Global Non-Invasive Cancer Diagnostics Market - Key Trends & Drivers Summarized

Can Cancer Detection Be Revolutionized Without a Scalpel or Biopsy Needle?

Non-invasive cancer diagnostics are transforming the oncology landscape by enabling early, accurate detection and monitoring of malignancies through bodily fluids and imaging, rather than invasive tissue biopsies. Leveraging biomarkers found in blood, urine, saliva, and exhaled breath, these technologies allow clinicians to identify cancers at nascent stages, improving prognosis and reducing procedural risks. Techniques such as liquid biopsies, circulating tumor DNA (ctDNA) analysis, exosome profiling, and molecular imaging are emerging as critical tools in personalized oncology. These approaches are especially impactful in screening hard-to-access cancers like pancreatic, ovarian, and lung, where traditional biopsies pose high risk and low yield.The convergence of genomics, proteomics, and advanced imaging has expanded the scope of non-invasive diagnostics beyond mere detection to encompass tumor typing, mutation profiling, and real-time treatment response monitoring. Liquid biopsies, for instance, are being used not only for initial cancer diagnosis but also for identifying resistance mutations during therapy and tracking minimal residual disease post-treatment. These modalities offer advantages in repeat testing, reduced patient discomfort, and faster turnaround, aligning with the growing emphasis on patient-centric and precision-based cancer care. They are increasingly being integrated into clinical guidelines and trial designs across major oncology centers worldwide.

Why Is the Demand for Less Invasive, Faster Diagnostics Gaining Ground Globally?

The demand for non-invasive diagnostics is surging due to a combination of demographic, clinical, and economic factors. Globally rising cancer incidence, aging populations, and growing awareness of the benefits of early detection are prompting health systems to adopt screening tools that are scalable, non-traumatic, and cost-effective. Governments and public health programs are prioritizing non-invasive diagnostics to expand population-based screening, especially in low- and middle-income countries where access to surgical biopsy facilities remains limited. These tools offer the possibility of early intervention before symptom onset, thereby reducing the burden of late-stage cancer treatment and improving survival rates.In high-income countries, the shift toward value-based care models is compelling payers and providers to favor diagnostic solutions that reduce unnecessary procedures, hospitalizations, and treatment delays. Non-invasive tests enable efficient risk stratification and reduce the dependence on high-cost imaging or exploratory surgery. Furthermore, patient preference is increasingly influencing clinical choices - minimally invasive options are gaining traction among individuals wary of pain, complications, and repeated invasive monitoring. From lung cancer breath analysis to stool-DNA testing for colorectal cancer, diverse platforms are being embraced by patients seeking accessible, home-based diagnostic solutions.

How Are Cutting-Edge Technologies Elevating Diagnostic Precision and Accessibility?

Advanced technologies such as next-generation sequencing (NGS), digital PCR, microfluidics, and machine learning are enhancing the sensitivity, specificity, and scalability of non-invasive cancer diagnostics. NGS-based liquid biopsies now detect single nucleotide variants, copy number alterations, and fusion genes from as little as 1 mL of plasma, enabling comprehensive tumor profiling. Digital PCR platforms offer ultra-sensitive quantification of ctDNA, supporting longitudinal monitoring with unmatched precision. Microfluidic chips are being developed to isolate circulating tumor cells (CTCs) and exosomes in real time, supporting decentralized testing and point-of-care diagnostics.Artificial intelligence (AI) and data analytics are being applied to radiomics and pathology imaging to extract deep phenotypic features from non-invasive scans. Radiogenomics is enabling the integration of imaging biomarkers with genomic data to non-invasively infer molecular subtypes of tumors. Cloud-connected diagnostic platforms allow clinicians to remotely monitor disease progression and therapy response using serial blood tests or imaging scans. Startups and medtech innovators are focusing on multiplexed assays, wearable sensors, and at-home diagnostic kits, democratizing access and enabling proactive cancer surveillance for high-risk populations.

What's Driving the Breakneck Growth in the Non-Invasive Cancer Diagnostics Market?

The growth in the non-invasive cancer diagnostics market is driven by several powerful forces that are reshaping the global oncology ecosystem. A key driver is the growing adoption of precision medicine, where early, non-invasive detection is foundational to treatment planning, companion diagnostics, and real-time monitoring. Biopharma companies are increasingly collaborating with diagnostic firms to co-develop assays that guide targeted therapy selection and clinical trial enrollment, accelerating commercialization and reimbursement support.Another crucial growth catalyst is the rising acceptance of liquid biopsies and non-invasive tests by regulatory bodies, clinical societies, and payers. The FDA's accelerated approvals of ctDNA-based companion diagnostics and CMS's favorable reimbursement decisions for multi-cancer detection tests have validated market potential and driven investment. Clinical trials and real-world studies continue to demonstrate the utility of these tools in detecting early-stage cancers, tracking resistance mutations, and improving treatment outcomes. In parallel, rising venture capital inflows and M&A activity are fueling innovation and global market expansion.

The expanding use of multi-omics platforms, AI-enhanced diagnostics, and decentralized sample collection is also reducing cost barriers and bringing non-invasive cancer diagnostics to outpatient settings, primary care clinics, and even patients' homes. As oncology transitions into a continuous-care model focused on prevention, monitoring, and survivorship, non-invasive diagnostics will play a central role in transforming cancer from a late-stage crisis to a manageable chronic condition. With robust R&D pipelines, supportive policy landscapes, and strong clinical momentum, the market is poised for exponential growth across indications and geographies.

Report Scope

The report analyzes the Non-Invasive Cancer Diagnostics market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Immunochemistry, Clinical Microbiology, Point of Care Test, Hematology, Other Product Types); Cancer Type (Lung Cancer, Breast Cancer, Solid Tumors, Blood Cancer, Ovarian Cancer, Other Cancer Types); End-Use (Hospitals & Clinics, Diagnostic Centers, Ambulatory Care, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Immunochemistry segment, which is expected to reach US$100.5 Billion by 2030 with a CAGR of a 8.1%. The Clinical Microbiology segment is also set to grow at 4% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $42.6 Billion in 2024, and China, forecasted to grow at an impressive 10.1% CAGR to reach $46.8 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Non-Invasive Cancer Diagnostics Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Non-Invasive Cancer Diagnostics Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Non-Invasive Cancer Diagnostics Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as ABB Ltd., Altech Corporation, CG Power and Industrial Solutions Limited, CHINT Group, Craig & Derricott Limited and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Non-Invasive Cancer Diagnostics market report include:

- Biocept, Inc.

- Caris Life Sciences

- Datar Cancer Genetics

- DELFI Diagnostics

- Exact Sciences Corporation

- Foundation Medicine

- Freenome Holdings, Inc.

- Guardant Health, Inc.

- iCAD, Inc.

- Illumina, Inc.

- Lucence Health Inc.

- Myriad Genetics, Inc.

- Natera, Inc.

- Oncocyte Corporation

- Pacific Edge Ltd.

- QIAGEN N.V.

- Roche Diagnostics

- SAGA Diagnostics AB

- Thermo Fisher Scientific

- Veracyte, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Biocept, Inc.

- Caris Life Sciences

- Datar Cancer Genetics

- DELFI Diagnostics

- Exact Sciences Corporation

- Foundation Medicine

- Freenome Holdings, Inc.

- Guardant Health, Inc.

- iCAD, Inc.

- Illumina, Inc.

- Lucence Health Inc.

- Myriad Genetics, Inc.

- Natera, Inc.

- Oncocyte Corporation

- Pacific Edge Ltd.

- QIAGEN N.V.

- Roche Diagnostics

- SAGA Diagnostics AB

- Thermo Fisher Scientific

- Veracyte, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 385 |

| Published | January 2026 |

| Forecast Period | 2024 - 2030 |

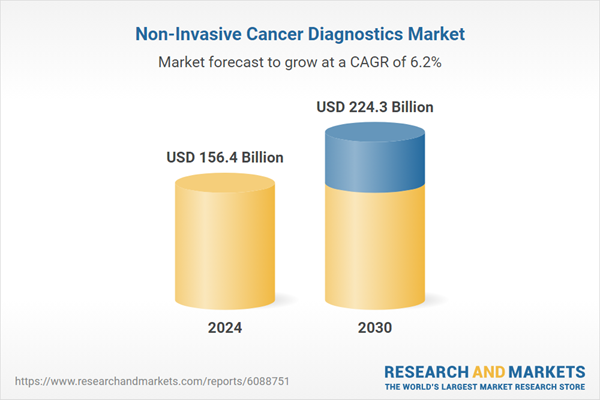

| Estimated Market Value ( USD | $ 156.4 Billion |

| Forecasted Market Value ( USD | $ 224.3 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |