Global Pin Fin Heat Sink for IGBT Market - Key Trends & Drivers Summarized

How Are Power Density Trends Reshaping Cooling Strategies in High-Performance Electronics?

Pin fin heat sinks have become increasingly vital in managing thermal loads in high-performance power semiconductor environments, particularly in systems utilizing Insulated Gate Bipolar Transistors (IGBTs). As IGBT modules become denser and more compact - driven by electrification trends in automotive, rail, and renewable energy infrastructure - thermal management becomes a design-critical challenge. Pin fin heat sinks, known for their three-dimensional airflow distribution and enhanced surface area, offer an optimal solution for convective and liquid-cooled thermal dissipation. Their geometry facilitates turbulent flow even at low Reynolds numbers, ensuring efficient heat transfer under constrained spatial and airflow conditions.The use of pin fin heat sinks in IGBT assemblies is particularly valuable in environments where forced air or liquid cooling is employed, such as electric vehicle powertrains, industrial drives, and grid-tied solar inverters. These applications often generate transient thermal spikes and sustained operational heat that, if unmanaged, degrade switching efficiency, increase conduction losses, and reduce lifespan. The versatility of pin fin structures - configurable in base materials such as aluminum or copper, and in varying fin diameters, aspect ratios, and densities - allows for tailored thermal resistance values that align with specific IGBT module packages and heat flux densities. This makes them an essential part of next-gen power electronics cooling strategies.

What Role Does Advanced Manufacturing Play in Boosting Heat Sink Performance?

Precision in manufacturing plays a critical role in maximizing the thermal efficiency of pin fin heat sinks. Additive manufacturing and CNC machining are increasingly used to fabricate complex fin geometries that were previously unachievable with traditional extrusion methods. These technologies support optimized pin spacing, orientation, and tapering, which collectively improve fluid dynamics and heat dissipation rates. Moreover, the ability to customize fin topography - such as cross-drilled or dimpled structures - enhances turbulence and convective heat transfer, especially in liquid-cooled IGBT setups.Surface treatments and coatings also influence performance. Anodization, nickel plating, or thermally conductive polymers can be applied to reduce thermal resistance or enhance corrosion resistance in aggressive environments such as outdoor installations or marine systems. The integration of vapor chambers or heat pipes into the base of pin fin heat sinks is another innovation being used to spread localized hotspots across a larger area, thus improving overall heat distribution to the fin array. These engineering enhancements not only extend the operational life of IGBTs but also allow for higher current densities and switching frequencies in compact device footprints, enabling power system designers to push functional boundaries while maintaining thermal reliability.

Why Are Specific End-Use Sectors Investing in High-Efficiency IGBT Thermal Management?

The electrification of transport systems is one of the strongest demand generators for pin fin heat sinks in IGBT assemblies. In electric vehicles (EVs), hybrid trains, and electric aircraft subsystems, IGBT-based inverters and converters operate under dynamic load profiles that require fast, efficient, and compact cooling mechanisms. Similarly, wind turbine converters, photovoltaic inverters, and battery energy storage systems use IGBTs to handle grid-scale power switching, necessitating effective thermal control to meet 24/7 operational demands and harsh environmental conditions.In industrial automation and robotics, IGBT power modules used in motor drives and high-frequency welders also generate high heat loads. These systems benefit from liquid-cooled pin fin heat sinks with optimized geometries that support prolonged operational stability and safety. Moreover, data centers and telecom base stations are deploying modular power systems with embedded IGBTs, where air-cooled pin fin designs are preferred for their ability to maintain performance in densely packed electronic enclosures. Across all these sectors, the common theme is the need for thermally optimized, compact, and reliable heat dissipation solutions - conditions where pin fin heat sinks are uniquely positioned to deliver value.

What's Driving the Rapid Adoption of Pin Fin Heat Sinks in IGBT-Centric Power Systems?

The growth in the global pin fin heat sink for IGBT market is driven by several factors, including the intensifying need for thermal control in high-density power modules and the widespread deployment of IGBTs across electrified and industrial domains. As power electronics evolve to handle greater loads in smaller footprints, the reliability and efficiency of thermal management systems become directly correlated with product lifespan and functional integrity. Pin fin heat sinks provide a favorable thermal performance-to-volume ratio, making them ideal for modern applications constrained by space and airflow limitations.Regulatory standards around energy efficiency and safety in power systems are compelling OEMs to adopt high-performance cooling technologies that support thermal compliance while reducing derating requirements. Simultaneously, advances in cooling fluid dynamics modeling, rapid prototyping, and materials science are allowing faster innovation cycles and broader customization in pin fin designs. The rise of electric mobility, renewable energy deployments, and distributed energy systems further expands the application scope of IGBT modules - and by extension, their thermal management solutions. With growing investments in EV infrastructure, smart grids, and industrial automation, the demand for thermally robust, high-surface-area cooling components like pin fin heat sinks is expected to rise steadily, anchoring long-term market growth.

Report Scope

The report analyzes the Pin Fin Heat Sink for IGBT market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Material (Aluminum, Copper); Application (Automotive Field, Consumer Electronics).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; and Rest of Europe); Asia-Pacific; Rest of World.

Key Insights:

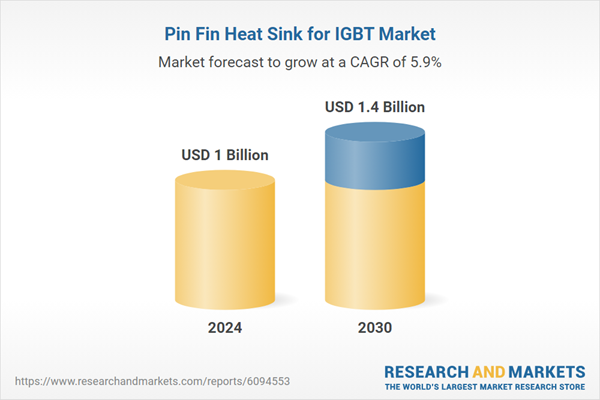

- Market Growth: Understand the significant growth trajectory of the Aluminum Material segment, which is expected to reach US$970.8 Million by 2030 with a CAGR of a 6.8%. The Copper Material segment is also set to grow at 4.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $263.2 Million in 2024, and China, forecasted to grow at an impressive 5.7% CAGR to reach $225.9 Million by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Pin Fin Heat Sink for IGBT Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Pin Fin Heat Sink for IGBT Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Pin Fin Heat Sink for IGBT Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Ariose Electronics Co., Ltd., CUI Devices, DB Products Limited, GD SWT Smart Tech Co., Ltd., Hokuriku Electric Industry Co., Ltd. and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 43 companies featured in this Pin Fin Heat Sink for IGBT market report include:

- Aavid Thermalloy (Boyd Corporation)

- Advanced Micro Devices (AMD)

- Advanced Thermal Solutions, Inc.

- Allbrass Industrial

- Apex Microtechnology

- Chomerics (Parker Hannifin Corporation)

- Comair Rotron

- Cooler Master

- CUI Devices

- Delta Electronics, Inc.

- Fischer Elektronik GmbH & Co. KG

- Honeywell International Inc.

- Kunshan Googe Metal Products Co., Ltd.

- Marlow Industries (a subsidiary of II-VI Incorporated)

- Molex, LLC

- Ohmite Manufacturing Company

- Radian Thermal Products, Inc.

- Semikron Danfoss

- TE Connectivity

- Wakefield-Vette, Inc.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Aavid Thermalloy (Boyd Corporation)

- Advanced Micro Devices (AMD)

- Advanced Thermal Solutions, Inc.

- Allbrass Industrial

- Apex Microtechnology

- Chomerics (Parker Hannifin Corporation)

- Comair Rotron

- Cooler Master

- CUI Devices

- Delta Electronics, Inc.

- Fischer Elektronik GmbH & Co. KG

- Honeywell International Inc.

- Kunshan Googe Metal Products Co., Ltd.

- Marlow Industries (a subsidiary of II-VI Incorporated)

- Molex, LLC

- Ohmite Manufacturing Company

- Radian Thermal Products, Inc.

- Semikron Danfoss

- TE Connectivity

- Wakefield-Vette, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 172 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1 Billion |

| Forecasted Market Value ( USD | $ 1.4 Billion |

| Compound Annual Growth Rate | 5.9% |

| Regions Covered | Global |