Global Granular Urea Market - Key Trends & Drivers Summarized

Why Does Granular Urea Continue to Dominate Global Nitrogen Fertilizer Usage?

Granular urea remains the most widely used nitrogen fertilizer worldwide due to its high nitrogen content (46%), ease of handling, and cost-effectiveness across a range of crop and soil types. Unlike prilled urea, granular urea consists of larger, harder particles that offer better resistance to caking, superior storage stability, and slower dissolution rates. These physical properties make granular urea especially suitable for use in large-scale mechanized farming, particularly in humid and tropical regions where moisture management is critical. It is favored for broadcast applications, direct soil blending, and slow-release formulations, which are essential for improving nitrogen-use efficiency and minimizing environmental losses.The demand for granular urea is closely tied to the intensification of agriculture and the global push for higher crop yields to meet growing food demand. Regions with intensive cereal cultivation, such as South Asia, Latin America, and parts of Africa, rely heavily on urea for its economic value and consistent performance. Its adaptability for use in various climatic zones and compatibility with both traditional and precision application technologies further strengthens its dominance. As fertilizer application becomes more science-based and region-specific, granular urea continues to be a key component in integrated nutrient management systems aimed at optimizing both productivity and environmental sustainability.

How Are Manufacturing and Trade Dynamics Shaping the Global Market?

Global production and distribution of granular urea are deeply influenced by energy prices, natural gas availability, and geopolitical trade routes, given that urea is synthesized from ammonia and carbon dioxide. Major producers such as China, India, Russia, and the Middle East export significant volumes of granular urea, creating a complex and interdependent trade ecosystem. Fertilizer production hubs in countries like Saudi Arabia and Qatar, which benefit from abundant and low-cost natural gas, are emerging as dominant suppliers in the international market. At the same time, countries dependent on imports - such as Brazil, the U.S., and parts of Sub-Saharan Africa - are particularly sensitive to freight costs, tariff changes, and supply disruptions.In recent years, rising natural gas prices and periodic export restrictions (e.g., from China) have disrupted global urea supply chains, triggering price volatility and prompting importing nations to diversify sources or invest in domestic production capacity. Trade liberalization efforts, regional free trade agreements, and strategic stockpiling by governments are reshaping procurement strategies. In addition, logistical advancements such as improved bulk handling, port infrastructure, and packaging innovations are enhancing the cross-border movement of granular urea. These trends are reinforcing its availability and supporting global market expansion despite ongoing challenges in energy sourcing and climate-related policy shifts.

What Technological and Regulatory Trends Are Influencing Market Evolution?

The granular urea market is being increasingly shaped by environmental regulations and the push for more sustainable agricultural inputs. As nitrogen leaching and ammonia volatilization contribute to water pollution and greenhouse gas emissions, regulatory agencies and environmental groups are pressuring fertilizer producers and users to adopt more efficient practices. This has led to rising demand for enhanced efficiency fertilizers (EEFs) - including coated, stabilized, or slow-release urea - which use additives or surface treatments to control nitrogen release rates and reduce losses. Granular urea is particularly well-suited for these modifications due to its surface area and structural integrity.Technological advancements in urea coating formulations, such as sulfur-coated and polymer-coated variants, are creating value-added product segments that offer better crop response while complying with tightening nitrogen-use regulations. Simultaneously, digital agriculture tools, including GPS-guided spreaders and variable-rate application systems, are enabling more precise and efficient use of granular urea in the field. These innovations are helping to address environmental concerns without sacrificing yield potential. Furthermore, carbon footprint tracking and life-cycle assessment (LCA) metrics are increasingly being used by institutional buyers and governments to evaluate the sustainability of urea production and application, driving greater transparency and differentiation in the market.

What Is Driving Growth in the Global Granular Urea Market Across Regions and Sectors?

The growth in the granular urea market is driven by several factors closely aligned with agricultural intensification, global food security goals, and evolving crop nutrition strategies. One of the foremost drivers is the rising demand for high-efficiency nitrogen fertilizers in cereal, sugarcane, cotton, and oilseed cultivation, particularly in emerging markets with growing populations and limited arable land. Increasing mechanization and precision agriculture in large farms - particularly in Brazil, India, the U.S., and parts of Africa - are favoring the adoption of granular urea over other nitrogen sources due to its ease of application and compatibility with spreading equipment.Government subsidies, fertilizer promotion schemes, and public-private partnerships in agriculture are supporting urea distribution and access, especially in countries like India and several African nations. Moreover, the expansion of blending facilities and nutrient balancing programs is boosting the use of granular urea in customized fertilizer blends tailored to specific soil and crop conditions. In the industrial sector, granular urea also finds applications in chemical manufacturing and resin production, contributing to non-agricultural demand. Finally, the shift toward climate-smart agriculture and environmentally regulated fertilization practices is increasing the appeal of value-added granular urea formulations, positioning the market for sustained, multifaceted growth.

Report Scope

The report analyzes the Granular Urea market, presented in terms of market value (US$). The analysis covers the key segments and geographic regions outlined below:- Segments: Product Type (Fertilizer Grade, Feed Grade, Technical Grade); End-Use (Agriculture, Chemical, Building & Construction, Other End-Uses).

- Geographic Regions/Countries: World; United States; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom; Spain; Russia; and Rest of Europe); Asia-Pacific (Australia; India; South Korea; and Rest of Asia-Pacific); Latin America (Argentina; Brazil; Mexico; and Rest of Latin America); Middle East (Iran; Israel; Saudi Arabia; United Arab Emirates; and Rest of Middle East); and Africa.

Key Insights:

- Market Growth: Understand the significant growth trajectory of the Fertilizer Grade Urea segment, which is expected to reach US$29.9 Billion by 2030 with a CAGR of a 3.5%. The Feed Grade Urea segment is also set to grow at 2.3% CAGR over the analysis period.

- Regional Analysis: Gain insights into the U.S. market, valued at $11.4 Billion in 2024, and China, forecasted to grow at an impressive 6.1% CAGR to reach $10 Billion by 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and the Asia-Pacific.

Why You Should Buy This Report:

- Detailed Market Analysis: Access a thorough analysis of the Global Granular Urea Market, covering all major geographic regions and market segments.

- Competitive Insights: Get an overview of the competitive landscape, including the market presence of major players across different geographies.

- Future Trends and Drivers: Understand the key trends and drivers shaping the future of the Global Granular Urea Market.

- Actionable Insights: Benefit from actionable insights that can help you identify new revenue opportunities and make strategic business decisions.

Key Questions Answered:

- How is the Global Granular Urea Market expected to evolve by 2030?

- What are the main drivers and restraints affecting the market?

- Which market segments will grow the most over the forecast period?

- How will market shares for different regions and segments change by 2030?

- Who are the leading players in the market, and what are their prospects?

Report Features:

- Comprehensive Market Data: Independent analysis of annual sales and market forecasts in US$ Million from 2024 to 2030.

- In-Depth Regional Analysis: Detailed insights into key markets, including the U.S., China, Japan, Canada, Europe, Asia-Pacific, Latin America, Middle East, and Africa.

- Company Profiles: Coverage of players such as Addex Therapeutics, Allena Pharmaceuticals, Amgen Inc., Arthrosi Therapeutics, AstraZeneca plc and more.

- Complimentary Updates: Receive free report updates for one year to keep you informed of the latest market developments.

Some of the 36 companies featured in this Granular Urea market report include:

- Acron Group

- BASF SE

- CF Industries Holdings, Inc.

- EuroChem Group AG

- Fertiglobe

- Indian Farmers Fertiliser Cooperative Limited (IFFCO)

- Jiangsu Sanmu Group

- Koch Fertilizer LLC

- National Fertilizers Limited

- Nutrien Ltd.

- OCI N.V.

- PhosAgro

- PT Pupuk Kalimantan Timur

- Qatar Fertiliser Company (QAFCO)

- SABIC Agri-Nutrients Co.

- Shandong Hualu-Hengsheng Chemical Co., Ltd.

- The Mosaic Company

- Yara International ASA

- Zhongtai Chemical Co., Ltd.

- Zuari Agro Chemicals Ltd.

This edition integrates the latest global trade and economic shifts into comprehensive market analysis. Key updates include:

- Tariff and Trade Impact: Insights into global tariff negotiations across 180+ countries, with analysis of supply chain turbulence, sourcing disruptions, and geographic realignment. Special focus on 2025 as a pivotal year for trade tensions, including updated perspectives on the Trump-era tariffs.

- Adjusted Forecasts and Analytics: Revised global and regional market forecasts through 2030, incorporating tariff effects, economic uncertainty, and structural changes in globalization. Includes historical analysis from 2015 to 2023.

- Strategic Market Dynamics: Evaluation of revised market prospects, regional outlooks, and key economic indicators such as population and urbanization trends.

- Innovation & Technology Trends: Latest developments in product and process innovation, emerging technologies, and key industry drivers shaping the competitive landscape.

- Competitive Intelligence: Updated global market share estimates for 2025, competitive positioning of major players (Strong/Active/Niche/Trivial), and refined focus on leading global brands and core players.

- Expert Insight & Commentary: Strategic analysis from economists, trade experts, and domain specialists to contextualize market shifts and identify emerging opportunities.

Table of Contents

Companies Mentioned (Partial List)

A selection of companies mentioned in this report includes, but is not limited to:

- Acron Group

- BASF SE

- CF Industries Holdings, Inc.

- EuroChem Group AG

- Fertiglobe

- Indian Farmers Fertiliser Cooperative Limited (IFFCO)

- Jiangsu Sanmu Group

- Koch Fertilizer LLC

- National Fertilizers Limited

- Nutrien Ltd.

- OCI N.V.

- PhosAgro

- PT Pupuk Kalimantan Timur

- Qatar Fertiliser Company (QAFCO)

- SABIC Agri-Nutrients Co.

- Shandong Hualu-Hengsheng Chemical Co., Ltd.

- The Mosaic Company

- Yara International ASA

- Zhongtai Chemical Co., Ltd.

- Zuari Agro Chemicals Ltd.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 276 |

| Published | February 2026 |

| Forecast Period | 2024 - 2030 |

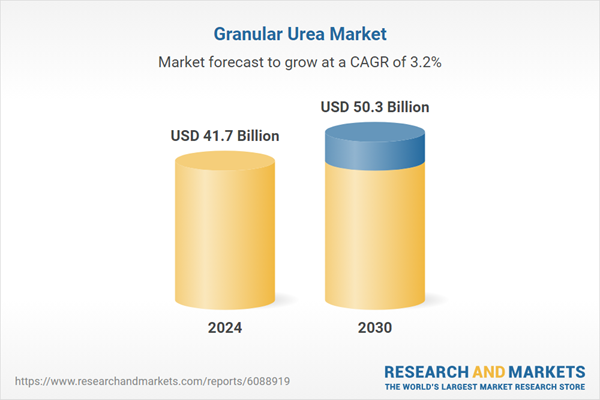

| Estimated Market Value ( USD | $ 41.7 Billion |

| Forecasted Market Value ( USD | $ 50.3 Billion |

| Compound Annual Growth Rate | 3.2% |

| Regions Covered | Global |