Global Optical Heart Rate Sensors Market - Key Trends & Drivers Summarized

Can Light-Based Sensing Redefine the Future of Cardiac Monitoring and Fitness Tracking?

Optical heart rate sensors, which measure pulse by detecting blood flow variations via photoplethysmography (PPG), are transforming how cardiovascular metrics are tracked in wearables, fitness devices, and clinical diagnostics. Unlike electrocardiogram (ECG) sensors that require direct skin contact with conductive electrodes, optical sensors operate non-invasively using light-emitting diodes (LEDs) and photodetectors to assess volumetric changes in blood. Their integration into consumer electronics - from smartwatches and earbuds to fitness bands and smart rings - has made continuous heart rate monitoring a ubiquitous health metric for millions.As digital health moves toward proactive and personalized care, optical heart rate sensors are being leveraged for more than just exercise feedback. Advanced devices now support heart rate variability (HRV), atrial fibrillation (AFib) detection, and stress level analysis, empowering users to identify anomalies and optimize physical and emotional well-being. In clinical settings, these sensors are entering ambulatory care and remote patient monitoring programs, especially for chronic cardiac patients and the elderly, due to their comfort, affordability, and ease of use.

Why Are Accuracy Enhancements and Multimodal Integration Fueling Innovation?

While optical heart rate sensors have long been appreciated for convenience, their accuracy - particularly during motion, low perfusion, or dark skin tones - has been a technical hurdle. Recent innovations are overcoming these challenges through multi-wavelength sensing (e.g., green, red, IR), adaptive signal processing algorithms, and machine learning-based motion artifact correction. Leading OEMs are combining optical sensors with accelerometers, gyroscopes, and skin temperature sensors to compensate for movement-induced errors and improve signal fidelity.Moreover, multimodal integration is elevating the value proposition of wearables. Devices that incorporate optical heart rate monitoring with SpO2, respiration rate, blood pressure estimation, and electrodermal activity provide a more holistic picture of cardiovascular and metabolic health. The miniaturization of optical components and adoption of low-power light sources have made continuous monitoring feasible without compromising battery life - key for 24/7 health tracking.

How Are Regulatory Recognition and Preventive Health Trends Driving Market Penetration?

The validation of optical heart rate sensing for medical-grade applications is steadily increasing. Some wearable devices have received FDA clearance or CE marking for detecting conditions such as AFib, placing them in the evolving category of consumer-medical hybrid devices. This is a significant shift from purely wellness-focused sensors to regulated tools capable of clinical decision support. It also opens opportunities for integration into electronic health records (EHRs), telehealth platforms, and disease management ecosystems.Preventive healthcare is another powerful driver. With cardiovascular diseases (CVDs) continuing to be the leading cause of mortality globally, early detection and behavioral interventions are crucial. Governments, employers, and insurers are promoting heart health awareness campaigns and incentivizing the use of digital health tools. Optical heart rate sensors, being user-friendly and non-intrusive, are positioned as front-line data sources in this paradigm, especially among at-risk populations seeking lifestyle modification tools.

What's Accelerating the Global Demand for Optical Heart Rate Sensors?

The growth in the optical heart rate sensors market is driven by the convergence of consumer health awareness, wearable technology innovation, and digital health integration. A primary growth driver is the explosive demand for smart wearables, particularly in Asia-Pacific, North America, and Europe. Leading brands such as Apple, Fitbit, Garmin, Huawei, and Samsung are continuously refining their sensor stacks to deliver real-time, high-precision cardiac insights across diverse demographics and lifestyles.Additionally, the expansion of remote patient monitoring programs - especially post-COVID - has triggered adoption of sensor-based health assessment kits, where optical heart rate monitoring plays a key role. In parallel, the rise of AI-enabled health platforms and personalized fitness ecosystems is increasing the value of continuous heart rate data for trend analysis, anomaly alerts, and behavioral nudging.

As the lines blur between wellness and clinical monitoring, optical heart rate sensors will remain at the forefront of democratized health intelligence. Their portability, versatility, and compatibility with smart ecosystems ensure enduring relevance in the evolving landscape of digital cardiology and health optimization.

Report Scope

The report analyzes the Optical Heart Rate Sensors market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Photoplethysmography Sensors, Electrocardiography Sensors); Application (Smart Bracelet, Smartwatches, Headset, Smart Phone, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Photoplethysmography Sensors segment, which is expected to reach US$1.9 Billion by 2030 with a CAGR of a 9%. The Electrocardiography Sensors segment is also set to grow at 12.8% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $468.7 Million in 2024, and China, forecasted to grow at an impressive 13.9% CAGR to reach $630.6 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Optical Heart Rate Sensors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Optical Heart Rate Sensors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Optical Heart Rate Sensors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as AFL Global, Corning Incorporated, Fasten Group, FCJ Opto Tech, FiberHome and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 42 companies featured in this Optical Heart Rate Sensors market report include:

- AliveCor

- ams OSRAM

- Analog Devices, Inc.

- Apple Inc.

- Biotricity

- CardiacSense Ltd

- Cardiosport

- COROS Wearables

- Fitbit Inc.

- Garmin Ltd.

- Maxim Integrated

- OSRAM Licht AG

- Philips Healthcare

- Polar Electro

- ROHM Semiconductor

- Samsung Electronics

- Silicon Laboratories

- Suunto

- Texas Instruments Inc.

- Valencell

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AliveCor

- ams OSRAM

- Analog Devices, Inc.

- Apple Inc.

- Biotricity

- CardiacSense Ltd

- Cardiosport

- COROS Wearables

- Fitbit Inc.

- Garmin Ltd.

- Maxim Integrated

- OSRAM Licht AG

- Philips Healthcare

- Polar Electro

- ROHM Semiconductor

- Samsung Electronics

- Silicon Laboratories

- Suunto

- Texas Instruments Inc.

- Valencell

Table Information

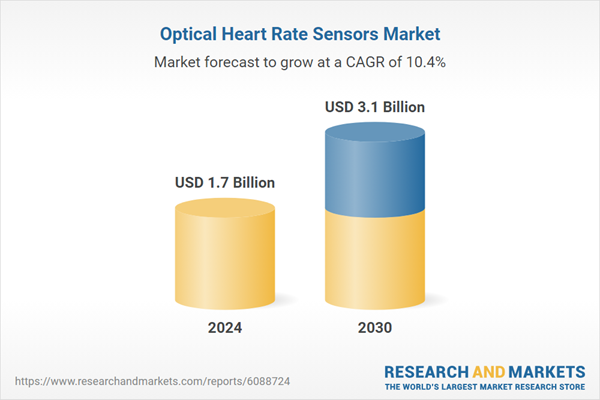

| Report Attribute | Details |

|---|---|

| No. of Pages | 282 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.7 Billion |

| Forecasted Market Value ( USD | $ 3.1 Billion |

| Compound Annual Growth Rate | 10.4% |

| Regions Covered | Global |