dosage of medical compounds, fuel injection rates in engines, or power output in renewable energy systems, precision meters offer the data integrity and repeatability that high-reliability environments demand. Their increasing adoption is aligned with global movements toward digital manufacturing, real-time quality assurance, and data-driven operations.

How Are Advancements in Sensing Technology and Connectivity Elevating Meter Capabilities?

Precision meters have undergone significant evolution through innovations in sensor technology, digital signal processing, and wireless communication. The latest generation of meters features non-invasive sensors, real-time digital displays, and error-correction algorithms that enhance both measurement precision and reliability. Capacitive, piezoelectric, electromagnetic, ultrasonic, and optical sensing technologies are being utilized depending on the parameter being measured and the environmental conditions involved.The integration of IoT and industrial communication protocols such as Modbus, HART, and Ethernet/IP has enabled meters to be connected to distributed control systems (DCS), SCADA systems, and cloud platforms. This allows for remote monitoring, predictive maintenance, and data analytics at scale. Smart precision meters equipped with Bluetooth or LoRaWAN connectivity are increasingly used in field operations, particularly in utilities, agriculture, and environmental monitoring. These technologies are also driving the development of self-diagnosing and auto-calibrating meters, reducing downtime and enhancing measurement consistency.

Where Are Precision Meters Being Deployed Across Sectors and Applications?

In the energy sector, precision flow and temperature meters are critical for turbine optimization, fuel monitoring, and emission control in both conventional and renewable power plants. In pharmaceuticals and biotechnology, ultra-precise liquid and gas flow meters are used to ensure accurate formulation, sterile processing, and cleanroom compliance. The chemical industry employs precision mass flow meters and conductivity sensors to maintain batch consistency and safety standards in hazardous processing environments.In the automotive and aerospace sectors, torque meters, pressure transducers, and voltage testers are integral to test benches, component validation, and system diagnostics. Water utilities and environmental agencies rely on precision meters for resource tracking, leakage detection, and regulatory reporting. In manufacturing, metrology-grade instruments are deployed for tool calibration, production quality assurance, and machining accuracy. Laboratory-grade instruments also form a crucial part of scientific research, semiconductor fabrication, and nanotechnology where exact measurements are foundational to experimentation and innovation.

What's Driving the Global Growth of the Precision Meters Market?

The growth in the global precision meters market is driven by increasing demand for accuracy in industrial and scientific measurements, rising automation in manufacturing, and stricter regulatory compliance across sectors. As production systems become more complex and digitized, the margin for measurement error narrows. This has intensified the demand for high-resolution, low-drift, and high-frequency meter solutions that support lean manufacturing, energy optimization, and operational transparency.Sustainability goals and energy efficiency regulations are prompting industries to monitor and optimize resource use in real time-creating new use cases for flow, energy, and emission meters. In parallel, the growing adoption of Industry 4.0 and smart factory principles is creating demand for meters that are not only precise but also intelligent and interoperable. Government incentives for clean technologies, safety compliance, and process standardization are further fueling market expansion. As industries evolve toward precision-centric, digitally integrated operations, the global precision meters market is set to grow across diverse technical and geographic landscapes.

Report Scope

The report analyzes the Precision Meters market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Measurement Type (Voltage Meters, Current Meters, Power Meters, Frequency Meters, Energy Meters, Temperature Meters, Other Measurement Types); End-User (Electrical & Electronics, Automotive, Aerospace & Defense, Energy & Utilities, Manufacturing, Healthcare, Other End-Users).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Voltage Meters segment, which is expected to reach US$2.6 Billion by 2030 with a CAGR of a 4.5%. The Current Meters segment is also set to grow at 5.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.5 Billion in 2024, and China, forecasted to grow at an impressive 8% CAGR to reach $2.4 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Precision Meters Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Precision Meters Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Precision Meters Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ag Leader Technology, AGCO Corporation, AgJunction Inc., Bayer CropScience AG, Case IH Agriculture and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Precision Meters market report include:

- ABB Ltd.

- Ametek, Inc.

- B&K Precision Corporation

- Badger Meter, Inc.

- DIGI Group

- Emerson Electric Co.

- Endress+Hauser Group

- Honeywell International Inc.

- Itron, Inc.

- Kamstrup A/S

- Landis+Gyr Group AG

- Megger Group Limited

- Mettler-Toledo International Inc.

- Ningbo Water Meter Co., Ltd.

- Plumberstar

- Precision Digital Corporation

- Precision Flow Inc.

- Precision Meters (Pty) Ltd.

- Siemens AG

- Yokogawa Electric Corporation

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ABB Ltd.

- Ametek, Inc.

- B&K Precision Corporation

- Badger Meter, Inc.

- DIGI Group

- Emerson Electric Co.

- Endress+Hauser Group

- Honeywell International Inc.

- Itron, Inc.

- Kamstrup A/S

- Landis+Gyr Group AG

- Megger Group Limited

- Mettler-Toledo International Inc.

- Ningbo Water Meter Co., Ltd.

- Plumberstar

- Precision Digital Corporation

- Precision Flow Inc.

- Precision Meters (Pty) Ltd.

- Siemens AG

- Yokogawa Electric Corporation

Table Information

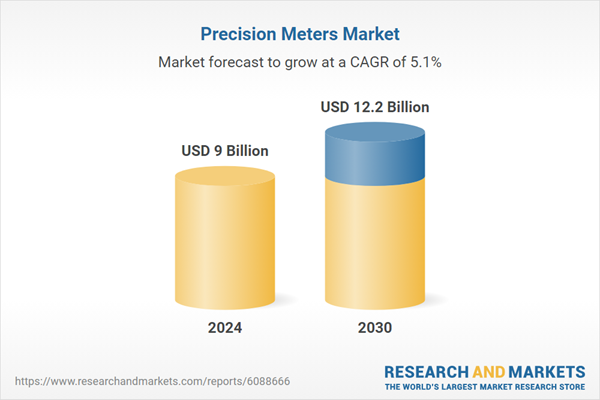

| Report Attribute | Details |

|---|---|

| No. of Pages | 304 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 9 Billion |

| Forecasted Market Value ( USD | $ 12.2 Billion |

| Compound Annual Growth Rate | 5.1% |

| Regions Covered | Global |