Global Plastic Adhesives Market - Key Trends & Drivers Summarized

Why Are Plastic Adhesives Gaining Momentum Over Traditional Mechanical Fasteners?

Plastic adhesives are increasingly being adopted as a superior bonding alternative to mechanical fasteners, rivets, or welding techniques in applications involving plastic substrates. These adhesives offer lightweight, flexible, and stress-distributing bonds that preserve material integrity and eliminate the need for perforation or thermal distortion. The global shift toward lighter and more compact products across the automotive, electronics, packaging, and medical device sectors has brought plastic adhesives to the forefront, especially where joining dissimilar materials or intricate geometries is required.Their rising popularity is also linked to the ongoing trend of miniaturization in consumer electronics and wearable technology, where conventional joining methods become impractical. Plastic adhesives, including acrylics, cyanoacrylates, polyurethanes, epoxies, and hot melts, are tailored to meet specific requirements such as fast curing, chemical resistance, optical clarity, or biocompatibility. Furthermore, the ability to customize adhesive formulations for bonding low-surface-energy plastics - like polypropylene, polyethylene, and PTFE - has expanded their utility in high-performance and commodity plastic bonding alike. These advantages are establishing plastic adhesives as essential enablers in lightweight, multifunctional product assemblies across global industries.

How Are Material Innovations and Surface Chemistry Advancing Bonding Capabilities?

Adhesion to plastic surfaces poses unique challenges due to the low surface energy and chemical inertness of many polymer materials. To overcome these hurdles, adhesive manufacturers are leveraging advanced surface activation techniques such as plasma treatment, corona discharge, and chemical primers to improve substrate wettability and promote adhesive anchoring. Concurrently, the development of novel adhesion promoters and coupling agents, such as silanes or functionalized polymers, is enabling durable bonds even under cyclic stress, moisture, or temperature fluctuations.On the materials side, hybrid adhesive systems that combine physical toughness with flexibility are being formulated to accommodate thermal expansion mismatches and dynamic loading in plastic assemblies. UV-curable and dual-cure systems are offering enhanced control over bond formation in time-sensitive manufacturing environments, particularly in electronics and medical devices. Moreover, reactive hot melts and one-component moisture-cure polyurethanes are gaining traction in automotive interiors and appliances due to their strong bond strength and process simplicity. These technical advancements are pushing plastic adhesives into high-performance categories that were traditionally dominated by mechanical or thermal joining methods.

Which Application Sectors Are Creating the Most Diverse Demand Profiles?

The automotive sector is one of the largest consumers of plastic adhesives, driven by the need to reduce vehicle weight, improve fuel efficiency, and integrate dissimilar materials such as ABS, polycarbonate, and fiber-reinforced composites. Applications include dashboard components, trims, emblems, lighting units, and under-the-hood assemblies. In electric vehicles (EVs), adhesives are critical for battery encapsulation, sensor mounting, and wire harness bonding, where vibration dampening and thermal management are key considerations.The packaging industry is another major growth area, particularly in flexible and rigid plastic packaging for food, personal care, and industrial goods. Adhesives used in laminates, labels, and container sealing must meet stringent requirements for chemical resistance, migration compliance, and sustainability. In consumer electronics, plastic adhesives support the assembly of smartphone housings, display modules, and internal circuit components with compact, non-intrusive bonding lines. Additionally, the medical sector is adopting medical-grade adhesives for device housings, catheters, and wearable sensors, demanding precise adhesion with biocompatibility and sterilization resistance. This diversity in application scope is ensuring steady, sector-wide demand for advanced plastic adhesive systems.

What's Propelling the Long-Term Growth of the Global Plastic Adhesives Market?

The growth in the global plastic adhesives market is driven by several factors, including the rising adoption of lightweight, multifunctional plastics across consumer and industrial products, advancements in adhesive chemistries, and the shift toward more automated and seamless assembly lines. The growing penetration of plastics in structural and aesthetic applications is requiring adhesive solutions that not only provide robust bonding but also meet design, compliance, and manufacturing objectives simultaneously.Sustainability concerns are encouraging the development of solvent-free, recyclable, and low-VOC adhesive systems that align with circular economy principles, particularly in packaging and consumer goods. Technological integration, such as smart dispensers and robotic application systems, is enabling consistent and high-speed adhesive deposition in mass production environments. Additionally, the increasing demand for modular product designs and repairable components is opening new use-cases for adhesive bonding in replaceable parts. With global industries pushing for design simplification, durability, and performance under variable conditions, plastic adhesives are set to play an integral role in next-generation manufacturing and product innovation.

Report Scope

The report analyzes the Plastic Adhesives market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Resin Type (Epoxy Resin, Acrylic Resin, Silicon Resin, Polyurethane Resin, Cyanoacrylate Resin, Other Resin Types); Substrate Type (Polyethylene, Polypropylene, Fluoropolymer, Acetal, Thermoplastic Vulcanizates, Other Substrate Types); Technology (Solvent Based, Water Based); End-Use (Automotive, Building & Construction, Electrical & Electronics, Healthcare, Packaging, Footwear, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Epoxy Resin segment, which is expected to reach US$3.3 Billion by 2030 with a CAGR of a 6.8%. The Acrylic Resin segment is also set to grow at 4.1% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $2.1 Billion in 2024, and China, forecasted to grow at an impressive 8.9% CAGR to reach $2.2 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Plastic Adhesives Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Plastic Adhesives Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Plastic Adhesives Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as BASF SE, Calder Industrial Materials Ltd, CEMEX S.A.B. de C.V., Eazymix Ltd., Egger Group and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 34 companies featured in this Plastic Adhesives market report include:

- 3M Company

- Arkema Group

- Ashland Global Holdings Inc.

- Avery Dennison Corporation

- BASF SE

- Bostik (a subsidiary of Arkema)

- Dow Inc.

- Dymax Corporation

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman Corporation

- Illinois Tool Works Inc.

- MAPEI S.p.A.

- Master Bond Inc.

- Panacol-Elosol GmbH

- Parker Hannifin Corporation

- Permabond LLC

- Pidilite Industries Ltd.

- Sika AG

- Toagosei Co., Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- 3M Company

- Arkema Group

- Ashland Global Holdings Inc.

- Avery Dennison Corporation

- BASF SE

- Bostik (a subsidiary of Arkema)

- Dow Inc.

- Dymax Corporation

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman Corporation

- Illinois Tool Works Inc.

- MAPEI S.p.A.

- Master Bond Inc.

- Panacol-Elosol GmbH

- Parker Hannifin Corporation

- Permabond LLC

- Pidilite Industries Ltd.

- Sika AG

- Toagosei Co., Ltd.

Table Information

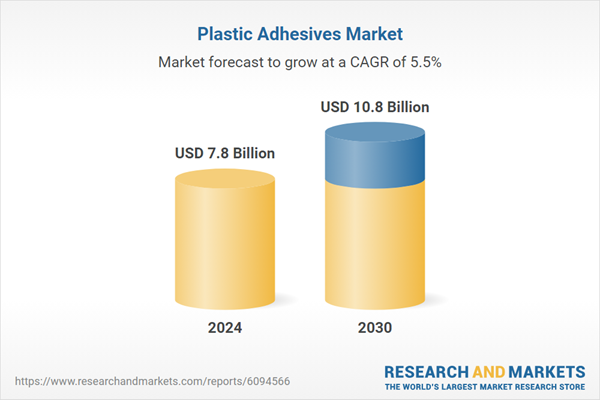

| Report Attribute | Details |

|---|---|

| No. of Pages | 490 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 7.8 Billion |

| Forecasted Market Value ( USD | $ 10.8 Billion |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Global |