Global OLED Materials Market - Key Trends & Drivers Summarized

Can Materials Innovation Propel OLEDs Beyond Current Performance Limits?

OLED materials form the foundational components of organic light-emitting diode displays, encompassing emissive, conductive, and encapsulation layers that enable light generation and transport. These materials include small molecules, polymers, host-dopant systems, and encapsulants that define the brightness, efficiency, color purity, and lifetime of OLED devices. As OLED adoption grows across smartphones, TVs, tablets, laptops, automotive dashboards, and emerging wearables, the market for high-performance OLED materials is expanding rapidly. With the industry shifting from LCD to OLED for superior contrast, flexibility, and design freedom, materials science has become the central driver of performance, durability, and cost competitiveness.The rise of high-resolution displays (4K, 8K), foldable form factors, and power-efficient panels is increasing demand for next-generation OLED materials, such as thermally activated delayed fluorescence (TADF) emitters, fluorescent blue emitters with extended lifespans, and hybrid host systems. Manufacturers are investing in material formulations that deliver high external quantum efficiency (EQE), low voltage operation, and minimal burn-in while meeting production scalability and environmental safety standards. The evolution of tandem OLED structures and hybrid OLED-QLED displays is further catalyzing R&D in novel emitter and charge transport materials.

Why Are Efficiency and Lifetime Improvements Fueling the R&D Race?

Despite commercial success, OLED displays face inherent limitations - particularly in the short lifespan of blue emitters and overall power efficiency under high-brightness use cases. As a result, materials suppliers and display OEMs are prioritizing research into longer-lasting blue phosphorescent and TADF emitters that can match the stability of red and green counterparts. Blue-emitting materials capable of operating at high luminance without thermal degradation are considered the “holy grail” of OLED materials innovation.Efficiency is another key challenge. Materials that enable higher charge carrier mobility, better charge balance, and reduced energy loss are crucial for improving OLED panel power consumption, especially in battery-sensitive applications like smartphones and wearables. This has spurred interest in low-voltage electron injection layers, highly crystalline organic semiconductors, and advanced light outcoupling layers. Cross-disciplinary research integrating quantum chemistry, molecular modeling, and nano-engineering is being deployed to accelerate innovation and shorten commercialization timelines.

How Is the Material Supply Chain Evolving Amid Growing OLED Demand?

The OLED materials supply chain is consolidating and diversifying simultaneously. Key players such as Universal Display Corporation (UDC), DuPont, Merck, LG Chem, Idemitsu Kosan, and Sumitomo Chemical are enhancing their OLED material portfolios and expanding manufacturing footprints to meet rising demand. Materials suppliers are entering long-term partnerships and licensing agreements with display manufacturers to secure pipeline revenues and jointly develop customized emissive or transport layer formulations.Geographic diversification is also underway, with China aggressively investing in domestic OLED materials development to reduce reliance on imported IP-protected materials. Several Chinese firms are investing in small molecule and polymer OLED materials targeting Gen 6 and Gen 8+ fab deployments. Meanwhile, the push for environmentally sustainable materials and solvent-free processing is influencing supplier R&D and regulatory strategy, particularly in Europe and North America. With the proliferation of multi-stack OLED and foldable OLED technologies, the complexity of materials sourcing and supply chain integration is increasing, creating opportunities for niche innovators and vertically integrated players alike.

What's Driving the Accelerated Growth of the OLED Materials Market?

The growth in the OLED materials market is driven by explosive demand for OLED displays, technological migration from LCD to OLED in consumer devices, and continuous innovation in organic chemistry for enhanced performance. A major driver is the surge in smartphone and wearable OLED adoption, as manufacturers prioritize slimmer, lighter, and more power-efficient screens with superior contrast and flexibility. OLED TV penetration is also rising, with brands like LG, Sony, and Samsung expanding their premium OLED lines while new entrants in China boost demand for emissive materials.In automotive interiors, OLED displays are gaining traction due to their curvature, contrast, and ambient light adaptability. This use case demands durable, heat-resistant materials capable of maintaining brightness and color fidelity under variable operating conditions. As OLED lighting applications also gain niche traction in automotive, architectural, and luxury lighting, the material demand base is diversifying. The development of flexible, stretchable, and transparent OLEDs for future foldable and rollable devices is further amplifying R&D momentum across emissive and barrier material segments.

With constant progress in emissive layer technology, improved charge transport, and encapsulation innovations, the OLED materials market is poised for long-term growth. As device manufacturers demand better color tuning, energy efficiency, and mechanical flexibility, materials suppliers will remain the linchpin of OLED ecosystem evolution, driving breakthroughs that define the future of display and lighting innovation.

Report Scope

The report analyzes the OLED Materials market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Substrate, Encapsulation, Anode, HIL, HTL, ETL, EML, Cathode, Other Product Types); Application (Residential, Commercial, Industrial).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Substrate segment, which is expected to reach US$27.1 Billion by 2030 with a CAGR of a 24.9%. The Encapsulation segment is also set to grow at 17.7% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $8.3 Billion in 2024, and China, forecasted to grow at an impressive 28.5% CAGR to reach $23 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global OLED Materials Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global OLED Materials Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global OLED Materials Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Aixtron SE, Applied Materials, Inc., Canon Tokki Corporation, Contrel Technology, DEVICEENG Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 39 companies featured in this OLED Materials market report include:

- AU Optronics Corp.

- BOE Technology Group Co., Ltd.

- Cynora GmbH

- DuPont de Nemours, Inc.

- eMagin Corporation

- Idemitsu Kosan Co., Ltd.

- Jilin OLED Material Tech Co., Ltd.

- Kyulux, Inc.

- LG Chem Ltd.

- Merck KGaA

- Novaled GmbH

- OLEDWorks LLC

- PPG Industries, Inc.

- Samsung SDI Co., Ltd.

- SFC Co., Ltd.

- Solus Advanced Materials Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- TCI America

- Universal Display Corporation

- Visionox Technology Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AU Optronics Corp.

- BOE Technology Group Co., Ltd.

- Cynora GmbH

- DuPont de Nemours, Inc.

- eMagin Corporation

- Idemitsu Kosan Co., Ltd.

- Jilin OLED Material Tech Co., Ltd.

- Kyulux, Inc.

- LG Chem Ltd.

- Merck KGaA

- Novaled GmbH

- OLEDWorks LLC

- PPG Industries, Inc.

- Samsung SDI Co., Ltd.

- SFC Co., Ltd.

- Solus Advanced Materials Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- TCI America

- Universal Display Corporation

- Visionox Technology Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 294 |

| Published | January 2026 |

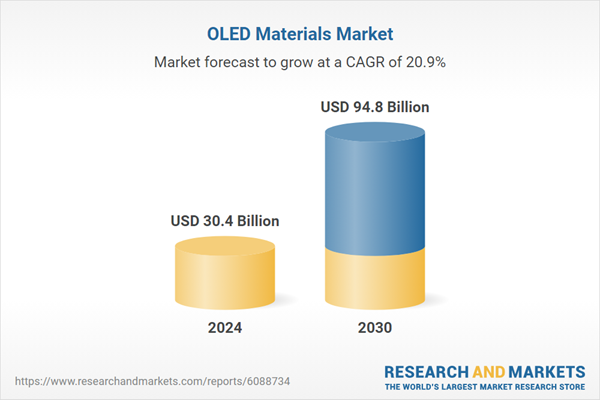

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 30.4 Billion |

| Forecasted Market Value ( USD | $ 94.8 Billion |

| Compound Annual Growth Rate | 20.9% |

| Regions Covered | Global |