Global Optical Detectors Market - Key Trends & Drivers Summarized

How Are Optical Detectors Powering the Intelligence Behind Light-Driven Systems?

Optical detectors - devices that convert light into electrical signals - form the backbone of modern photonics, enabling precision sensing, imaging, communication, and instrumentation across a multitude of industries. These detectors range from simple photodiodes and phototransistors to advanced charge-coupled devices (CCDs), complementary metal-oxide-semiconductor (CMOS) sensors, avalanche photodiodes (APDs), and quantum detectors. As photonic technologies continue to permeate fields such as telecommunications, autonomous vehicles, healthcare, aerospace, and environmental monitoring, the demand for high-speed, low-noise, and high-sensitivity optical detectors is surging globally.The rapid digitization of industrial systems - through Industry 4.0, smart factories, and sensor-rich IoT ecosystems - is expanding the use of optical detection in automation, safety, and analytics. From lidar sensors in driverless cars to pulse oximeters in wearable health devices, optical detectors are instrumental in capturing, processing, and interpreting light-based data. With the growing push toward contactless measurement, real-time monitoring, and ultra-precise optical instrumentation, the detector market is evolving from commodity electronics into a strategic pillar of intelligent system design.

Why Are Speed, Sensitivity, and Wavelength Agility Becoming Critical Differentiators?

As application needs diversify, the performance demands on optical detectors are becoming more stringent. Speed (response time), spectral range, quantum efficiency, and noise performance are now key selection criteria in sectors such as high-speed optical communications, hyperspectral imaging, and quantum computing. Photodetectors capable of operating in the ultraviolet (UV), near-infrared (NIR), and mid-infrared (MIR) ranges are increasingly sought for applications in spectroscopy, thermal imaging, LIDAR, and biomedical diagnostics.To meet these needs, manufacturers are investing in compound semiconductor materials such as indium gallium arsenide (InGaAs), germanium, and mercury cadmium telluride (MCT) to expand detection capabilities beyond the visible spectrum. Hybrid detector arrays combining different sensing materials, pixel geometries, or photonic integration are enabling advanced imaging systems with unprecedented resolution and sensitivity. Miniaturized CMOS-compatible detectors are also gaining traction in portable and edge-computing devices, allowing photonic sensing to scale into mass-market consumer and industrial electronics.

How Is Technological Convergence Expanding Application Frontiers for Optical Detection?

Optical detectors are becoming increasingly integrated with advanced signal processing, machine learning, and networking technologies to deliver actionable intelligence. In biomedical imaging, for instance, photodetectors embedded in compact diagnostic devices enable real-time optical coherence tomography (OCT), fluorescence microscopy, and flow cytometry at the point of care. In aerospace and defense, photon-counting detectors are being used in LiDAR and laser range-finding systems for navigation, targeting, and terrain mapping.Telecommunications is another major driver, with coherent detection and high-bandwidth photodiodes enabling the evolution of 5G/6G and high-speed fiber optics. In consumer electronics, the integration of miniature detectors in cameras, facial recognition systems, and ambient light sensors is transforming device interaction and user experience. Environmental monitoring, agriculture, and energy sectors are adopting multispectral optical detection for real-time air quality analysis, crop health assessment, and laser-based power line inspection.

What's Driving the Upward Momentum of the Optical Detectors Market?

The growth in the optical detectors market is driven by increasing reliance on photonics for sensing, automation, and communication across high-growth industries. A major growth driver is the deployment of optical sensing in automotive safety systems - particularly LIDAR for ADAS (advanced driver-assistance systems) and autonomous navigation. As automotive OEMs and Tier-1 suppliers expand investments in solid-state LIDAR and 3D mapping, detector suppliers are innovating for compact form factors, enhanced detection ranges, and cost scalability.Simultaneously, the proliferation of optical detection in healthcare diagnostics - fueled by wearable health monitoring, rapid disease detection, and home-based medical devices - is opening new commercial avenues. Defense budgets and aerospace modernization initiatives are supporting the adoption of high-end detectors in surveillance, missile guidance, and remote sensing. Furthermore, the miniaturization and integration of optical detectors with AI-powered analytics are enabling edge applications in consumer, industrial, and robotics domains.

As demand grows for faster, smarter, and spectrum-diverse photonic systems, the global optical detectors market is poised for continuous growth. With innovations in material science, integration platforms, and application-specific performance tuning, optical detectors are emerging as critical components of tomorrow's data-driven, light-enabled technologies.

Report Scope

The report analyzes the Optical Detectors market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Type (Extrinsic, Intrinsic); Sensor Type (Fiber Optic Sensor, Image Sensor, Photoelectric Sensor, Ambient Light, Proximity Sensor); End-Use (Automotive, Medical, Consumer Electronics, Industrial, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Extrinsic Detectors segment, which is expected to reach US$4.6 Billion by 2030 with a CAGR of a 8.3%. The Intrinsic Detectors segment is also set to grow at 12.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $1.2 Billion in 2024, and China, forecasted to grow at an impressive 13.1% CAGR to reach $1.6 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Optical Detectors Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Optical Detectors Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Optical Detectors Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Axelor, Bitrix24, CiviCRM, Corteza, Dolibarr and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Optical Detectors market report include:

- ams OSRAM

- Broadcom Inc.

- Coherent Corp.

- DECTRIS Ltd.

- Excelitas Technologies

- Hamamatsu Photonics

- Jenoptik AG

- LightPath Technologies

- MACOM Technology Solutions

- Newport Corporation

- Novacam Technologies Inc.

- Ocean Optics

- OMNIVISION

- Ophir Optronics

- OSI Optoelectronics

- Pantron Instruments GmbH

- Phlux Technology

- ROHM Semiconductor

- SensoPart Industriesensorik

- Viscom AG

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- ams OSRAM

- Broadcom Inc.

- Coherent Corp.

- DECTRIS Ltd.

- Excelitas Technologies

- Hamamatsu Photonics

- Jenoptik AG

- LightPath Technologies

- MACOM Technology Solutions

- Newport Corporation

- Novacam Technologies Inc.

- Ocean Optics

- OMNIVISION

- Ophir Optronics

- OSI Optoelectronics

- Pantron Instruments GmbH

- Phlux Technology

- ROHM Semiconductor

- SensoPart Industriesensorik

- Viscom AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 385 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

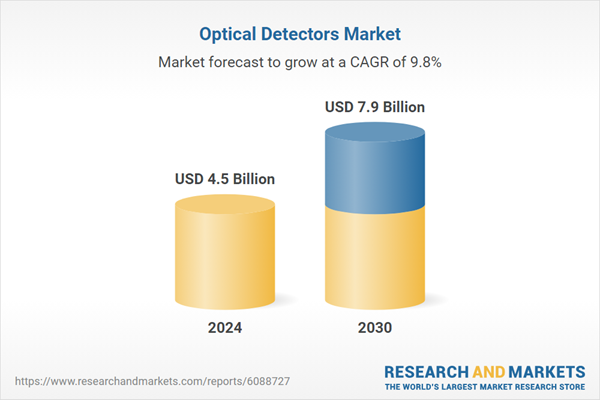

| Estimated Market Value ( USD | $ 4.5 Billion |

| Forecasted Market Value ( USD | $ 7.9 Billion |

| Compound Annual Growth Rate | 9.8% |

| Regions Covered | Global |