Global 'Recycled Metals' Market - Key Trends & Drivers Summarized

Are Recycled Metals The Engine Of Sustainable Industrialization?

Recycled metals are becoming a cornerstone of sustainable industrial practices, offering a lower-carbon, energy-efficient alternative to virgin metal extraction. With increasing demand for steel, aluminum, copper, and rare earths across automotive, construction, aerospace, and electronics, recycling is helping bridge supply gaps and reduce environmental impacts. The production of recycled metals consumes significantly less energy - up to 95% less for aluminum and 60% less for steel - making them central to decarbonization strategies. As industries pursue ESG goals and governments legislate circular economy policies, recycled metals are not just a byproduct - they are a strategic input to cleaner, more resilient supply chains.How Are Smart Recycling Technologies Improving Metal Recovery Rates?

The metal recycling sector is rapidly adopting advanced technologies to improve efficiency, material purity, and traceability. AI-enabled sorting systems, eddy current separators, and x-ray fluorescence (XRF) analyzers are enabling precise separation of mixed metal waste streams. Robotics and automation are speeding up scrap processing and reducing labor costs. Closed-loop recycling systems in manufacturing ensure internal metal waste is continuously reused. Blockchain is being tested for end-to-end material tracking, particularly in critical metal supply chains. Mobile shredders, smarter logistics, and real-time pricing platforms are also increasing the agility and profitability of metal recycling operations. These innovations are transforming scrap into a high-value, traceable resource.Which Industries Are Driving The Recycled Metals Boom?

The construction industry is a major consumer of recycled steel and aluminum for structural beams, rebar, and facades. Automotive OEMs are integrating recycled metals into body panels, engines, and EV battery systems to lower carbon footprints. Electronics manufacturers rely on recycled copper, aluminum, and rare earth elements for circuit boards, casings, and power components. Aerospace and defense firms are incorporating high-purity recycled metals to meet both cost and compliance needs. Consumer goods companies are also switching to recycled metal packaging to align with sustainability mandates. As demand for electric vehicles, smart cities, and renewable energy infrastructure grows, so too does the reliance on recycled metal resources.What's Powering The Growth Of The Recycled Metals Market?

The growth in the recycled metals market is driven by environmental regulations, material scarcity, and advancements in recovery and refining technologies. On the technology front, improved sorting, alloy separation, and closed-loop processing are maximizing yield and purity. End-use demand is rising from green construction, EV manufacturing, and electronics recycling programs. Public policies such as carbon pricing, extended producer responsibility (EPR), and export restrictions on virgin ores are incentivizing recycled metal use. Moreover, sustainability-conscious consumers and institutional investors are pressuring companies to disclose and reduce embodied carbon. These forces are making recycled metals an essential pillar of global material strategies.Report Scope

The report analyzes the Recycled Metals market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Metal (Ferrous Metals, Non-Ferrous Metals); Material Source (Post-Consumer Scrap, Industrial Scrap, Construction Scrap, Obsolete Electronics); Recycling Process (Shredding & Melting, Electrolysis, Smelting, Hydrometallurgical Processes); End-Use (Construction, Automotive, Electronics, Packaging, Energy, Manufacturing, Aerospace, Jewelry & Art).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Ferrous Metals segment, which is expected to reach US$58.5 Billion by 2030 with a CAGR of a 8.9%. The Non-Ferrous Metals segment is also set to grow at 5% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $15.6 Billion in 2024, and China, forecasted to grow at an impressive 11.9% CAGR to reach $18.9 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Recycled Metals Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Recycled Metals Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Recycled Metals Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 2M Ressources Inc., ACE Glass Recycling, Ardagh Group S.A., Balcones Resources, Berryman Glass Recycling and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 48 companies featured in this Recycled Metals market report include:

- AMG Vanadium

- Aqua Metals

- ArcelorMittal

- Aurubis AG

- Baosteel Co., Ltd.

- Commercial Metals Company (CMC)

- Dowa Holdings Co., Ltd.

- European Metal Recycling Ltd.

- Gerdau S.A.

- Hanwa Co., Ltd.

- Kuusakoski Recycling

- Novelis Inc.

- Nucor Corporation

- Real Alloy

- REMONDIS SE & Co. KG

- Sims Metal

- Sojitz Corporation

- Tata Steel

- TMS International

- Umicore

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- AMG Vanadium

- Aqua Metals

- ArcelorMittal

- Aurubis AG

- Baosteel Co., Ltd.

- Commercial Metals Company (CMC)

- Dowa Holdings Co., Ltd.

- European Metal Recycling Ltd.

- Gerdau S.A.

- Hanwa Co., Ltd.

- Kuusakoski Recycling

- Novelis Inc.

- Nucor Corporation

- Real Alloy

- REMONDIS SE & Co. KG

- Sims Metal

- Sojitz Corporation

- Tata Steel

- TMS International

- Umicore

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 495 |

| Published | February 2026 |

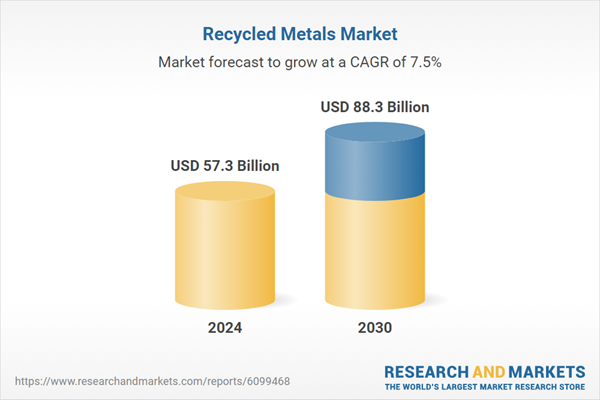

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 57.3 Billion |

| Forecasted Market Value ( USD | $ 88.3 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |