Global Plastic Alloys Market - Key Trends & Drivers Summarized

What Makes Plastic Alloys a Preferred Solution in Engineering-Grade Material Applications?

Plastic alloys, or polymer blends, are emerging as high-performance materials that combine the best properties of two or more polymer types to meet application-specific demands. By merging the characteristics of different plastics - such as impact resistance, heat stability, chemical inertness, and optical clarity - plastic alloys offer tailored performance that single-resin polymers often cannot achieve. These materials are particularly valuable in automotive, electronics, healthcare, and aerospace industries where durability, dimensional stability, and processability are critical.Unlike composites that incorporate fillers or reinforcements, plastic alloys rely on molecular-level compatibility and interphase adhesion between base polymers to form a homogeneous material. Common combinations include PC/ABS (polycarbonate/acrylonitrile butadiene styrene), PC/PBT (polycarbonate/polybutylene terephthalate), and PPE/PS (polyphenylene ether/polystyrene), each offering unique mechanical, electrical, and thermal properties. These materials are used in applications ranging from laptop housings and medical equipment enclosures to automotive fascia and under-the-hood components. Their ability to balance cost and performance is making plastic alloys a go-to solution in design-intensive, weight-sensitive, and reliability-critical product segments.

How Are Compatibilization and Blending Techniques Improving Alloy Performance?

The compatibility of different polymers is a key determinant of plastic alloy performance. Most base resins are inherently immiscible, necessitating the use of compatibilizers - functionalized block copolymers or reactive additives - that enhance interfacial bonding and phase dispersion. These compatibilizers improve impact strength, stress cracking resistance, and long-term thermal stability, allowing the alloy to function under demanding environmental conditions. Advanced twin-screw extrusion and reactive blending techniques are being employed to achieve fine-phase morphologies, uniform mixing, and repeatable material characteristics.Nanocomposite reinforcements and coupling agents are also being used to further enhance alloy performance in specific applications. For example, adding glass fibers to PC/PBT alloys improves stiffness and heat resistance, while rubber modifiers increase toughness for structural load-bearing parts. Moreover, flame retardants, UV stabilizers, and antistatic additives are being incorporated to customize the material for regulatory compliance and application longevity. These processing innovations are significantly widening the usability of plastic alloys across consumer electronics, telecommunications, electrical components, and automotive interiors where multi-functional performance is essential.

Which Sectors Are Leading Demand for High-Performance Plastic Alloys?

The automotive industry is the largest consumer of plastic alloys, utilizing them for interior trim, bumper beams, instrument panels, mirror housings, and engine compartment parts. Their superior dimensional stability, surface aesthetics, and resistance to high temperatures make them ideal for replacing metal or single-resin plastics in both ICE and electric vehicles. Lightweight plastic alloys also contribute to improved fuel efficiency and reduced emissions - key metrics in modern vehicle design.The electrical and electronics sector is another high-growth area, where plastic alloys are used in connectors, switches, circuit board housings, and insulation components. Flame-retardant grades are particularly important in meeting UL standards and ensuring operational safety in high-voltage or heat-generating environments. In the healthcare sector, medical device housings made from plastic alloys provide chemical resistance to disinfectants, sterilization durability, and patient-safe aesthetics. Aerospace and defense applications are increasingly turning to thermoplastic alloys for their strength-to-weight ratios and environmental durability, especially in cabin interiors, instrument panels, and lightweight enclosures. These diverse application areas underscore the material's versatility and long-term strategic importance.

What's Driving the Accelerated Growth of the Global Plastic Alloys Market?

The growth in the global plastic alloys market is driven by several factors, including the need for high-performance, lightweight, and cost-effective materials across design-intensive industries. The convergence of engineering requirements such as impact resistance, thermal endurance, dimensional precision, and regulatory compliance is fostering material substitution away from metals and single-polymers toward more adaptable plastic alloy systems. Rapid innovation in polymer compatibilization, additive integration, and compounding technologies is enabling the development of application-specific grades that fulfill functional and environmental criteria.Sustainability trends are also influencing demand, with recyclability and reusability becoming essential design priorities. Many plastic alloy manufacturers are now incorporating post-consumer resins (PCRs) or bio-based feedstocks to meet eco-labeling and circular economy goals. Furthermore, the expansion of electric mobility, 5G infrastructure, and miniaturized electronics is creating new material needs that plastic alloys are uniquely equipped to address. As product development cycles shorten and performance expectations rise, plastic alloys are emerging as an indispensable class of advanced materials poised to deliver customized, compliant, and high-performing solutions across global manufacturing ecosystems.

Report Scope

The report analyzes the Plastic Alloys market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Physical Methods, Chemical Methods); Application (Electronic, Automotive, Construction, Other Applications).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Physical Methods segment, which is expected to reach US$2.6 Billion by 2030 with a CAGR of a 2.8%. The Chemical Methods segment is also set to grow at 4.6% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $936 Million in 2024, and China, forecasted to grow at an impressive 6.4% CAGR to reach $835.5 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Plastic Alloys Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Plastic Alloys Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Plastic Alloys Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as 3M Company, Arkema Group, Ashland Global Holdings Inc., Avery Dennison Corporation, BASF SE and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 44 companies featured in this Plastic Alloys market report include:

- Asahi Kasei Corporation

- BASF SE

- Borealis AG

- Celanese Corporation

- Covestro AG

- Daicel Corporation

- Dow Inc.

- Ensinger GmbH

- Evonik Industries AG

- Inter Primo A/S

- LANXESS AG

- LG Chem Ltd.

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Corporation

- RTP Company

- SABIC

- Sekisui Kydex

- Solvay S.A.

- Star Thermoplastics

- Teijin Limited

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Asahi Kasei Corporation

- BASF SE

- Borealis AG

- Celanese Corporation

- Covestro AG

- Daicel Corporation

- Dow Inc.

- Ensinger GmbH

- Evonik Industries AG

- Inter Primo A/S

- LANXESS AG

- LG Chem Ltd.

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Corporation

- RTP Company

- SABIC

- Sekisui Kydex

- Solvay S.A.

- Star Thermoplastics

- Teijin Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 281 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

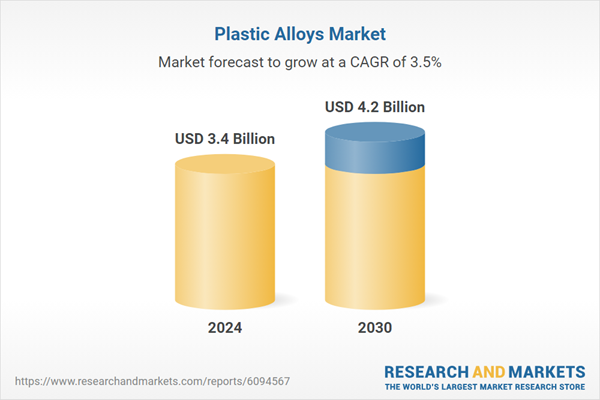

| Estimated Market Value ( USD | $ 3.4 Billion |

| Forecasted Market Value ( USD | $ 4.2 Billion |

| Compound Annual Growth Rate | 3.5% |

| Regions Covered | Global |